How Your Credit Score Is Determined St Louis Fed

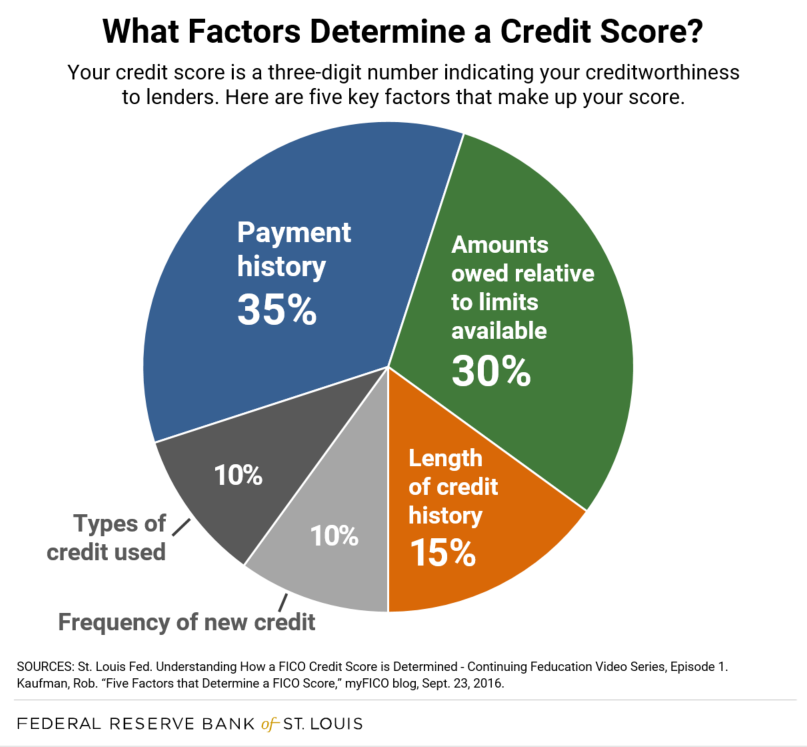

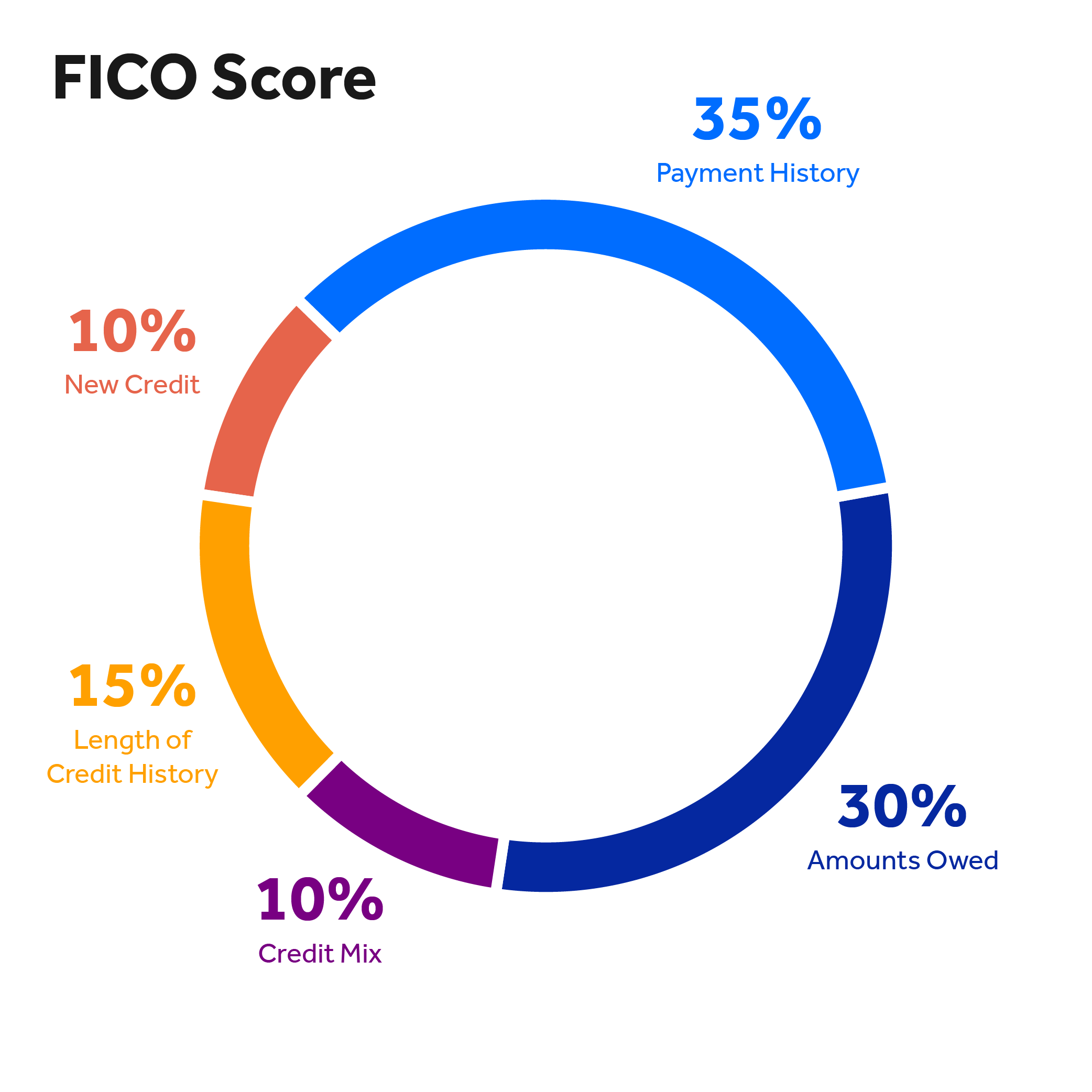

How Your Credit Score Is Determined St Louis Fed Credit scores: reports from the three big bureaus are used to determine a three digit credit score. flowers explained that one commonly used by lenders is the fico score—specifically, fico score 8. fico, which stands for fair isaac corp., is an analytics company that offers credit products to lenders. a fico score ranges from 300 to 850, with. A fico credit score is the most common credit score used to determine loan eligibility and the interest rates a person pays. a credit score is a person's financial story packed into a three digit number, which indicates a person's credit risk. your credit score is based on information found in your credit report.

How Is Your Credit Score Determined Oppu This video provides a short overview of credit scores—how they are determined and why they are important. . if you have difficulty accessing this content due to a disability, please contact us at 314 444 8624 or [email protected]. the continuing feducation video series offers animated videos on a variety of economics and. Graph and download economic data for large bank consumer credit card balances: current credit score: 50th percentile (rcccbscorepct50) from q3 2012 to q1 2024 about score, fr y 14m, consumer credit, credit cards, large, percentile, balance, credits, loans, consumer, banks, depository institutions, and usa. The 50th percentile credit score among outstanding first liens. the current credit score is the most recently determined commercially available credit score of the primary borrower on the mortgage loan. the credit score provider may vary by fr y 14m reporting firm and even within the firm's reporting. Total consumer credit owned and securitized, flow. monthly. billions of dollars, monthly rate, seasonally adjusted feb 1943 to jun 2024 (aug 7) billions of dollars, annual rate, seasonally adjusted feb 1943 to jun 2024 (aug 7) billions of dollars, annual rate, not seasonally adjusted feb 1943 to jun 2024 (aug 7) billions of dollars, monthly.

Know About Your Credit Score And Credit Reports The 50th percentile credit score among outstanding first liens. the current credit score is the most recently determined commercially available credit score of the primary borrower on the mortgage loan. the credit score provider may vary by fr y 14m reporting firm and even within the firm's reporting. Total consumer credit owned and securitized, flow. monthly. billions of dollars, monthly rate, seasonally adjusted feb 1943 to jun 2024 (aug 7) billions of dollars, annual rate, seasonally adjusted feb 1943 to jun 2024 (aug 7) billions of dollars, annual rate, not seasonally adjusted feb 1943 to jun 2024 (aug 7) billions of dollars, monthly. The covid retirement boom. the labor force participation rate 1 registered its largest drop on record in 2020, falling from 63.2 percent in the fourth quarter of 2019 to 60.8 percent in the second quarter of 2020. 2 by the second quarter of 2021, the rate had recovered slightly, to 61.6 percent, but was still 1.6 percentage points below its pre. The federal funds rate is the central interest rate in the u.s. financial market. it influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. additionally, the federal funds rate indirectly influences longer term interest rates such as mortgages, loans, and savings, all.

Your Credit Score Factors Mortgage Faq Simplified The covid retirement boom. the labor force participation rate 1 registered its largest drop on record in 2020, falling from 63.2 percent in the fourth quarter of 2019 to 60.8 percent in the second quarter of 2020. 2 by the second quarter of 2021, the rate had recovered slightly, to 61.6 percent, but was still 1.6 percentage points below its pre. The federal funds rate is the central interest rate in the u.s. financial market. it influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. additionally, the federal funds rate indirectly influences longer term interest rates such as mortgages, loans, and savings, all.

Comments are closed.