How To Amortize Intangible Assets Youtube

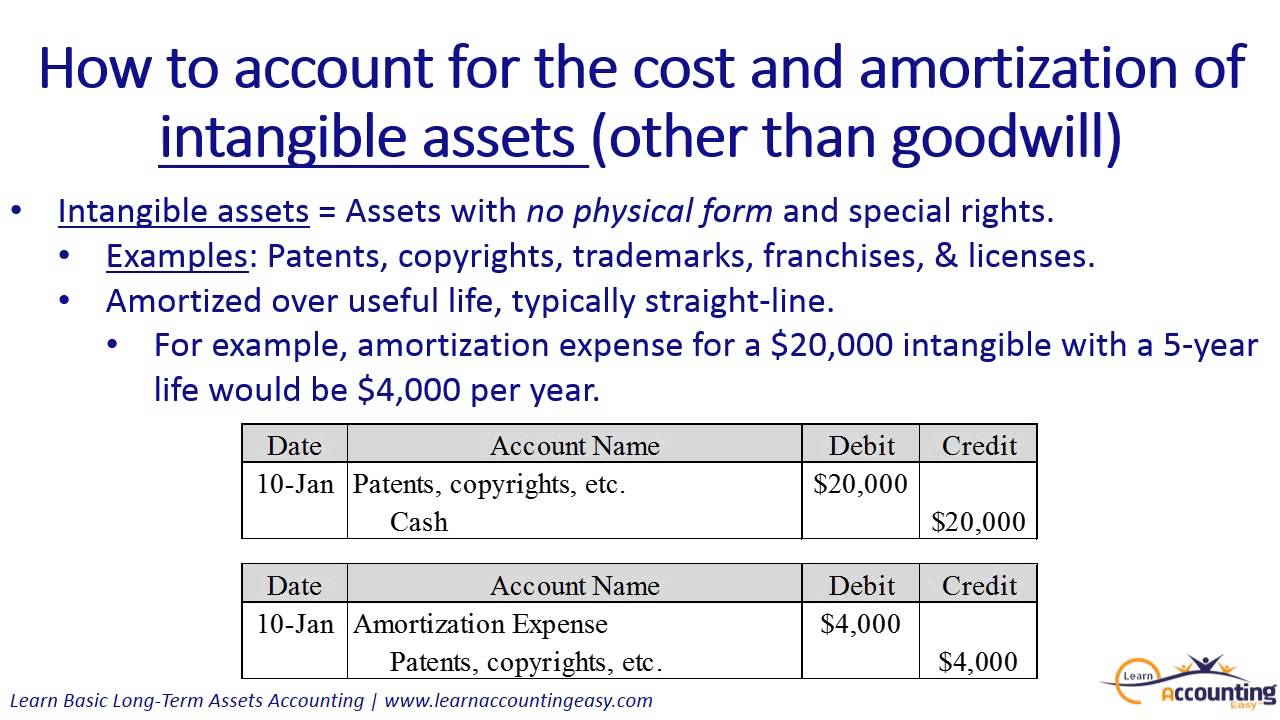

How To Amortize Intangible Assets Youtube Reviewing how intangible assets are amortized and the journal entry to record amortization expense.guided notes worksheet: docs.google document d. In this video, we cover how to amortize intangible assets. we begin by defining intangible assets and discuss when to amortize. we place amortization expense.

How To Amortize Intangible Assets Youtube This video explains how to amortize intangible assets. this topic can be found in chapter 7 of the textbook. Classification and tax implications. the balance is part of the dotdash meredith publishing family. calculating the amortization of intangible assets differs based on “useful life” as determined by the irs. intangible assets have no physical form, but they have value. Amortization expense = (historical cost of intangible asset – residual value) ÷ useful life. where: historical cost of intangible asset the historical cost refers to the amount paid on the initial date of purchase. residual value the residual value, or “salvage value”, is the estimated value of a fixed asset at the end of its useful life. The company should subtract the residual value from the recorded cost, and then divide that difference by the useful life of the asset. each year, that value will be netted from the recorded cost.

How To Account For Intangible Assets Including Amortization 3 Of 5 Amortization expense = (historical cost of intangible asset – residual value) ÷ useful life. where: historical cost of intangible asset the historical cost refers to the amount paid on the initial date of purchase. residual value the residual value, or “salvage value”, is the estimated value of a fixed asset at the end of its useful life. The company should subtract the residual value from the recorded cost, and then divide that difference by the useful life of the asset. each year, that value will be netted from the recorded cost. Intangible assets can be broadly classified into two categories: 1. definite life. definite life intangible assets refer to assets with a finite life. for example, a license to produce a certain product for ten years. here, the asset is given an identifiable contract life of ten years. these types of intangible assets are typically subject to. If an intangible asset is subsequently impaired (see below), you will likely have to adjust the amortization level to take into account the reduced carrying amount of the asset, and possibly a reduced useful life. for example, if the carrying amount of an asset is reduced through impairment recognition from $1,000,000 to $100,000 and its useful.

Comments are closed.