How To File Tx Franchise Tax Complete Diy Walkthrough

How To File Tx Franchise Tax Complete Diy Walkthrough Youtube What is texas franchise tax and how is it different from sales tax? this is an important distinction. and this video will walk you through all that, along wi. 📁 unlock business success with our comprehensive texas franchise tax filing guide! 🚀are you a business owner navigating the intricacies of the texas franch.

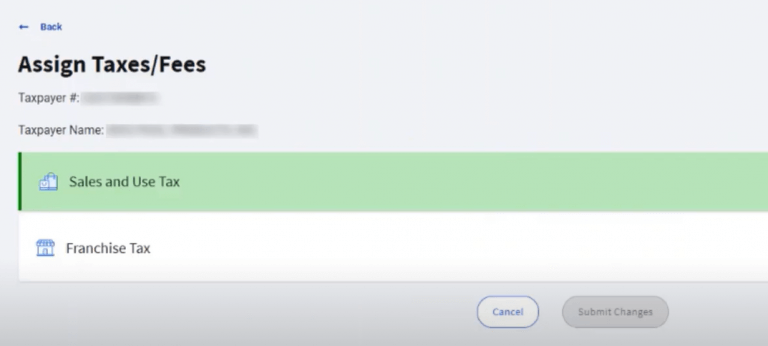

How To File Texas Franchise Tax A Complete Diy Walk Throughођ This is why you don’t want to just multiply your gross receipts in texas by the texas franchise tax rate. 11 – pull the gross receipts for texas from your sales channel. 12 – definitely check the info icon for more info on this one if you’re confused. 13 – divide line 11 by line 12. 14 – multiply line 10 by line 13. This walkthrough shows you how to use texas' webfile system to file franchise tax returns and public information reports (pirs). this is a follow up to our r. From the esystems menu, select webfile pay taxes and fees. if your business account is already listed, select the 11 digit taxpayer number next to your business name. if your account is not yet listed, enter your 11 digit taxpayer number. select “file a no tax due information report” and enter the report year. To determine your franchise tax liability, you must first calculate your total revenue. this includes all income generated from your normal business operations, as well as any other sources such.

How To File Texas Franchise Tax A Complete Diy Walk Throughођ From the esystems menu, select webfile pay taxes and fees. if your business account is already listed, select the 11 digit taxpayer number next to your business name. if your account is not yet listed, enter your 11 digit taxpayer number. select “file a no tax due information report” and enter the report year. To determine your franchise tax liability, you must first calculate your total revenue. this includes all income generated from your normal business operations, as well as any other sources such. Final franchise tax reports before getting a certificate of account status to terminate, convert, merge or withdraw registration with the texas secretary of state:. a texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge. A taxable entity's 2024 franchise tax report is based on the period sept. 15, 2023, through dec. 31, 2023 (108 days). its annualized total revenue is $2,534,722 ($750,000 divided by 108 days multiplied by 365 days). because annualized total revenue is greater than the $2,470,000 no tax due threshold, the taxable entity must file a franchise tax.

How To File Texas Franchise Tax A Complete Diy Walk Throughођ Final franchise tax reports before getting a certificate of account status to terminate, convert, merge or withdraw registration with the texas secretary of state:. a texas entity, terminating, converting or merging, must file its final tax report and pay any amount due in the year it plans to terminate, convert or merge. A taxable entity's 2024 franchise tax report is based on the period sept. 15, 2023, through dec. 31, 2023 (108 days). its annualized total revenue is $2,534,722 ($750,000 divided by 108 days multiplied by 365 days). because annualized total revenue is greater than the $2,470,000 no tax due threshold, the taxable entity must file a franchise tax.

Comments are closed.