How To Download Itr V Income Tax Return Acknowledgement вђ

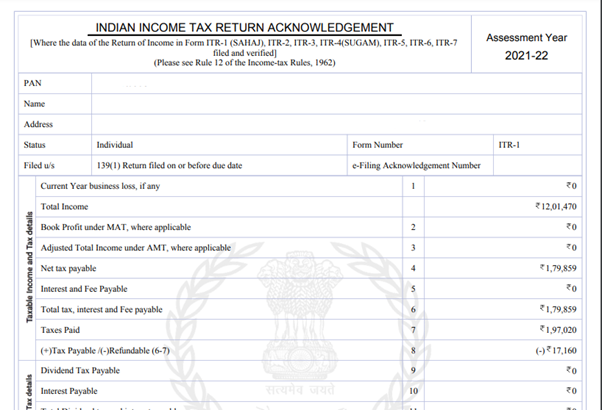

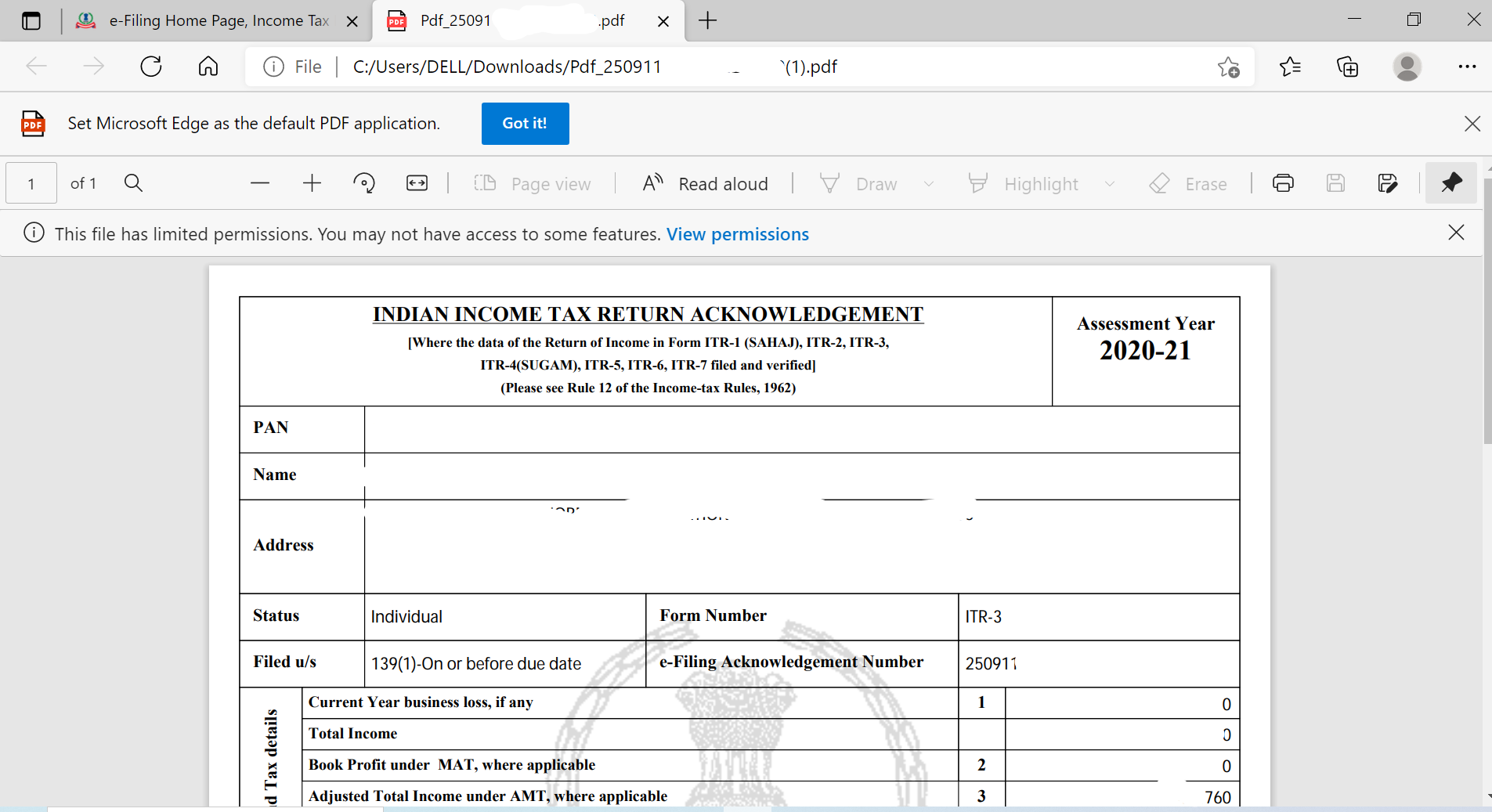

How To Download Itr V Acknowledgement From The Income Tax Depart Who falls under the tax bracket and who doesn’t -It is mandatory to file ITR for filing of return -They would also be liable for a late fee of Rs 5,000 For those below an income of Rs In case of an already filed Income Tax your ITR and then click Continue Step 12: Once your return is e-verified, you will see a success message displaying the Transaction ID and

How To Download Itr V Income Tax Return Acknowledgement вђ necessitating a belated ITR or an updated ITR (ITR-U) The number of defective income tax return (ITR) notices has been increasing lately, according to an Economic Times report, which added that This type of return is filed under Section 139(4) of the Income Tax Act, 1961 Also Read | ITR Filing FY 2023-24: What is Form 16 and how you can download it to file your income tax return How to Income tax returns must be processed within nine months of the end of the fiscal year after you file them It usually takes an average of 15-45 days from the e-verification date of income tax If your child or children recently started working (or otherwise earning income), they may need to file a tax return this year — and they might need your help to do so If your child is required

How To Download Itr V Acknowledgement Income Tax Edutaxtuber Income tax returns must be processed within nine months of the end of the fiscal year after you file them It usually takes an average of 15-45 days from the e-verification date of income tax If your child or children recently started working (or otherwise earning income), they may need to file a tax return this year — and they might need your help to do so If your child is required The amount you pay the IRS each year is determined by your tax bracket That, in turn, is based on your taxable income and filing status But there are several ways you can lower your taxable In addition to the amount a teen makes, the type of income they earn can impact their tax liability and how much they might be expected to pay Teens don’t need to file a separate tax return Read further for more information on how to file a final federal income tax return for a deceased person Profit and prosper with the best of expert advice on investing, taxes, retirement

How To Download Itr V Acknowledgement On New Income Tax Portal T The amount you pay the IRS each year is determined by your tax bracket That, in turn, is based on your taxable income and filing status But there are several ways you can lower your taxable In addition to the amount a teen makes, the type of income they earn can impact their tax liability and how much they might be expected to pay Teens don’t need to file a separate tax return Read further for more information on how to file a final federal income tax return for a deceased person Profit and prosper with the best of expert advice on investing, taxes, retirement

Comments are closed.