How To Fill Out Form 1041 For 2021 Step By Step Instructions Youtube

How To Fill Out Form 1041 For 2021 Step By Step Instructions Youtube 2022 version of a complex trust: youtu.be 9u1gyozzpggrantor trust tax return: youtu.be kguoj0zensmhow to fill out form 1041 for the 2021 tax. Don't use form 1041. use form 1041 n, u.s. income tax return for electing alaska native settlement trusts, to make the election. additionally, form 1041 n is the trust's income tax return and satisfies the section 6039h information reporting requirement for the trust.

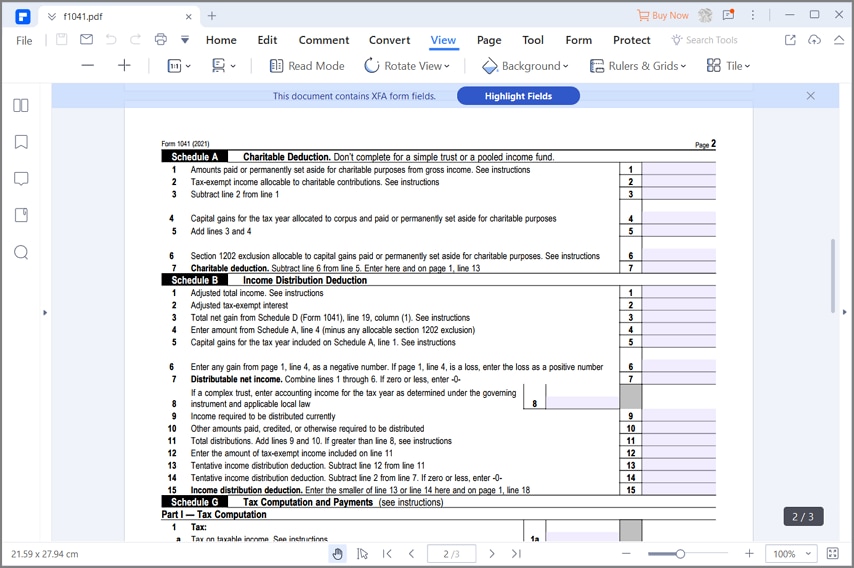

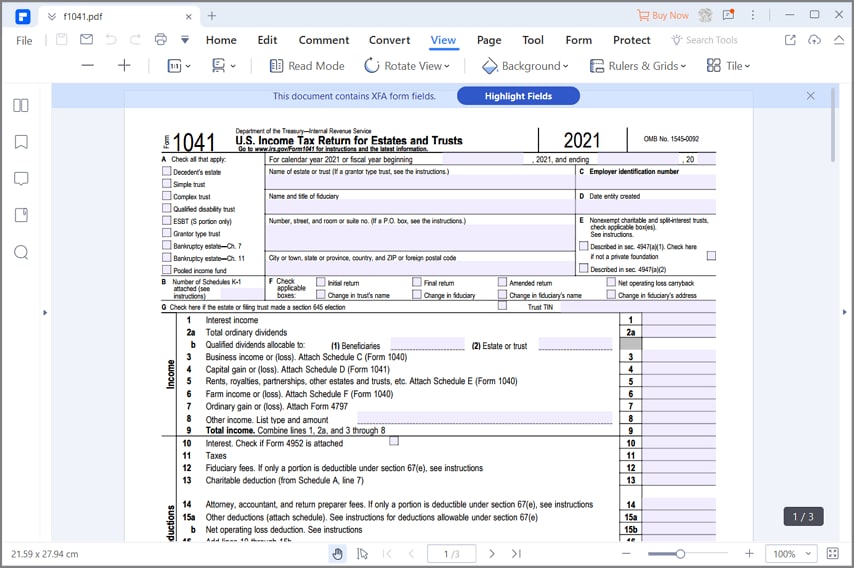

Guide For How To Fill In Irs Form 1041 A 45 minute webcast centered on navigating through form 1041 – u.s. income tax return for estates and trusts. this will contain who must file and when and wh. Form 1041 is generally required for domestic trusts with gross income of $600 or more during the year. for some other videos on trust tax issues:grantor vs . Form 1041 serves as the tax return for estates and trusts, akin to the form 1040 used by individuals. it is a document submitted to the internal revenue service (irs) that reports the income, losses, gains, and deductions of a trust or estate. the form also covers the income that is either accumulated or held for future distribution or. The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: the income, deductions, gains, losses, etc. of the estate or trust. the income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. any income tax liability of the estate or trust.

Guide For How To Fill In Irs Form 1041 Form 1041 serves as the tax return for estates and trusts, akin to the form 1040 used by individuals. it is a document submitted to the internal revenue service (irs) that reports the income, losses, gains, and deductions of a trust or estate. the form also covers the income that is either accumulated or held for future distribution or. The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: the income, deductions, gains, losses, etc. of the estate or trust. the income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. any income tax liability of the estate or trust. According to accounting today, the number of income tax returns for estates and trusts (form 1041) increased by 14.9% between 2020 and 2021. as an estate or trust beneficiary, figuring out all the tax implications and form 1041 filing requirements can be daunting. accurately reporting income made from trusts and estates is essential for tax. Enter irs form 1041. estate income tax is documented on irs form 1041. this form reports any income the estate earned after the date of death. this includes income earned from bank accounts or stock while the estate is being managed through a process called probate.

Comments are closed.