How To Calculate Loan Costs Sapling

How To Calculate Loan Costs Sapling You can calculate an estimate of effective cost using a fairly simple formula. first, find the total finance charges by adding all of the interest charged over the life of the loan to other fees. the formula to approximate effective cost is 2 (f * n) (a * (t 1)). f equals total finance charges, n is the number of payments per year, a equals. Origination fees vary but are often between 0.5 and 2 percent, according to quicken loans. on a $150,000 home loan with a 1 percent fee, you would pay $1,500 for the origination. on a $250,000 loan, the fee is $250,000 times 1 percent, which equals $2,500.

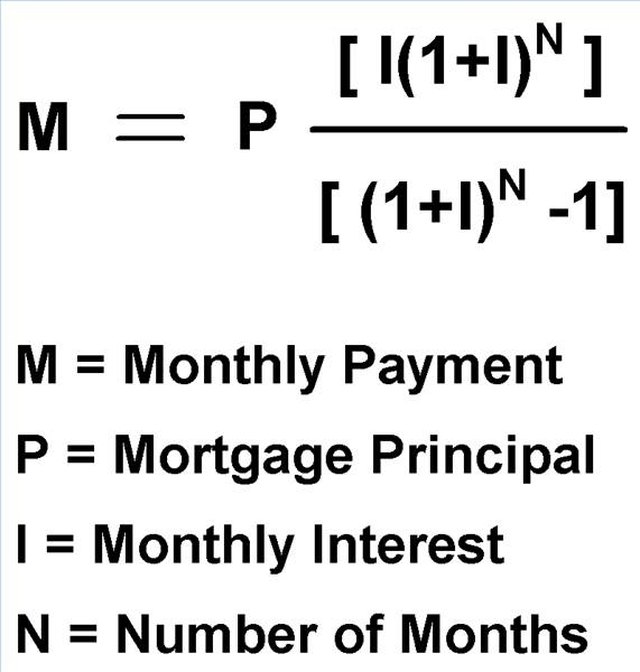

How To Calculate Loan Costs Sapling Images And Photos Finder A mortgage or loan covers the purchase price of the home, plus the cost, or interest for the loan. in reality the true cost of owning the home may be two or three times the purchase price when the interest is factored into the cost. when figuring the true cost of an acquisition, consider the purchase price and the cost of obtaining the financing. For the figures given, the loan payment formula would look like: 0.06 divided by 12 = 0.005. 0.005 x $20,000 = $100. in this example, you’d pay $100 in interest in the first month. as you. Use this calculator to compute the initial value of a bond loan based on a predetermined face value to be paid back at bond loan maturity. predetermined. due amount. loan term. years months. interest rate. compound. annually (apy) semi annually quarterly monthly (apr) semi monthly biweekly weekly daily continuously. Calculate loan payments, loan amount, interest rate or number of payments. use this calculator to try different loan scenarios for affordability by varying loan amount, interest rate, and payment frequency. create and print a loan amortization schedule to see how your loan payment pays down principal and bank interest over the life of the loan.

How To Calculate Cost Basis After A Spin Off Sapling Use this calculator to compute the initial value of a bond loan based on a predetermined face value to be paid back at bond loan maturity. predetermined. due amount. loan term. years months. interest rate. compound. annually (apy) semi annually quarterly monthly (apr) semi monthly biweekly weekly daily continuously. Calculate loan payments, loan amount, interest rate or number of payments. use this calculator to try different loan scenarios for affordability by varying loan amount, interest rate, and payment frequency. create and print a loan amortization schedule to see how your loan payment pays down principal and bank interest over the life of the loan. Follow the below steps to calculate loan interest. calculate the periodic rate (i) by dividing the annual interest rate by the number of payments in a year (n). calculate the total payment (p) by multiplying the periodic rate (i) with the loan amount (a) and the number of payment (n) and then divide it by the factor of 1 – (1 i) n. What is amortization? there are two general definitions of amortization. the first is the systematic repayment of a loan over time. the second is used in the context of business accounting and is the act of spreading the cost of an expensive and long lived item over many periods. the two are explained in more detail in the sections below.

How To Calculate Initial Mortgage Loan Amount With Known Loan Amount Follow the below steps to calculate loan interest. calculate the periodic rate (i) by dividing the annual interest rate by the number of payments in a year (n). calculate the total payment (p) by multiplying the periodic rate (i) with the loan amount (a) and the number of payment (n) and then divide it by the factor of 1 – (1 i) n. What is amortization? there are two general definitions of amortization. the first is the systematic repayment of a loan over time. the second is used in the context of business accounting and is the act of spreading the cost of an expensive and long lived item over many periods. the two are explained in more detail in the sections below.

How Do I Manually Calculate An Auto Loan Sapling

Comments are closed.