How To File For Bankruptcy In Canada Personal Bankruptcy Modus

How To File For Bankruptcy In Canada Personal Bankruptcy Modus To file for personal bankruptcy in canada, you must owe at least $1,000 and be unable to pay your debts as they become due. 3. how long does personal bankruptcy last in canada? bankruptcy typically lasts for nine months for first time bankruptcies in canada. your bankruptcy may extend to 21 months if you have surplus income and can make payments. For a family of four, the cut off is set at $4,168 (many examples of calculations are available here). if you declare bankruptcy a second time, you won’t be discharged for 24 to 36 months. once you’re discharged from your bankruptcy, r9 ratings stay on your file for six years (or 14 years after a second bankruptcy).

How To File Personal Bankruptcy In Canada To file personal bankruptcy, you must be insolvent. to be insolvent you must meet the following requirements: and. you owe at least $1000 in unsecured debt. you reside, do business, or hold most of your assets in canada. if you meet these requirements, you’re able to file for personal bankruptcy in canada. Step 2: contact a licensed insolvency trustee (lit) once you’ve established that you need to take action, the next step is contacting a licensed insolvency trustee. an lit is the only professional authorized to administer government related insolvency proceedings, such as consumer proposals or bankruptcies. In order to file the bankruptcy paperwork your trustee will need: your personal information (name, address, birth date). a list of your creditors. a list of your assets. after your trustee has your information, they will prepare the initial paperwork and review the bankruptcy process with you again. Timing of your discharge from bankruptcy (automatic discharge) if this is your first bankruptcy and you are not required to make surplus income payments (because your surplus income is less than $200 per month), you will be eligible for an automatic discharge from bankruptcy in nine months.

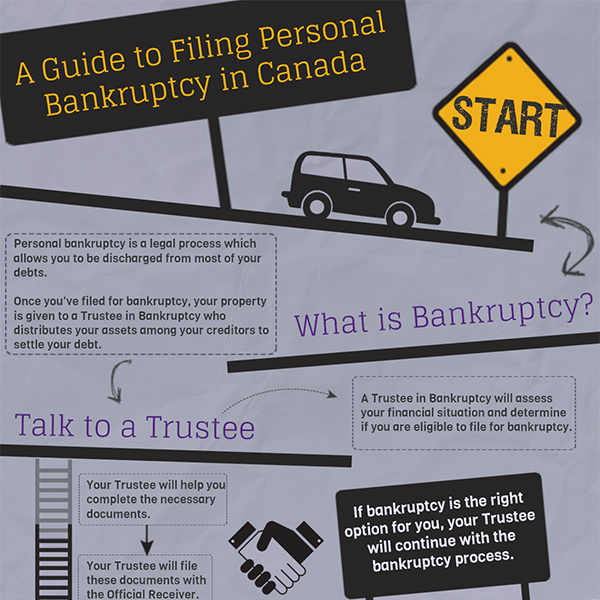

Guide To Filing Personal Bankruptcy In Canada Bankruptcy Canada In order to file the bankruptcy paperwork your trustee will need: your personal information (name, address, birth date). a list of your creditors. a list of your assets. after your trustee has your information, they will prepare the initial paperwork and review the bankruptcy process with you again. Timing of your discharge from bankruptcy (automatic discharge) if this is your first bankruptcy and you are not required to make surplus income payments (because your surplus income is less than $200 per month), you will be eligible for an automatic discharge from bankruptcy in nine months. The first step in the personal bankruptcy process is to schedule a consultation with a licensed insolvency trustee. this initial meeting allows the trustee to assess the individual’s financial situation, evaluate the eligibility for bankruptcy, and discuss potential alternatives to bankruptcy. This is how a person files for bankruptcy in canada. what happens if i declare bankruptcy in canada? once you declare bankruptcy (or file a consumer proposal), all collection and enforcement action against you stops. creditors can no longer sue you or harass you trying to collect the outstanding debts. you are now protected by the stay of.

A Step By Step Guide On How To File For Bankruptcy In Canada Chande The first step in the personal bankruptcy process is to schedule a consultation with a licensed insolvency trustee. this initial meeting allows the trustee to assess the individual’s financial situation, evaluate the eligibility for bankruptcy, and discuss potential alternatives to bankruptcy. This is how a person files for bankruptcy in canada. what happens if i declare bankruptcy in canada? once you declare bankruptcy (or file a consumer proposal), all collection and enforcement action against you stops. creditors can no longer sue you or harass you trying to collect the outstanding debts. you are now protected by the stay of.

File Bankruptcy In Canada Online Our Complete Guide On How To File

Comments are closed.