How To Prevent Direct Deposit Phishing Scams Stps

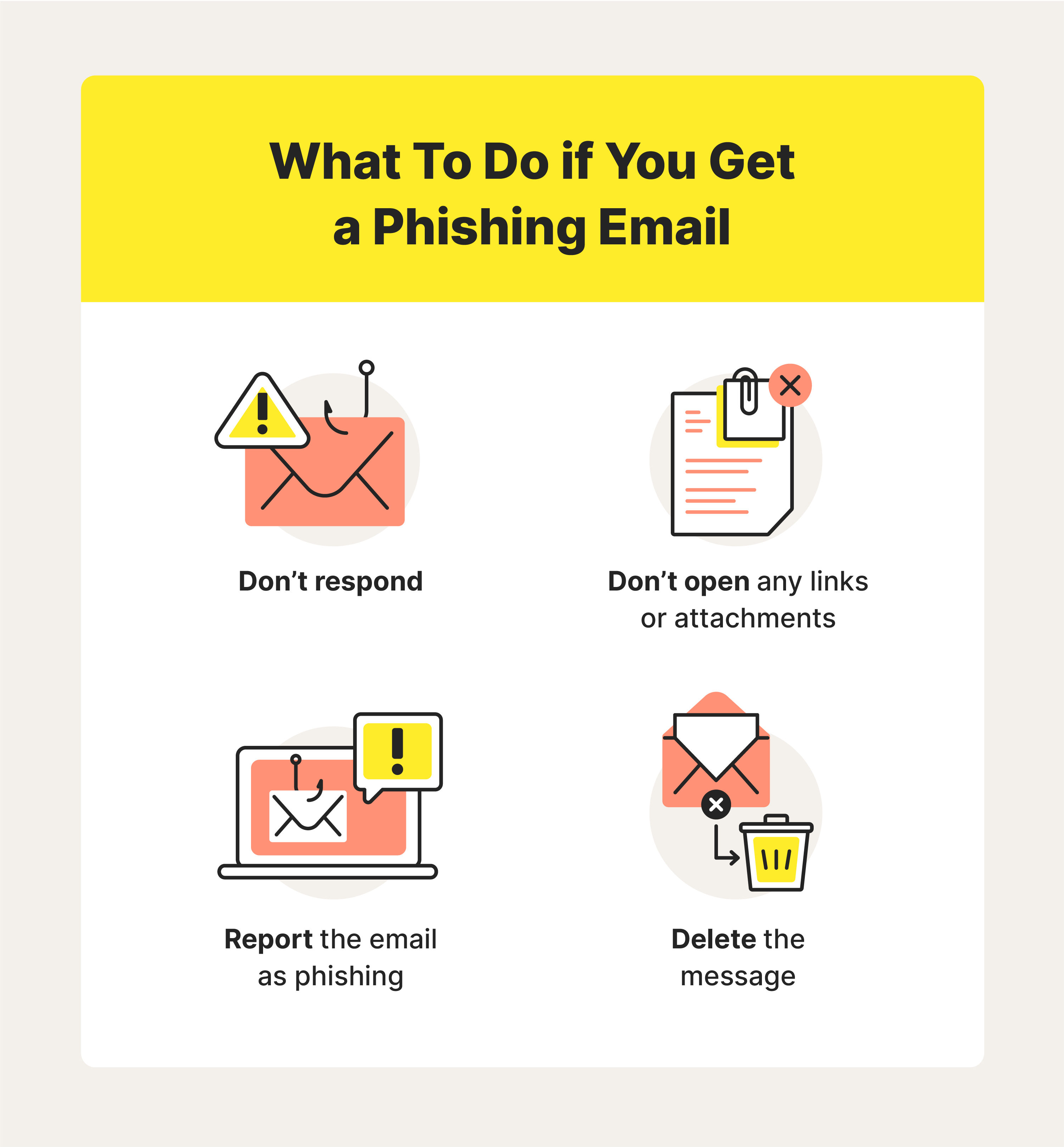

How To Prevent Direct Deposit Phishing Scams Stps One of the most crucial steps in preventing direct deposit phishing scams is to educate yourself and your employees on the warning signs of a phishing attempt. emails or text messages requesting to update personal or financial information, containing urgent or threatening language, or coming from an unfamiliar or suspicious sender are common indicators of a phishing attempt. Click [link to platform login page] enter your user id and password. click login, and you are done." at a quick glance, the email may not trigger a red flag — for one, it lacks the famously bad grammar that instantly gives away a phishing campaign. however, the email did have a couple of telltale signs.

How To Prevent Direct Deposit Phishing Scams Stps Double check the email address from which the request is coming. even if it appears to be from an employee, verify the address. cybercriminals often use slightly misspelled or completely different addresses to trick you into accepting fraudulent requests. confirm direct deposit changes directly. always follow up with the employee via a phone. And multifactor authentication (mfa) is an effective way to prevent all kinds of fraud, including direct deposit scams. ensure users verify their identity by first entering their username and password and then entering a time based one time code they receive by text message or phone call. this provides an extra layer of security for user logins. A direct deposit scam is a type of business email compromise or email account compromise (bec eac) scheme. widely prevalent, these scams affect industries in all sectors. in fact, in 2019, the fbi’s internet crime complaint center (ic3) received 23,775 reports of bec eac scams with adjusted losses of $1.7 billion. Preventing direct deposit phishing scams. a few steps organizations can take to prevent direct deposit phishing scams include: implement two step or multi factor verification for hr payroll platforms. require it, administrators, to monitor unusual activity, such as a large number of accounts having contact and banking info changed over a short.

How To Protect Against Phishing 18 Tips For Spotting A Scam A direct deposit scam is a type of business email compromise or email account compromise (bec eac) scheme. widely prevalent, these scams affect industries in all sectors. in fact, in 2019, the fbi’s internet crime complaint center (ic3) received 23,775 reports of bec eac scams with adjusted losses of $1.7 billion. Preventing direct deposit phishing scams. a few steps organizations can take to prevent direct deposit phishing scams include: implement two step or multi factor verification for hr payroll platforms. require it, administrators, to monitor unusual activity, such as a large number of accounts having contact and banking info changed over a short. When cybersecurity is inadequate, it can lead to stolen identity and financial loss. most scams and scammers have two main goals to steal your money and your identity. you should know what to look for, how they work, and what to do, so you can protect yourself and your finances. maintaining cybersecurity is very important, even for consumers. According to the fbi, the scam begins with a phishing campaign targeting individual employees. it’s a variation of sorts on the business email compromise, in which fraudsters impersonate a trusted person or a person of authority to get the victim to perform a certain action.

Comments are closed.