How To Apply For A Credit Card 5 Steps To Getting Approved Lexington Law

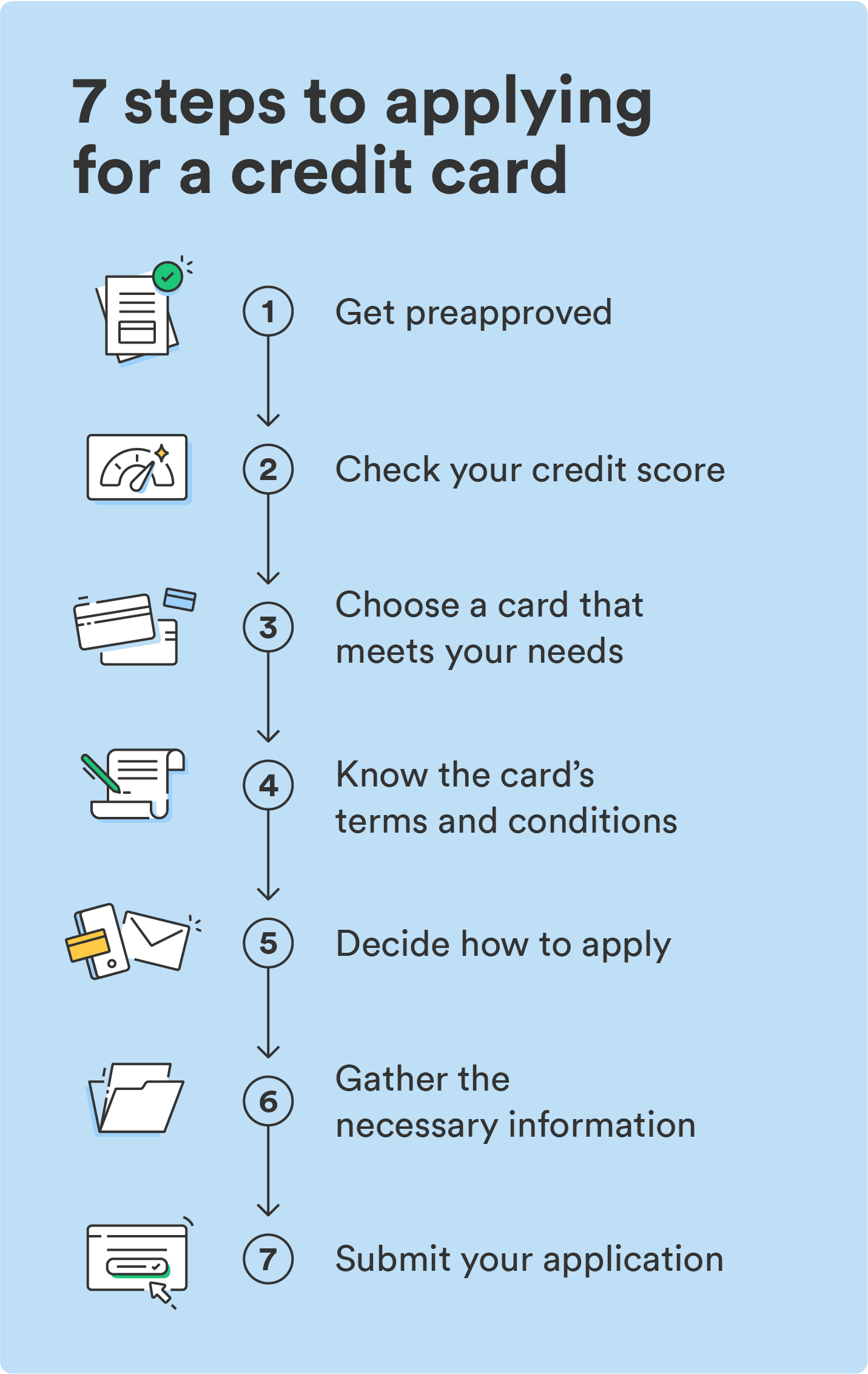

How To Get A Credit Card 7 Simple Steps Chime Determine the best card for you. submit your application. 1. understand how your credit score affects your application. understanding how your score affects your chances is an important first step to apply for a credit card. each issuer has their own set of criteria and may accept different credit scores for different credit card limits. Compare credit card offers. read the fine print. apply for one card at a time. 1. check your credit score. the first step towards getting a credit card is to check your credit score. credit cards usually have minimum credit requirements, so you can’t pick a card if you don’t know your score.

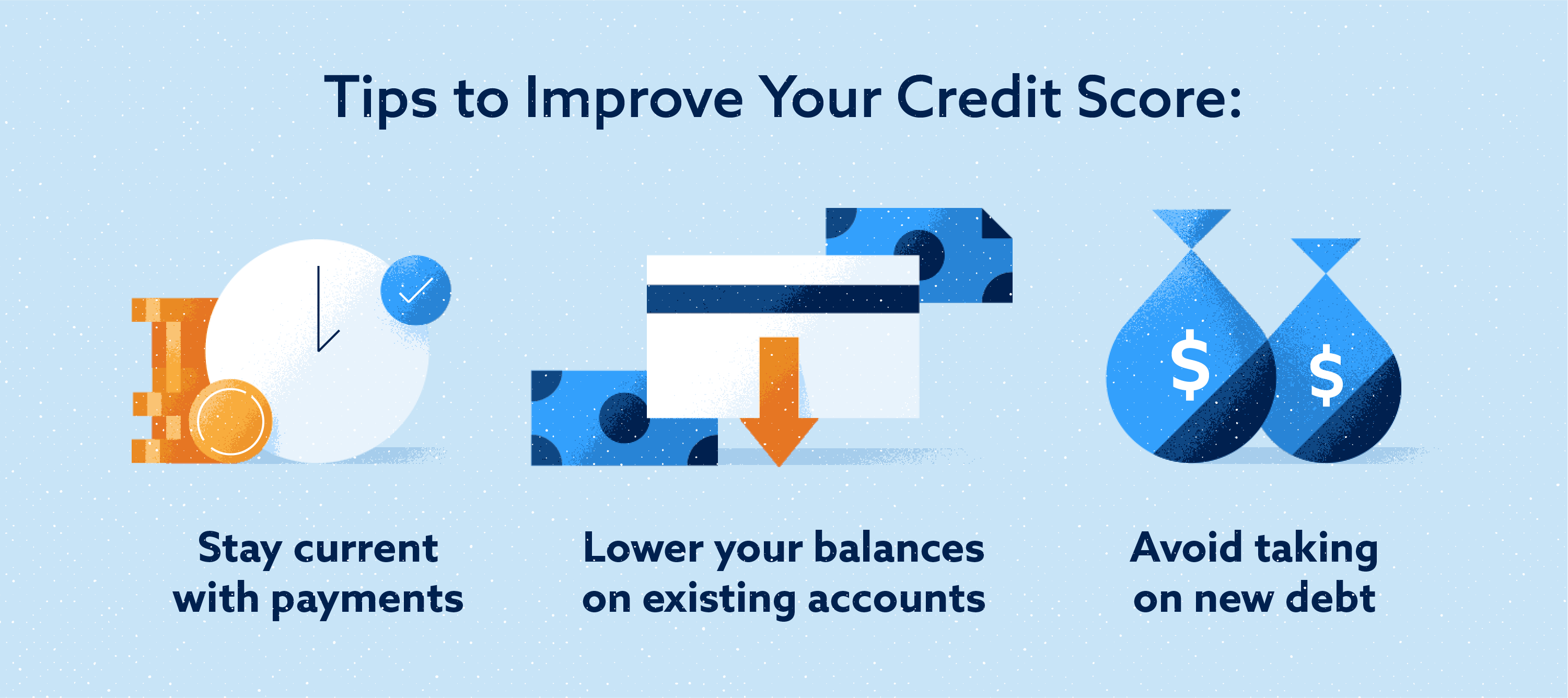

How To Apply For A Credit Card 5 Steps To Getting Approved Lexington Law 4. prepare for questions you’ll be asked. when you apply, you’ll be asked similar questions no matter which company is issuing the card. it helps the issuer to decide whether to approve you. For those trying to pay down debt, a balance transfer credit card can save money in interest. 2. use your credit scores to eliminate cards. so you’ve identified the type of card you want. next. Fair: 580 to 669. good: 670 to 739. very good: 740 to 799. excellent: 800 to 850. improving your credit score is the simplest way to increase your chances of being approved for a credit card. Here's a full list of steps to follow so that you apply and get approved for a credit card: use a free credit score tool to check your credit. choose a credit card that fits your credit score.

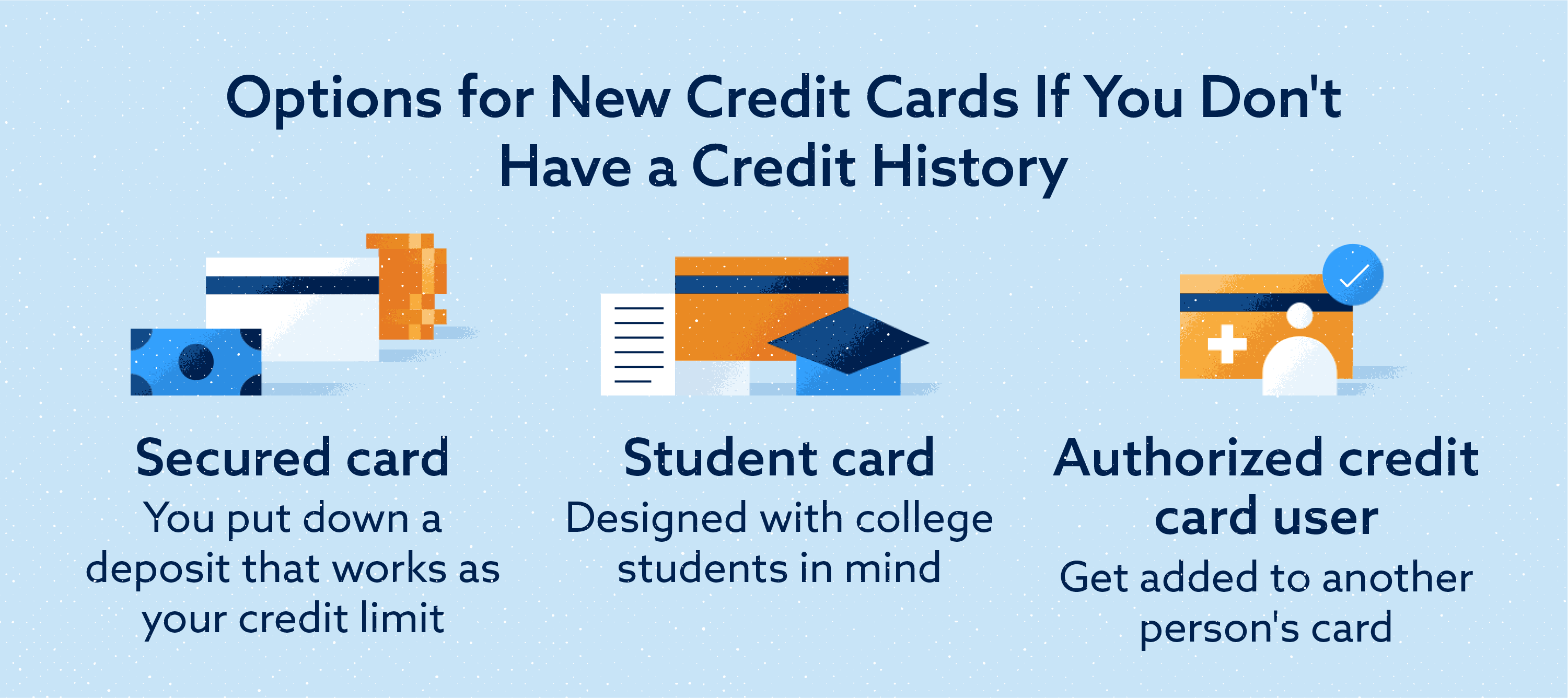

How To Get A Business Credit Card Lexington Law Fair: 580 to 669. good: 670 to 739. very good: 740 to 799. excellent: 800 to 850. improving your credit score is the simplest way to increase your chances of being approved for a credit card. Here's a full list of steps to follow so that you apply and get approved for a credit card: use a free credit score tool to check your credit. choose a credit card that fits your credit score. Below are five ways you can continue building your credit up and to the right. 6. become an authorized user on someone else’s card. as an authorized user, your name will begin to show on the credit history for someone else’s credit card account. in turn, you will be building credit. Here are the steps to apply for a credit card…. check your credit scores. determine what type of card you need. understand the terms on your credit card application. choose where to apply. check to see if you’re prequalified. prepare for a knock to your credit. use credit card best practices.

5 Tips To Get Your Credit Card Application Approved Gobankingrates Below are five ways you can continue building your credit up and to the right. 6. become an authorized user on someone else’s card. as an authorized user, your name will begin to show on the credit history for someone else’s credit card account. in turn, you will be building credit. Here are the steps to apply for a credit card…. check your credit scores. determine what type of card you need. understand the terms on your credit card application. choose where to apply. check to see if you’re prequalified. prepare for a knock to your credit. use credit card best practices.

How To Apply For A Credit Card 5 Steps To Getting Approved Lexington Law

Comments are closed.