How To Apply For A Credit Card And Get Approved Card Insider

How To Apply For A Credit Card And Get Approved Card Insider In canada, to qualify for a credit card, you must: be the age of majority (18 or 19 years old, depending on which province you live in) be a canadian citizen or resident. have a good credit score. 1. learn about credit scores. credit scores — you have many — are one of the most important factors in a credit card issuer's decision to approve your application. banks differ on how they.

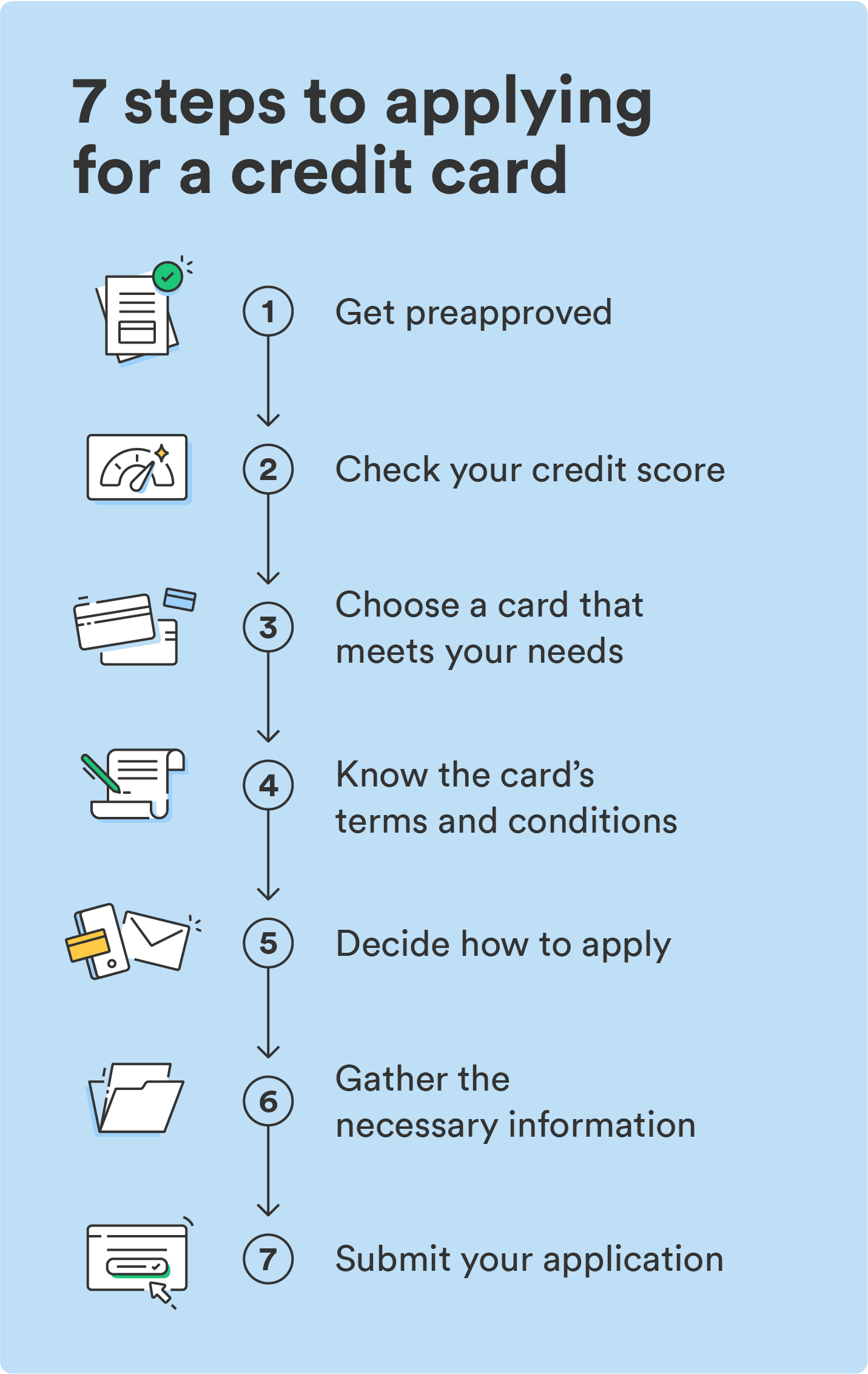

How To Get A Credit Card 7 Simple Steps Chime You can apply for a credit card online, in person, through the mail, or over the phone. check your credit score before applying to get a sense of interest rates and your card eligibility. if your. Best credit card by category. why we love it. best for instant use. canadian tire triangle mastercard. annual fee: $0. shop online instantly after being approved, and make purchases using apple. By mail. if you receive a physical card offer, you can mail your completed card application to the issuer. card approval with this method can take a few weeks, depending on the issuer. and you. Fair: 580 to 669. good: 670 to 739. very good: 740 to 799. excellent: 800 to 850. improving your credit score is the simplest way to increase your chances of being approved for a credit card.

How To Apply For A Credit Card And Get Approved In 8 Steps By mail. if you receive a physical card offer, you can mail your completed card application to the issuer. card approval with this method can take a few weeks, depending on the issuer. and you. Fair: 580 to 669. good: 670 to 739. very good: 740 to 799. excellent: 800 to 850. improving your credit score is the simplest way to increase your chances of being approved for a credit card. Lower your credit utilization ratio. in addition to lowering your debt, you'll also want to maintain a high credit amount. these two numbers make up your credit utilization ratio, which can be calculated by dividing your total credit card balances by your total available credit. westend61 getty images. 3. understand the terms on your credit card application. here are some common credit card terms and definitions to help you make an informed decision on whether to apply. annual fee this yearly fee, charged by the card issuer, lets you use the card and reap any associated benefits, like cash back rewards.

Comments are closed.