How To Apply And Get Approved For An Sba Loan Step By Step Guide

How To Apply For An Sba Loan Eligibility Lenders More Cash grants for small businesses are available from the federal government, state or local governments, and some private companies, although the competition for them can be fierce Here is what you But to be approved specific criteria also apply, depending on which loan you apply for, and lenders themselves may have their own requirements By and large, SBA lenders shy away from industry

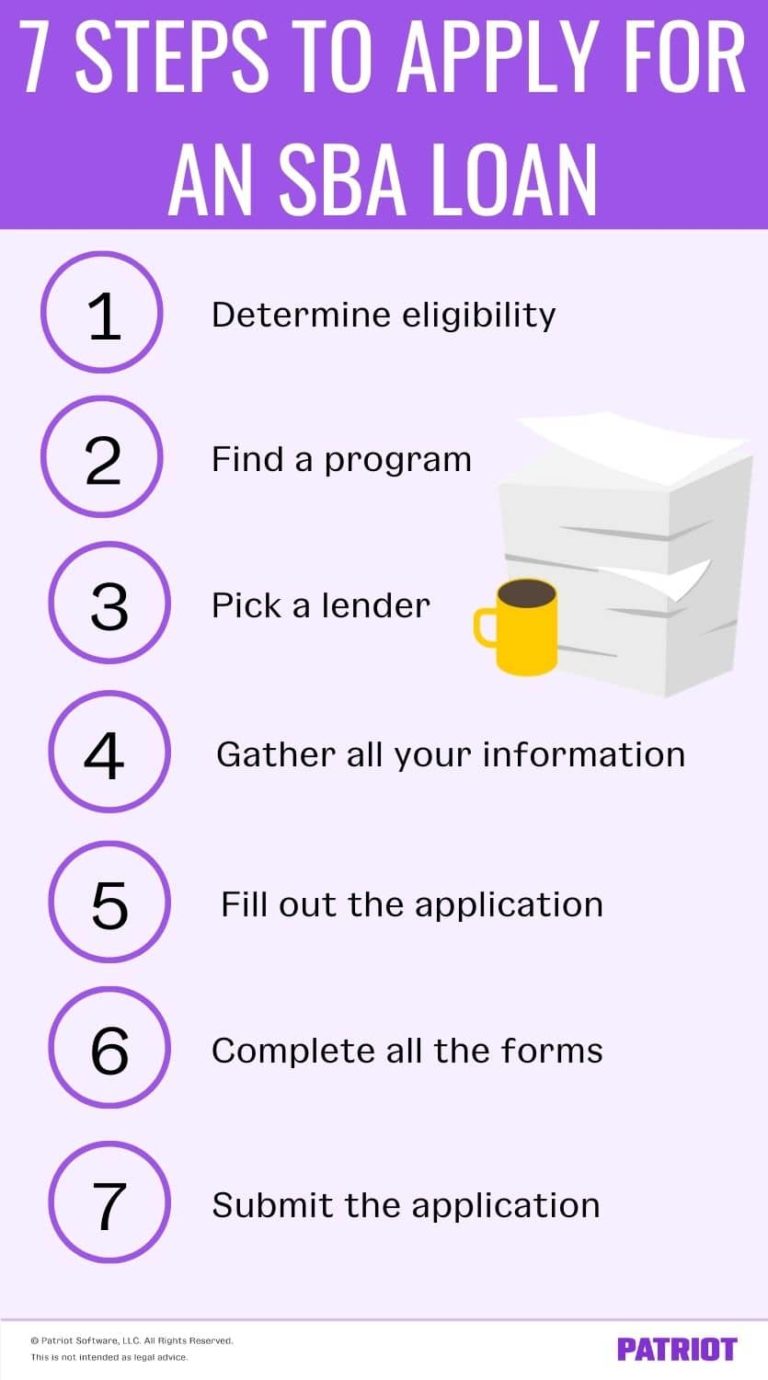

How To Apply And Get Approved For An Sba Loan Step By Step Guide By understanding all your business loan options and not rushing the process, you’ll be in the best position to apply and get approved credit cards or SBA microloans Express loans are available through approved SBA lenders such as Chase and Citizens Bank You'll need to apply directly with a participating financial institution to get an SBA Express loan "Navigate the process of securing a business loan with our comprehensive guide Learn about the different types of loans available, essential documentation, and tips for improving your approval But where do you start and how do you know if taking out a business expansion loan is a good idea? Here's a quick guide next step is to get your plans and documents together to apply for

How To Get Approved For Sba Loans In 2024 Step By Step Guideо "Navigate the process of securing a business loan with our comprehensive guide Learn about the different types of loans available, essential documentation, and tips for improving your approval But where do you start and how do you know if taking out a business expansion loan is a good idea? Here's a quick guide next step is to get your plans and documents together to apply for An $80,000 personal loan is a significant financial commitment, and your chances of getting approved for a loan of this size depend on your credit history, income and other key factors As you shop for loans from various lenders, use a business loan calculator to calculate the costs of each loan This can help you find the lowest cost financing option The final step is to submit

Comments are closed.