How To Calculate The Quick Ratio Acid Test From A Balance Sheet

How To Calculate Quick Ratio From Balance Sheet How Calculate ођ Cash & equivalents total $22.4 billion $3 billion in receivables = $25.4 billion (there are no short term investments listed). current liabilities total $27.4 billion. the acid test ratio for. The acid test ratio, also known as the quick ratio, is a liquidity ratio that measures how sufficient a company’s short term assets are to cover its current liabilities. in other words, the acid test ratio is a measure of how well a company can satisfy its short term (current) financial obligations.

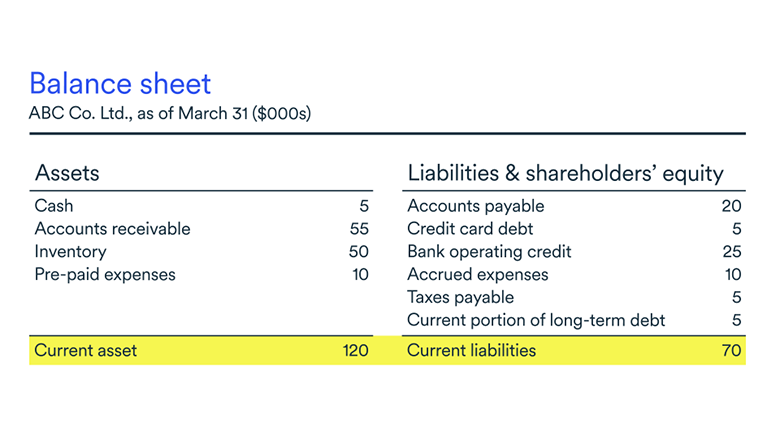

Quick Ratio Calculatorвђ Acid Test Ratio Bdc Ca The quick ratio or acid test ratio is a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. quick assets are current assets that can be converted to cash within 90 days or in the short term. cash, cash equivalents, short term investments or marketable securities, and. The acid test ratio, also called the quick ratio, is a metric used to see if a company is positioned to sell assets within 90 days to meet immediate expenses. in general, analysts believe if the. Formula for quick ratio. to calculate the quick ratio, use the following formula: quick ratio (or acid test ratio) = quick assets current liabilities. example. the data below was obtained from fine trading company's balance sheet. current assets: cash: $90,000; marketable securities: $65,000; accounts receivable: $200,000; prepaid expenses. Formula for the quick ratio. there are a few different ways to calculate the quick ratio. the most common approach is to add the most liquid assets and divide the total by current liabilities.

Comments are closed.