How To Build M A Origination Process Practitioner Playbook

How To Build M A Origination Process Practitioner Playbook A new playbook for today’s m&a 2 about the authors j. neely senior managing director, accenture strategy, mergers & acquisitions, global lead j. neely is senior managing director for mergers & acquisitions within accenture strategy. his role focuses on building accenture’s global m&a client service capabilities and on working with clients on. The m&a deal origination process happens in one of two ways: outbound: you contact parties in the market who are looking to close transactions, such as business owners and technology companies. inbound: parties in the market contact you about their willingness and availability to close transactions. the smaller your company or firm is, the more.

How To Build M A Origination Process Practitioner Playbook M&a pipeline management software is essentially m&a project management software that, ideally, is intuitive and collaborative, allowing for stakeholders and team members to communicate and remain accountable throughout the m&a process. pipeline management software can revitalize your m&a practices as it fosters organization and efficiency when. Clayton m. christensen, richard alton, curtis rising, and. andrew waldeck. from the magazine (march 2011) summary. companies spend more than $2 trillion on acquisitions every year, yet the m&a. M&a deal origination, also known as ‘ deal sourcing ’ is the process through which investment bankers, lawyers and other financial intermediaries ‘originate’ the mandates to advise on companies’ transactions. as their primary source of revenue for most investment bankers, the importance of deal origination cannot be overstated. In this ebook, we will explore how the best corporate development teams identify their targets, move past “gatekeepers” to build relationships with sellers, and gather essential information so they can ultimately get a deal closed. download now. solutions. pipeline management due diligence post merger integration m&a project management deal.

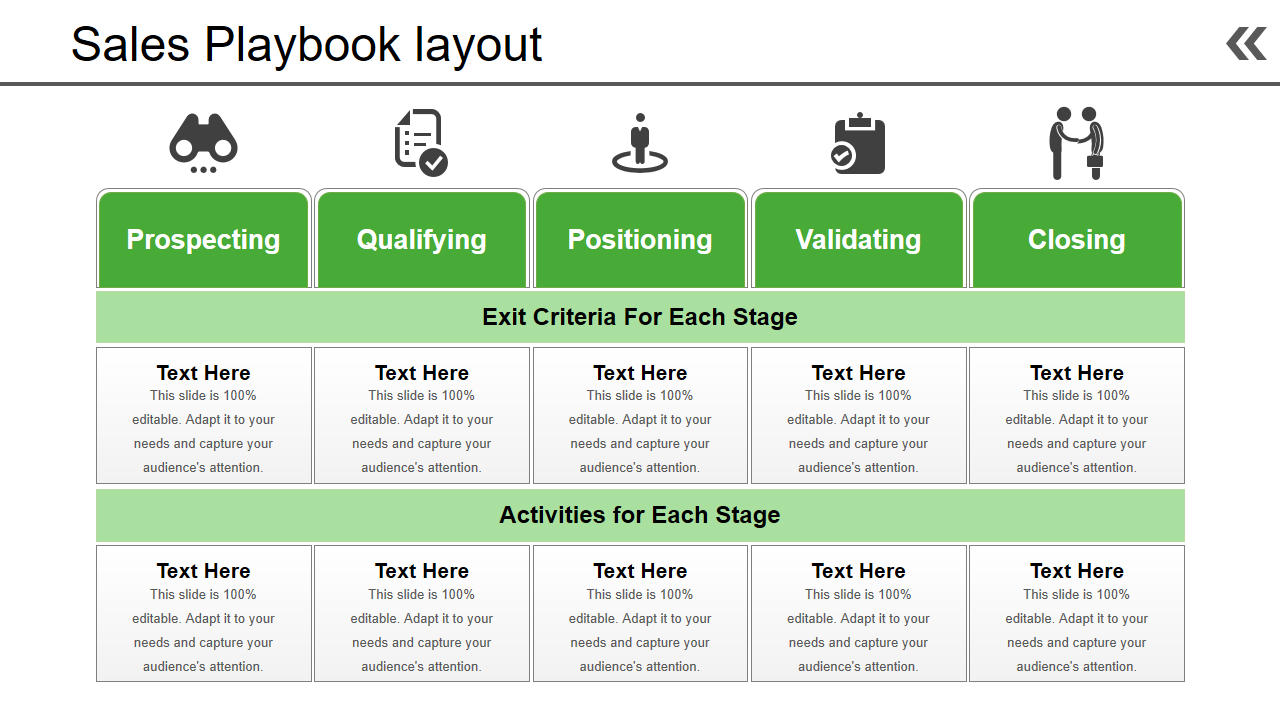

Use This Sales Process Cheat Sheet To Build A Sales Playbook In M&a deal origination, also known as ‘ deal sourcing ’ is the process through which investment bankers, lawyers and other financial intermediaries ‘originate’ the mandates to advise on companies’ transactions. as their primary source of revenue for most investment bankers, the importance of deal origination cannot be overstated. In this ebook, we will explore how the best corporate development teams identify their targets, move past “gatekeepers” to build relationships with sellers, and gather essential information so they can ultimately get a deal closed. download now. solutions. pipeline management due diligence post merger integration m&a project management deal. A well developed playbook functions as both a business plan and how to field guide, keeping the integration team focused on creating value while providing step by step guidance for tactical implementation. a playbook can help set the standard for speed of execution, consistency of approach, and accountability for performance. and by formalizing. A typical m&a integration timeline should include the following nine phases: 1. vision and mergers & acquisitions integration strategy. the initial responsibility in an m&a integration is to define and determine the value drivers and guiding principles of the deal that supports the vision and integration strategy.

The Ultimate Guide To Create A Business Playbook A well developed playbook functions as both a business plan and how to field guide, keeping the integration team focused on creating value while providing step by step guidance for tactical implementation. a playbook can help set the standard for speed of execution, consistency of approach, and accountability for performance. and by formalizing. A typical m&a integration timeline should include the following nine phases: 1. vision and mergers & acquisitions integration strategy. the initial responsibility in an m&a integration is to define and determine the value drivers and guiding principles of the deal that supports the vision and integration strategy.

M A Process Complete 10 Step Merger Acquisition Transaction

Comments are closed.