How To Buy Your First Home 9 Step Guide Moneywise

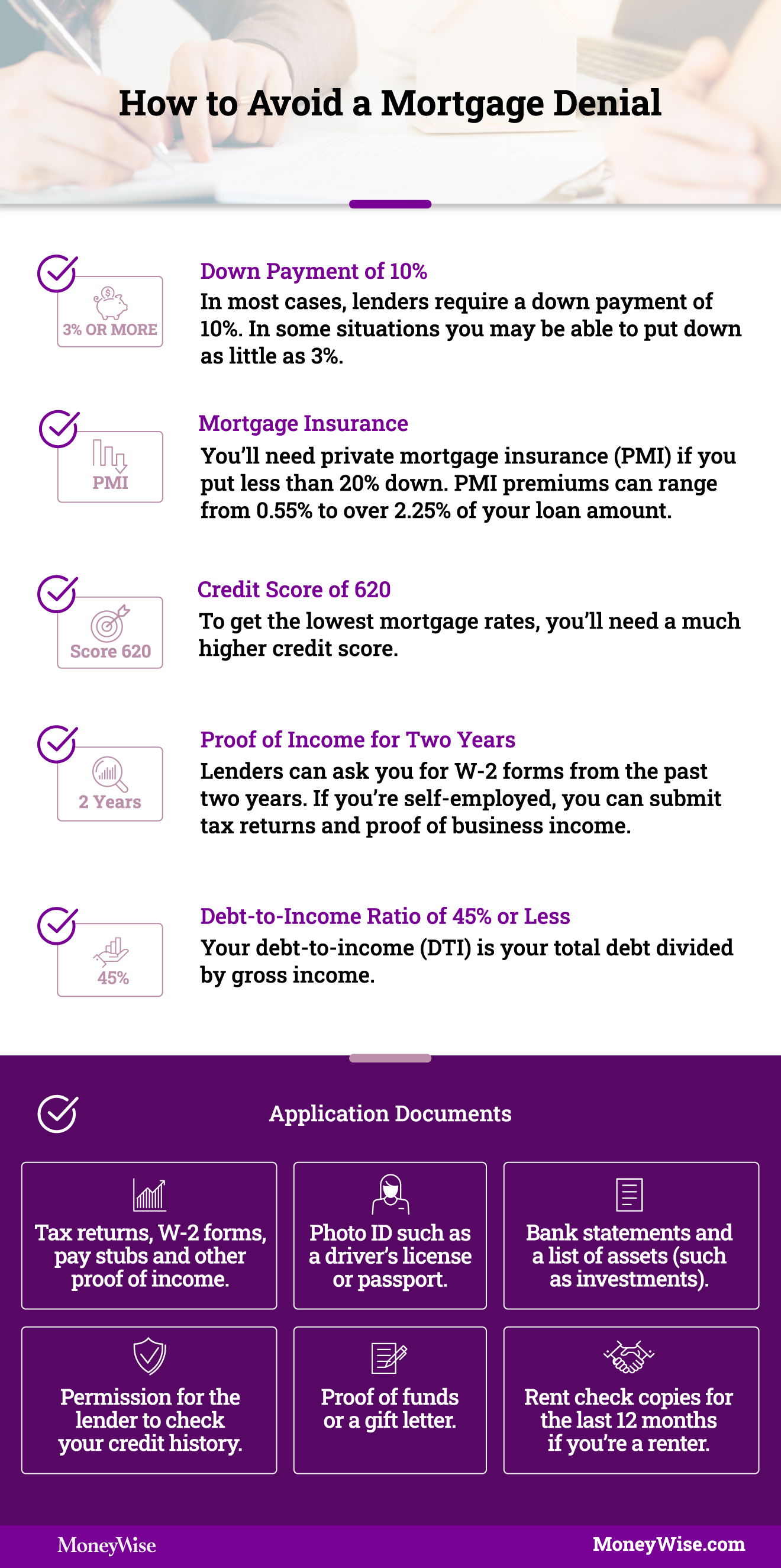

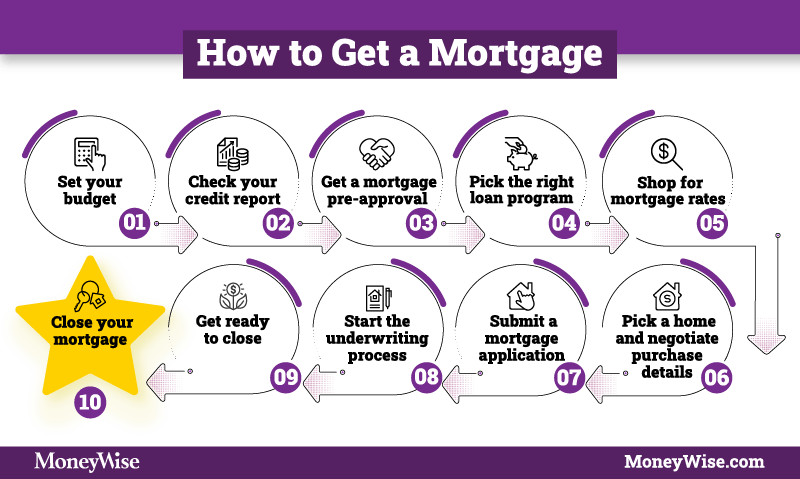

How To Buy Your First Home 9 Step Guide Moneywise Explore better rates. 2. check your credit score. your credit score is a three digit number that reflects how well you handle money. you'll need to see it before you apply for a home loan because the higher your score, the more banks will be willing to work with you, and the lower your mortgage rate will be. 5. save up for a down payment. most homebuyers, with some exceptions, will need to have a down payment when purchasing a home. while 20% down has become the gold standard in homebuying (and will help you avoid mortgage insurance), in reality, you may not need to put down nearly that much. in fact, in 2023, first time homebuyers put down an.

How To Buy Your First Home 9 Step Guide Moneywise Step 1: start saving a down payment. one of the most important steps to buying a house for the first time? figure out your finances. buying a new home (particularly for the first time) requires a. The following eight steps will help you get your financial and mental houses in order so you can search for a new home with confidence. 1. assess your debt. lenders want to know that you’ll be. We have thousands of articles in addition to our guides. search all our content for answers to your questions. or, speak to a lender and get personalized help. call now: this step by step guide. Explore some first time home buyer tips and advice intended to help you along the way. 1. be sure you’re ready to commit to a loan. one of the most important things for first time home buyers to know is that they shouldn’t purchase a home prematurely. as a first time home buyer, above all, be sure you’re ready to buy.

How To Buy Your First Home The Ultimate 8 Step Guide The Savvy C We have thousands of articles in addition to our guides. search all our content for answers to your questions. or, speak to a lender and get personalized help. call now: this step by step guide. Explore some first time home buyer tips and advice intended to help you along the way. 1. be sure you’re ready to commit to a loan. one of the most important things for first time home buyers to know is that they shouldn’t purchase a home prematurely. as a first time home buyer, above all, be sure you’re ready to buy. These tips for first time home buyers will help you navigate the process from start to finish. on va loans, nbkc offers down payments as low as 0%. veterans united offers va loans for as little as. 1. have your offer accepted. whether your first offer was a success, you negotiated on terms a bit or you had to keep looking for a home, eventually you’ll reach the point of going under contract. at this point, you're just a few weeks – and a good deal of paperwork – away from becoming a homeowner for the first time.

Comments are closed.