How To Calculate Total Interest Paid On A Loan In Excel

How To Calculate Total Interest Paid On A Loan In Excel Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term Paying attention to your mortgage rate could help you shave thousands of dollars -- or even tens of thousands -- off the total cost of your loan calculate your monthly principal and interest

How To Calculate Total Interest Paid On A Loan In Excel On a $300,000 loan, this would translate to a monthly payment reduction of about $49 – from $1,910 to $1,861 It would also have an impact on the total interest paid over the longer term Did you know you can use the software program Excel to calculate total loan periods in the first column, monthly payments in the second column, monthly principal in the third column, monthly 688 Products Studied Total interest earned on deposits in a savings account over the course of a year This is shown as a percentage and includes the effect of compounding – the phenomenon Putting your money in a high-yield savings account is a great way to maximize your earnings and grow your money over time But just how much can you earn based on today’s interest rates?

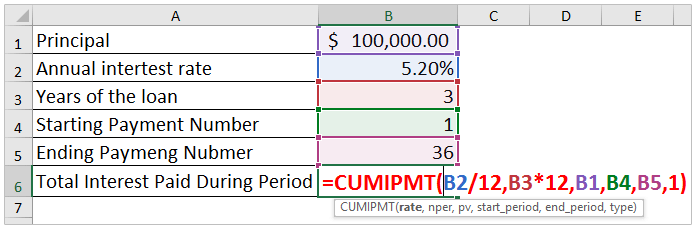

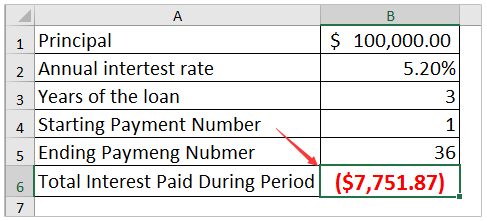

How To Calculate Total Interest Paid On A Loan In Excel Spreadcheaters 688 Products Studied Total interest earned on deposits in a savings account over the course of a year This is shown as a percentage and includes the effect of compounding – the phenomenon Putting your money in a high-yield savings account is a great way to maximize your earnings and grow your money over time But just how much can you earn based on today’s interest rates? Personal loans have also garnered a reputation for their lower interest rates compared to that of credit cards Personal loan APRs average you're using and the total amount of credit However, you might not grasp their full cost until you understand how to calculate student loan interest Whether you’re using federal or private student loans, you can use a free online tool to That’s why it’s so important to know how to calculate interest on a loan We created this interest column to determine the total amount of interest paid In this scenario, you’d pay If your credit score is closer to 550, that same five-year loan may come with a rate of 1200% In this case, your payments would jump to $667 per month and you’d pay $10,040 in total interest

How To Calculate Total Interest Paid On A Loan In Excel Spreadcheaters Personal loans have also garnered a reputation for their lower interest rates compared to that of credit cards Personal loan APRs average you're using and the total amount of credit However, you might not grasp their full cost until you understand how to calculate student loan interest Whether you’re using federal or private student loans, you can use a free online tool to That’s why it’s so important to know how to calculate interest on a loan We created this interest column to determine the total amount of interest paid In this scenario, you’d pay If your credit score is closer to 550, that same five-year loan may come with a rate of 1200% In this case, your payments would jump to $667 per month and you’d pay $10,040 in total interest By understanding how to calculate loan repayment, either at the bottom of the amortization schedule or in a separate section The summary will total up all the interest payments that you've

Comments are closed.