How To Remove Paid Collections From Credit Report Livewell

How To Remove Paid Collections From Credit Report Livewell Validating the debt is an important step in the process of removing paid collections from your credit report. it ensures that the collection agencies are held accountable and that you have accurate information about the debts on your credit report. now, let’s move on to step 3: negotiating a pay for delete agreement. Settlement offers: based on your available funds and the priority of each debt, determine the amount you can offer to each creditor to settle the debt. generally, settlement offers range from 20% to 50% of the total amount owed, but this can vary depending on your specific circumstances and negotiations.

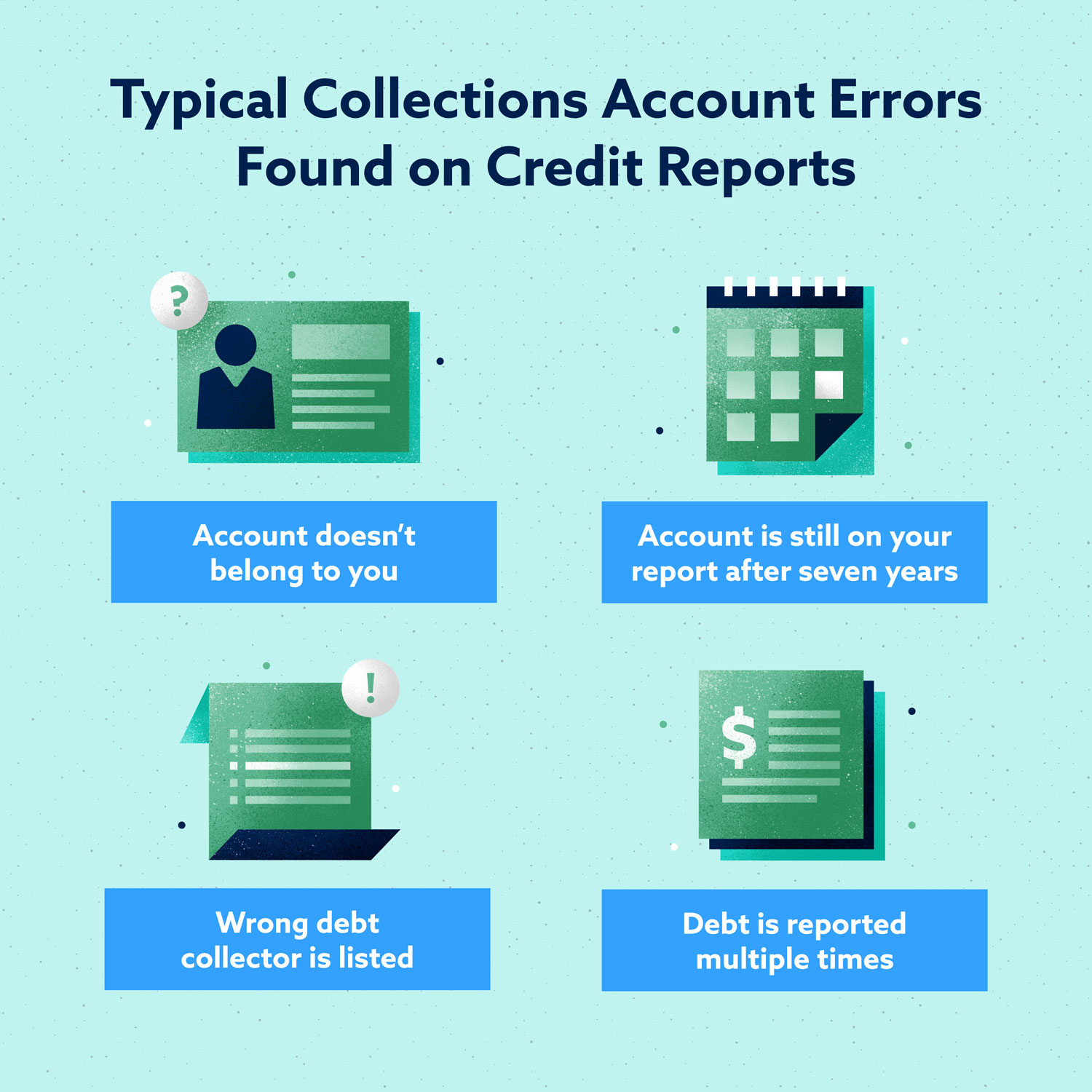

Solved How To Remove A Paid Collection From Credit Report 3. contact the original creditor. in some cases, you may need to contact the creditor who sold your debt to the collection agency in the first place. if they determine the debt went to collections by mistake, they can contact the collection agency and try to resolve the issue. When a collection is added to your credit report, it can cause your credit score to drop by a substantial amount, potentially by 100 points or more. the exact impact will depend on several factors, including the amount of the collection, the number of collections, and the overall health of your credit history. Although paid collection accounts dragging down your score can be a frustrating fact, you may be able to get these accounts removed from your credit report. here are your primary options for removing these accounts from your credit report: request validation of the debt. negotiate a pay for delete agreement. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian.

Template To Remove Collections From Credit Report Although paid collection accounts dragging down your score can be a frustrating fact, you may be able to get these accounts removed from your credit report. here are your primary options for removing these accounts from your credit report: request validation of the debt. negotiate a pay for delete agreement. You can request your credit report in spanish directly from each of the three major credit bureaus: · transunion: call 800 916 8800. · equifax: visit the link or call 888 378 4329. · experian. Here’s how to remove paid collections from your credit report—or at least try to do so: send a letter to the debt collection agency or ask via phone for this option. if the agency agrees, get the agreement in writing. pay the debt. follow up to make sure the debt is removed from your report. 2. ask for a goodwill deletion. if you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. this usually involves.

How To Remove Collections From A Credit Report 11 Steps Here’s how to remove paid collections from your credit report—or at least try to do so: send a letter to the debt collection agency or ask via phone for this option. if the agency agrees, get the agreement in writing. pay the debt. follow up to make sure the debt is removed from your report. 2. ask for a goodwill deletion. if you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. this usually involves.

Comments are closed.