How To Interpret Candlestick Chart Patterns Templates Printable Free

How To Interpret Candlestick Chart Patterns Templates Printable Free 5. bullish rectangle chart pattern. the bullish rectangle is a continuation candlestick pattern that occurs during an uptrend when prices pause before continuing upward. it is a chart formation developed when the price moves sideways, creating a range, and there’s a temporary equilibrium before the next price movement. Onthis is a short illustrated 10 page book. you’re about to see the most powerful breakout chart patterns and candlestick formati. , i’ve ever come across in over 2 decades. this works best on shares, indices, ulated profitable price targets (take profit)if you’re not a big reader and you just want a trading book.

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-7114a9af472f4a2cb5cbe4878c1767da.png)

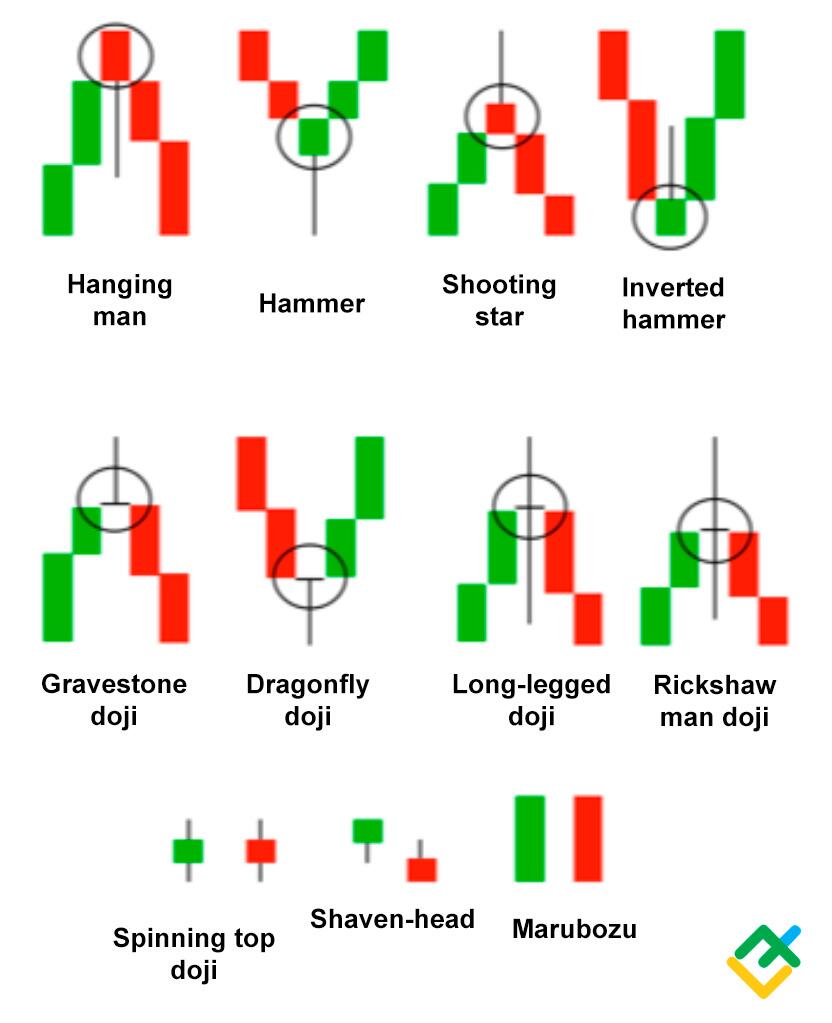

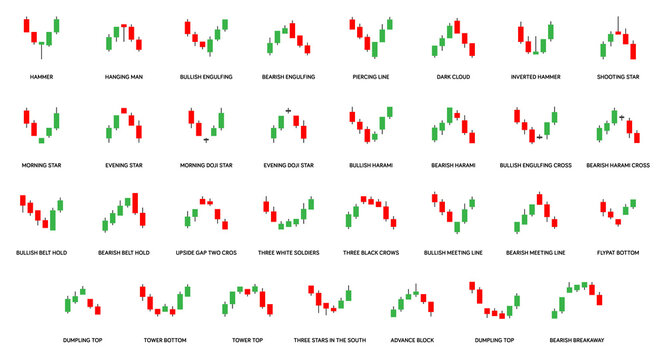

Understanding A Candlestick Chart In the example above, the proper entry would be below the body of the shooting star, with a stop at the high. 5. indecision candles. the doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. indecision candlestick patterns. Continuation patterns. they are chart patterns that display a temporary interruption in an ongoing trend, and after a short period, the trend continues in the original direction. right click the image below to download the candlestick patterns cheat sheet pdf. In neck candlestick pattern. definition: the in neck candlestick pattern is a bearish continuation pattern occurring in a downtrend. it consists of a long bearish candle followed by a smaller bullish candle that closes near the low of the previous candle. signal: indicates the continuation of the current downtrend. On super short charts, like 5 minutes, candlestick patterns change super fast. patterns might show quick changes in mood, but they don't hold as much weight. they're great for quick trades. medium timeframes (chillin' out): on hourly or daily charts, things even out a bit. candlestick patterns here matter more and can signal real trend shifts.

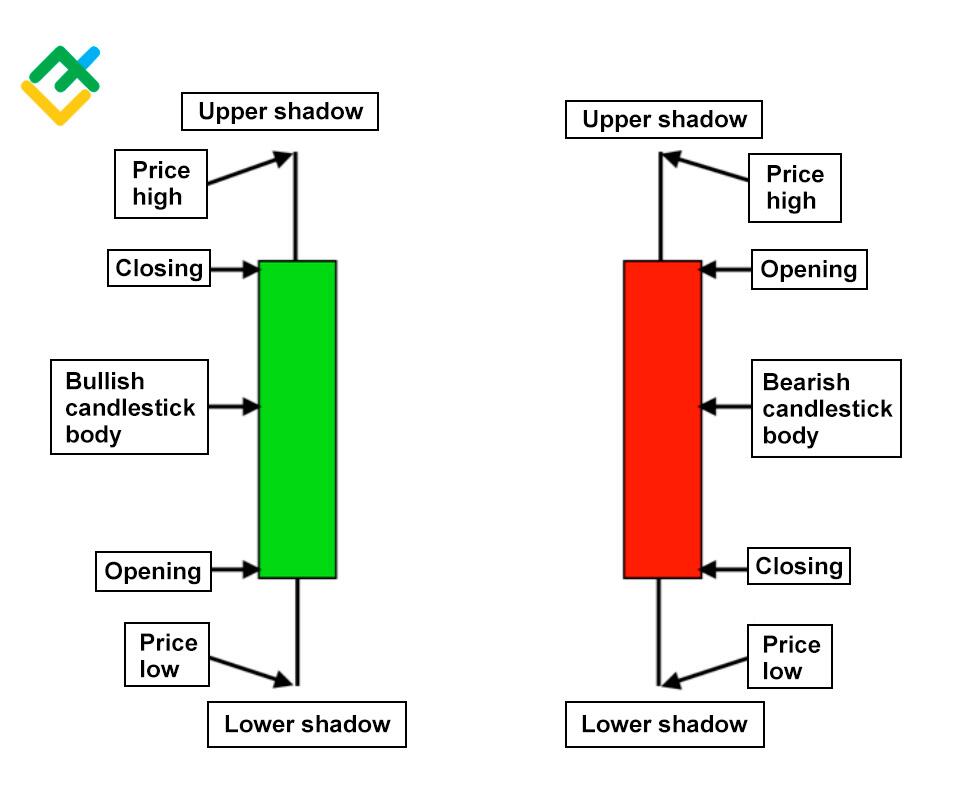

How To Read Candlestick Charts Printable Templates In neck candlestick pattern. definition: the in neck candlestick pattern is a bearish continuation pattern occurring in a downtrend. it consists of a long bearish candle followed by a smaller bullish candle that closes near the low of the previous candle. signal: indicates the continuation of the current downtrend. On super short charts, like 5 minutes, candlestick patterns change super fast. patterns might show quick changes in mood, but they don't hold as much weight. they're great for quick trades. medium timeframes (chillin' out): on hourly or daily charts, things even out a bit. candlestick patterns here matter more and can signal real trend shifts. At the same time, chart patterns can also be classified as harmonic, classical (traditional), and single candlestick patterns. finally, there are three groups of chart patterns: 1. reversal patterns. reversal patterns are chart formations that indicate a change in direction from a bearish to a bullish market trend and vice versa. Candlestick patterns are one of the oldest forms of technical and price action trading analysis. candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair. candlestick charting consists of bars and lines with a body, representing information showing the price open, close, high, and low.

12 Important Candlestick Patterns To Know How To Read Candles At the same time, chart patterns can also be classified as harmonic, classical (traditional), and single candlestick patterns. finally, there are three groups of chart patterns: 1. reversal patterns. reversal patterns are chart formations that indicate a change in direction from a bearish to a bullish market trend and vice versa. Candlestick patterns are one of the oldest forms of technical and price action trading analysis. candlesticks are used to predict and give descriptions of price movements of a security, derivative, or currency pair. candlestick charting consists of bars and lines with a body, representing information showing the price open, close, high, and low.

Printable Candlestick Patterns Cheat Sheet Pdf Printable Templates

Comments are closed.