How To Reconcile A Checkbook Register

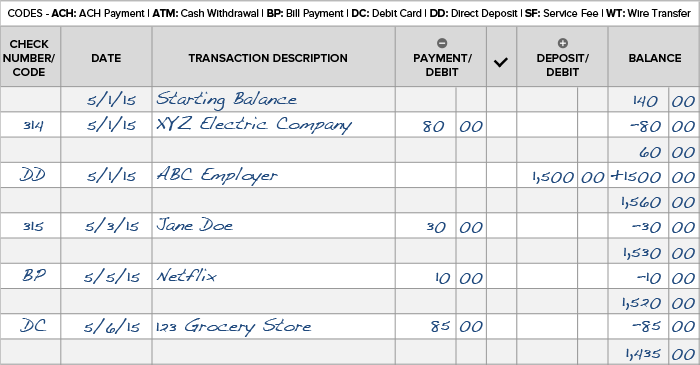

How To Reconcile A Checkbook Amounts for cash or check deposits, direct deposits, interest earnings and incoming transfers (ach or wire) go under the “credit ( )” column. add these to your prior balance, and record the sum in the “balance” column. every month — or sooner if you wish — you need to reconcile your own records against your bank statement. Add the amount of any deposit, credit, or transfer into the account to the total. subtract all your debits from your credits. you should end up with a positive number. write the new balance after each transaction in the rightmost column. 2. reconcile your checkbook.

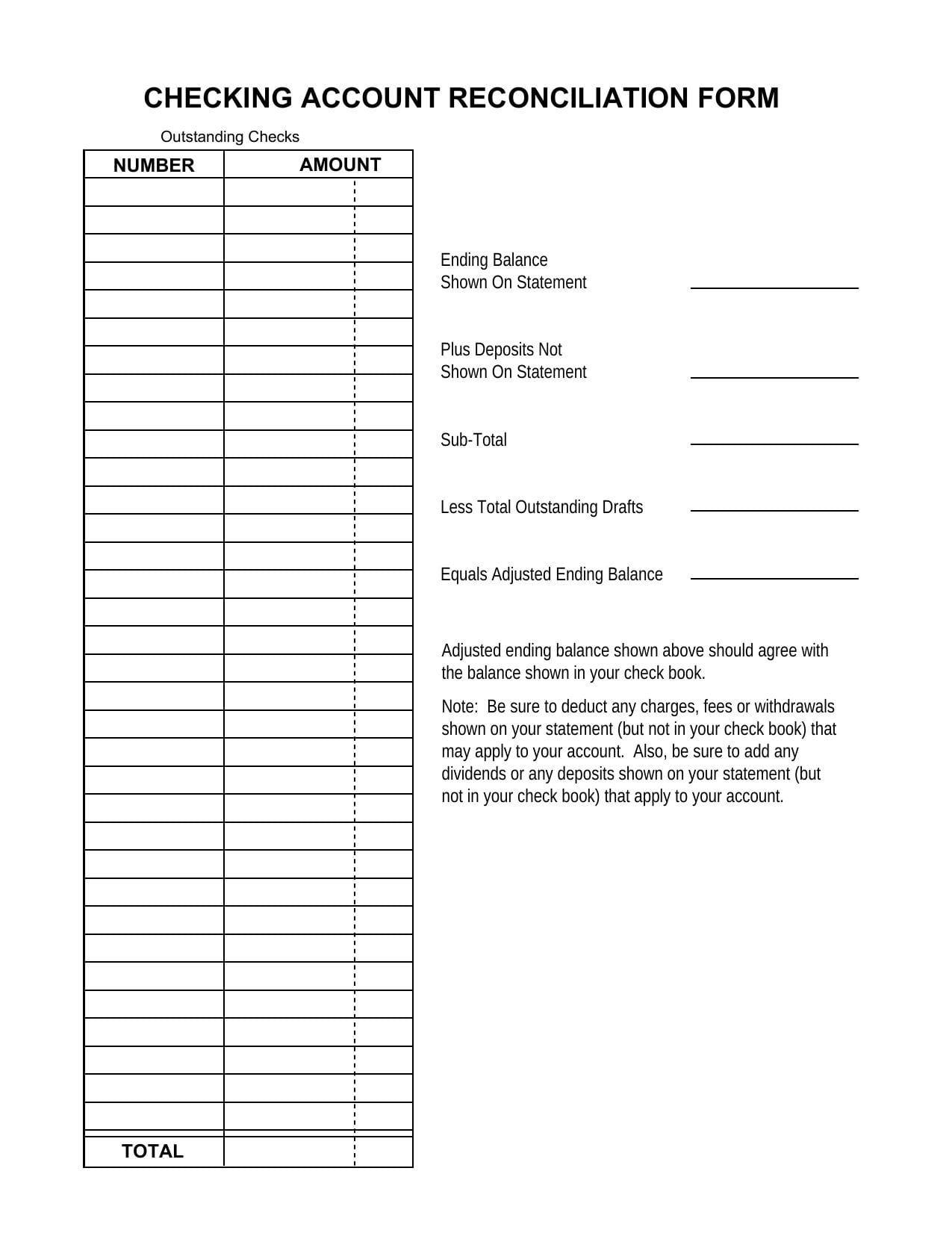

How To Reconcile A Checkbook Register Learn the essential skill of balancing a checkbook, or checkbook register, to reconcile and take control of your personal finances. a step by step guide for. 1. record your transactions. any time you write a check, make a payment using your debit card, or initiate any other kind of debit or withdrawal, always record the transactions in your spending tracker or checkbook ledger. if you’re writing a check, note the following info in the checkbook ledger too: check number. date. Step 9: balance your checkbook. note your statement ending balance from your current monthly statement. add all your outstanding deposits to your statement ending balance, then subtract all outstanding debits. the resulting total should match your check register balance. Amount. you add or subtract the corresponding amount to arrive at your new account balance. this can help with balancing your checkbook at the end of the month. to do that, you need your bank.

How To Reconcile A Checkbook Register Step 9: balance your checkbook. note your statement ending balance from your current monthly statement. add all your outstanding deposits to your statement ending balance, then subtract all outstanding debits. the resulting total should match your check register balance. Amount. you add or subtract the corresponding amount to arrive at your new account balance. this can help with balancing your checkbook at the end of the month. to do that, you need your bank. You will write down the date of the transaction and a brief description and, in the case of checks, the check number. for each debit, you’ll subtract the amount of the transaction from your. Step 1: write down your transactions often. start by getting out your check register (if you use an actual checkbook) or making a spreadsheet (check out the register example above). write down your current checking account balance in the “cash balance” column on the far right side.

How To Reconcile A Checkbook You will write down the date of the transaction and a brief description and, in the case of checks, the check number. for each debit, you’ll subtract the amount of the transaction from your. Step 1: write down your transactions often. start by getting out your check register (if you use an actual checkbook) or making a spreadsheet (check out the register example above). write down your current checking account balance in the “cash balance” column on the far right side.

How To Reconcile Bank Account And Balance Checkbook Reconciliation

Comments are closed.