How To Pay 1099 Independent Contractors As A Small Business

How To Pay 1099 Independent Contractors As A Small Business Owner Youtube If you pay independent contractors, you may have to file form 1099 nec, nonemployee compensation, to report payments for services performed for your trade or business. if the following four conditions are met, you must generally report a payment as nonemployee compensation. you made payments to the payee of at least $600 during the year. Getting paid more often helps keep company and contractor cash flows in check. so discuss with your contractors how often it’s best to process payments. 3. collect a completed w 9 form. once you.

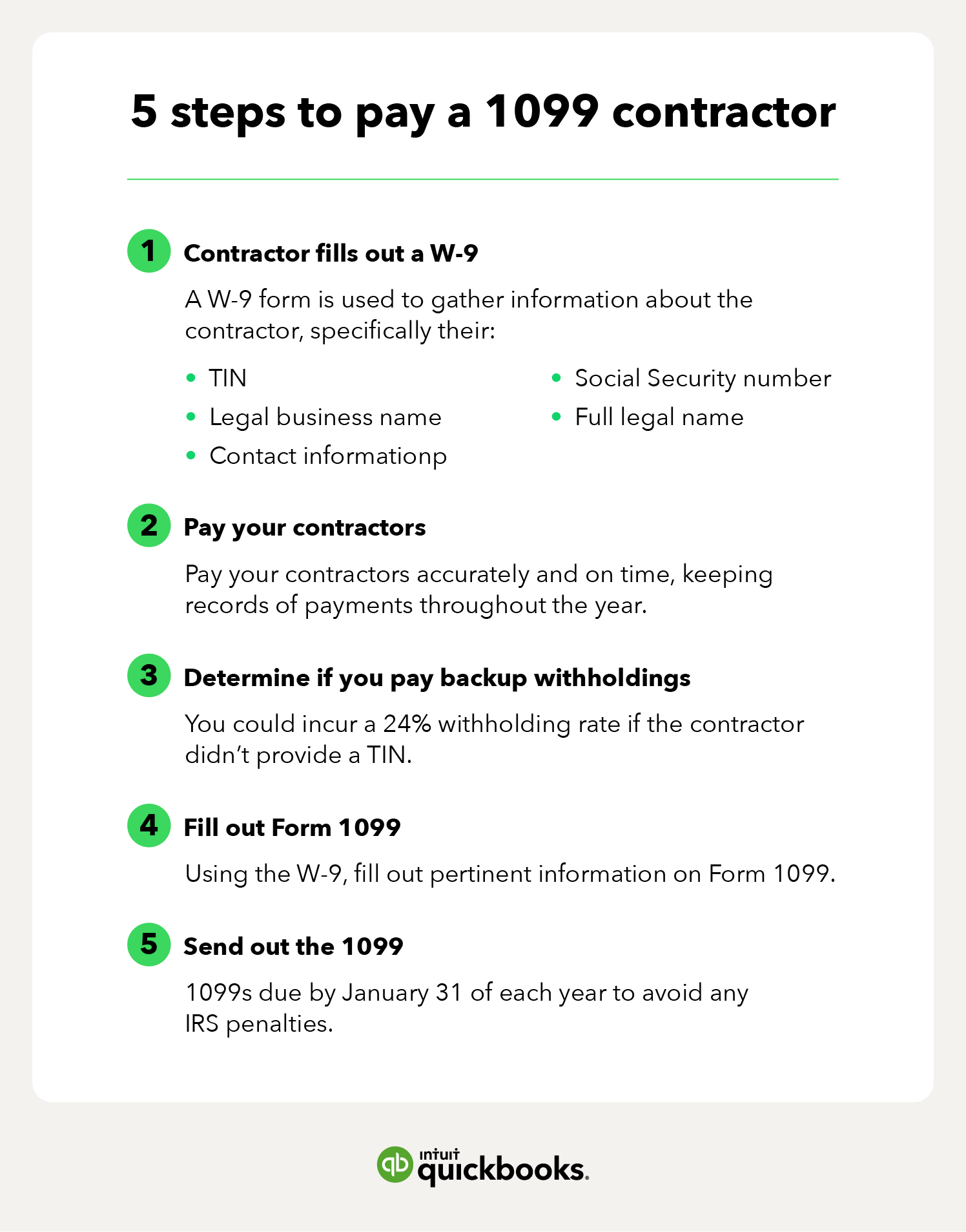

How To Pay 1099 Independent Contractors As A Small Business Youtube 1. have your contractor fill out a form w 9. this will provide you with all their identifying info. make sure to keep the irs form w 9 in your bookkeeping records for at least four years, and pay close attention to the business classification (i.e. sole proprietorship, s corp, etc.), which will appear in box 3 at the top of the form. And these self employment taxes really add up. the current self employment tax rate is 12.4% for social security and 2.9% for medicare — a total of 15.3% just in self employment tax. the good. A small business 1099 is a form small businesses use to report payments or income for certain transactions. the most common 1099 form small businesses use is form 1099 nec, which reports payments to independent contractors. one tax form you’ve likely come in contact with—either having to send or receive them in the mail—is a small. Companies that need to report compensation paid to independent contractors generally follow these steps: obtain a copy of form 1099 nec from the irs or a payroll service provider. provide the name and address of both the payer and the recipient. calculate the total compensation paid. note the amount of taxes withheld if backup withholding.

How To Simplify 1099 Contractor Variable Pay Rate Management A small business 1099 is a form small businesses use to report payments or income for certain transactions. the most common 1099 form small businesses use is form 1099 nec, which reports payments to independent contractors. one tax form you’ve likely come in contact with—either having to send or receive them in the mail—is a small. Companies that need to report compensation paid to independent contractors generally follow these steps: obtain a copy of form 1099 nec from the irs or a payroll service provider. provide the name and address of both the payer and the recipient. calculate the total compensation paid. note the amount of taxes withheld if backup withholding. A 1099 misc form reports miscellaneous income, like if a business pays at least $600 in rent to a landlord. while a 1099 nec reports nonemployee compensation, such as when a business pays at least $600 to an independent contractor. as of 2020, form 1099 misc no longer reports non employee compensation to independent contractors. Step 2: collect w 9 forms from contractors. once you decide how much and often to pay your contractors, you’ll have them complete a w 9 form, which includes personal information, like name and social security number, or if they operate under their own business entity, an employer identification number (ein).

What Is A 1099 Types Details And Who Receives One Quickbooks A 1099 misc form reports miscellaneous income, like if a business pays at least $600 in rent to a landlord. while a 1099 nec reports nonemployee compensation, such as when a business pays at least $600 to an independent contractor. as of 2020, form 1099 misc no longer reports non employee compensation to independent contractors. Step 2: collect w 9 forms from contractors. once you decide how much and often to pay your contractors, you’ll have them complete a w 9 form, which includes personal information, like name and social security number, or if they operate under their own business entity, an employer identification number (ein).

Comments are closed.