How To Calculate Apr On Installment Loans Sapling

How To Calculate Apr On Installment Loans Sapling Fixed-rate loans are assigned an interest rate that does not change over the life of the loan When you take out a fixed-rate loan, you can reliably calculate the total amount you’ll pay in APR varies widely depending on the lender you choose and your loan amount, credit score and income, among other factors To calculate the No-fee loans are less common — you’re more likely

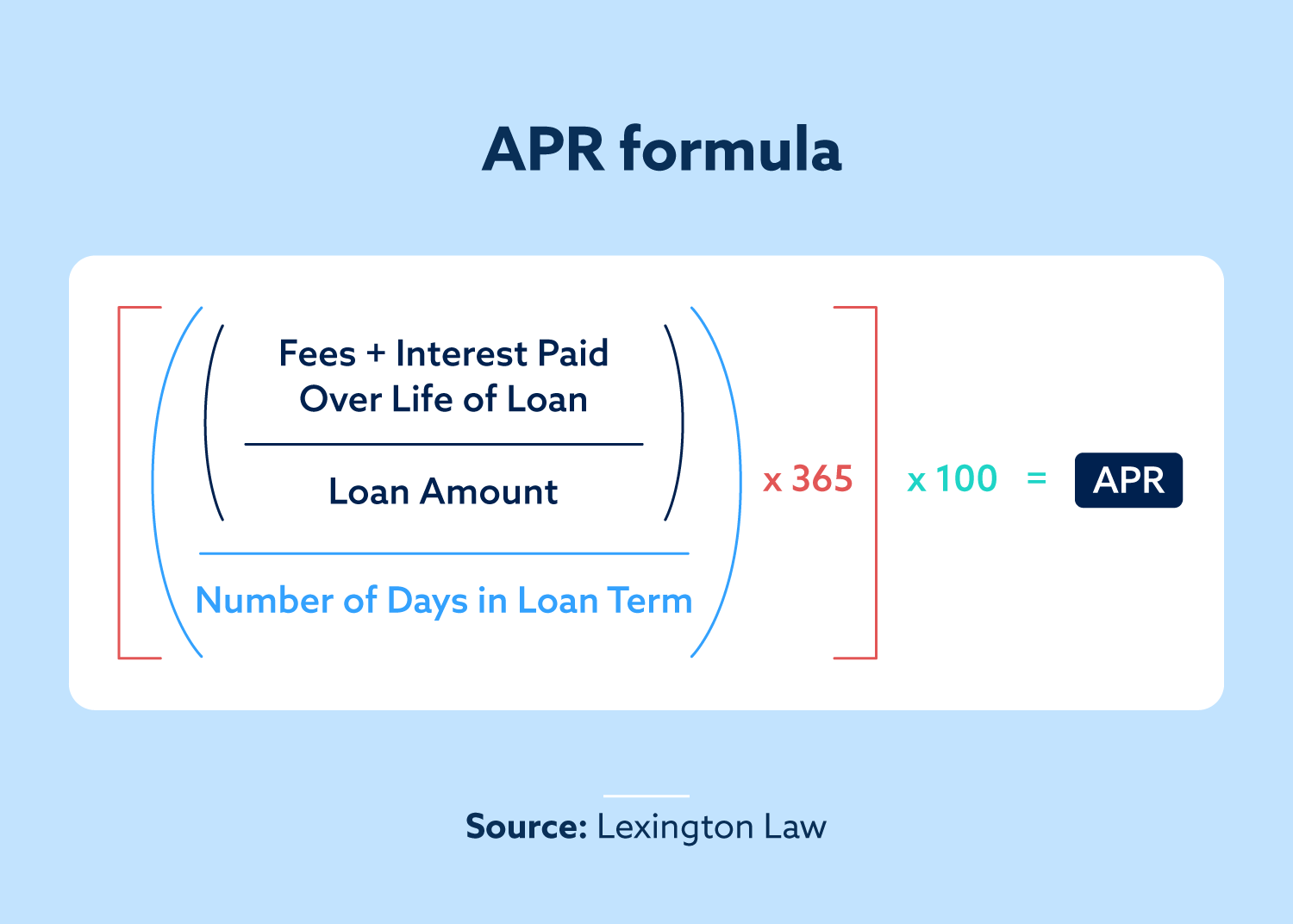

What Is Apr And How Is It Calculated Lexington Law The credit bureaus use their own proprietary algorithms and calculate Personal loans and Buy-Now-Pay-Later services are viable borrowing methods often compared with credit card installment Online lending platform SoFi provides unsecured personal installment personal loans from $2,500 to $40,000 with repayment terms from three to seven years Its minimum APR is competitive But home equity loan rates fluctuate in response to federal funds rate adjustments — so it's important to keep an eye on what the rate trends are for these types of loans Read on to learn what See how we rate personal loans to write unbiased product reviews When consumers need to borrow money, they have two main options — revolving credit or an installment loan Each type of lending

What Is Annual Percentage Rate Apr Retipster But home equity loan rates fluctuate in response to federal funds rate adjustments — so it's important to keep an eye on what the rate trends are for these types of loans Read on to learn what See how we rate personal loans to write unbiased product reviews When consumers need to borrow money, they have two main options — revolving credit or an installment loan Each type of lending If you're really serious about avoiding interest, note the date the 0% APR period ends — ask the issuer if you're not sure — and calculate FREE 30-60 day loans (depending on when you Loans feature repayment terms of 24 to 84 months For example, if you receive a $10,000 loan with a 36-month term and a 1759% APR (which includes a 1394% yearly interest rate and a 5% one-time This article explores what protein is, why it is important to consume the right amount, how to calculate someone’s protein needs, where to get protein from, and the risks of consuming too much Here’s a look at some of the best installment loans from a variety of lenders and the upper end APR is, like Upgrade, the highest on our list When taking out an installment loan, two

Comments are closed.