How To Use 72t Distributions To Access Retirement Funds Early

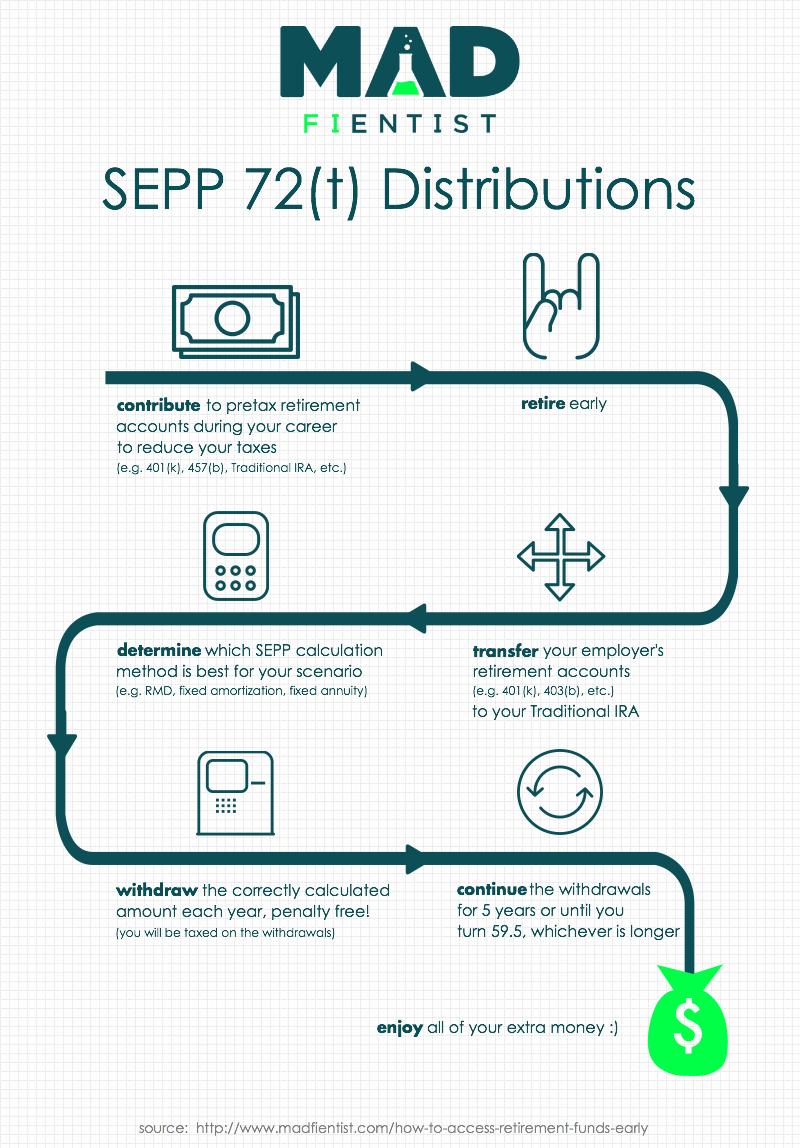

How To Access Retirement Funds Early Using internal revenue service rule 72(t) can help you generate income from your nest egg in your 50s or earlier without paying that penalty. The substantially equal periodic payment rule allows you to take money out of an ira before the age of 59 1 2. it also lets you avoid the 10% penalty tax.this approach is also called "72(t) payments," because the rule falls under irs code section 72(t).

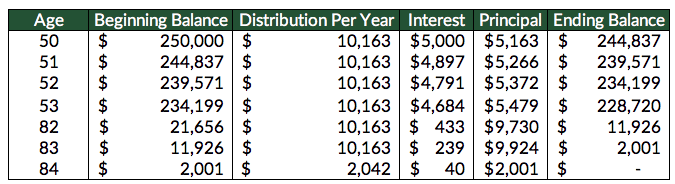

How To Use 72t Distributions To Access Retirement Funds Early And In this episode of ready for retirement, james discusses rule 72t distributions to access retirement funds early and penalty free.questions answered: how can. Calculate the three possible withdrawal amounts (see this irs document for more info) and pick the one that is closest to the number you decided in step #2. speak with a tax professional to ensure that your step #3 calculation were correct. withdraw (and pay tax on) that amount every year. Distributions from a retirement account before you reach age 59.5 (or distributions from a qualified plan, before you reach age 55 and are separated from service) may be subject to a 10% early withdrawal penalty under section 72(t) of the internal revenue code, in addition to any applicable taxes on the distributions. section 72(t) of the. Rule 72(t) allows access to your retirement funds before age 59½. know the rules of sepps to avoid a 10% penalty for early withdrawal. there are a few different ways to calculate your sepp.

72t Distribution How To Get Early Access To Your Retirement Savings Distributions from a retirement account before you reach age 59.5 (or distributions from a qualified plan, before you reach age 55 and are separated from service) may be subject to a 10% early withdrawal penalty under section 72(t) of the internal revenue code, in addition to any applicable taxes on the distributions. section 72(t) of the. Rule 72(t) allows access to your retirement funds before age 59½. know the rules of sepps to avoid a 10% penalty for early withdrawal. there are a few different ways to calculate your sepp. When you withdraw money from a qualified retirement account under rule 72 (t), the funds are distributed to you as sepps. these regular payments are made over the course of five years or until you. The primary purpose of a 72 (t) distribution is to allow individuals access to their retirement funds before the standard retirement age without incurring the typical 10% early withdrawal penalty. this option can be beneficial for those facing early retirement, unforeseen financial needs, or seeking additional financial flexibility.

Understanding 72t Distributions For Early Retirement Projectionlab When you withdraw money from a qualified retirement account under rule 72 (t), the funds are distributed to you as sepps. these regular payments are made over the course of five years or until you. The primary purpose of a 72 (t) distribution is to allow individuals access to their retirement funds before the standard retirement age without incurring the typical 10% early withdrawal penalty. this option can be beneficial for those facing early retirement, unforeseen financial needs, or seeking additional financial flexibility.

72t Distributions The Ultimate Guide To Early Retirement

Comments are closed.