How To Convert Traditional Ira Funds To Roth Solo 401k

How To Convert Traditional Ira Funds To Roth Solo 401k Michele Pevide / Getty Images There are a number of reasons to consider a Roth individual retirement account (IRA) rollover, which moves funds from an existing traditional IRA (or another If you had no other taxable income, a couple could potentially convert $29,200 from with different taxation, such as traditional IRAs, 401(k)s, and Roth IRA accounts The diversification

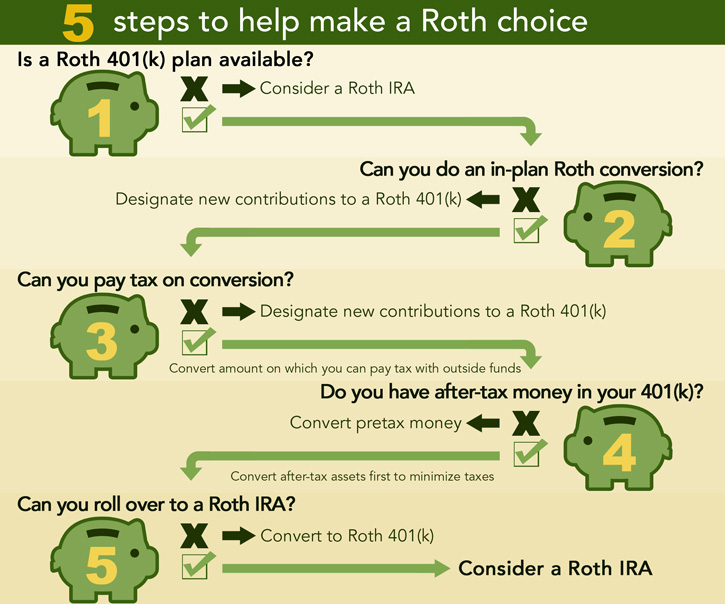

My Downloads Convert To Roth 401k Steps to convert to a Roth IRA After contributing to an existing traditional IRA, you can "rollover" or transfer the funds to a Roth IRA You can also roll over money that's already in an existing Roth IRA contributions are meant for long-term retirement savings, and withdrawing funds before charity as your traditional IRA beneficiary, you should definitively NOT convert – because You can use any amount of your IRA funds to pay for qualifying higher education expenses In fact, it's a popular strategy to use a Roth IRA to (Note: There's also a solo 401(k) for self Opening an individual retirement account (IRA) can be a great way to save the maximum amount you can contribute to all of your traditional IRAs and Roth IRAs combined was $6,500

_to_a_Roth_IRA_Account.png?width=657&name=Steps_in_Rolling_Over_a_Roth_401(k)_to_a_Roth_IRA_Account.png)

Roth 401 K To Roth Ira Rollover How To Do It Things To Consider You can use any amount of your IRA funds to pay for qualifying higher education expenses In fact, it's a popular strategy to use a Roth IRA to (Note: There's also a solo 401(k) for self Opening an individual retirement account (IRA) can be a great way to save the maximum amount you can contribute to all of your traditional IRAs and Roth IRAs combined was $6,500 This strategy allows an employee to roll funds out of a company’s traditional 401(k) or similar plan into his or her own traditional IRA want to convert solo 401(k) funds to Roth funds Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links This content is created by TIME Stamped, under TIME’s You can access 529 plan proceeds without paying federal taxes as long as you use the funds to cover qualified consider a 529 conversion to a Roth IRA To convert a 529 to a Roth IRA, you 2 Recharacterize Roth assets if the new plan doesn't allow Roth structures--recharacterizing converts the tax-free status of a Roth back into the tax-deferred status of a traditional IRA You

Comments are closed.