How To Amortize Intangible Assets

How To Amortize Intangible Assets All You Need To Know Efm Intangible assets are assets that don’t have a physical form. intangible assets include proprietary software, contracts, and franchise agreements. the irs requires you to amortize intangible assets over 15 years or 180 months. straight line depreciation is the usual method used to calculate amortization. The amortization of intangible assets is defined as the systematic process of allocating the cost of an intangible asset over its useful life. intangible assets are non physical assets that create value on behalf of a company for a period in excess of 12 months, such as patents, trademarks, and copyrights.

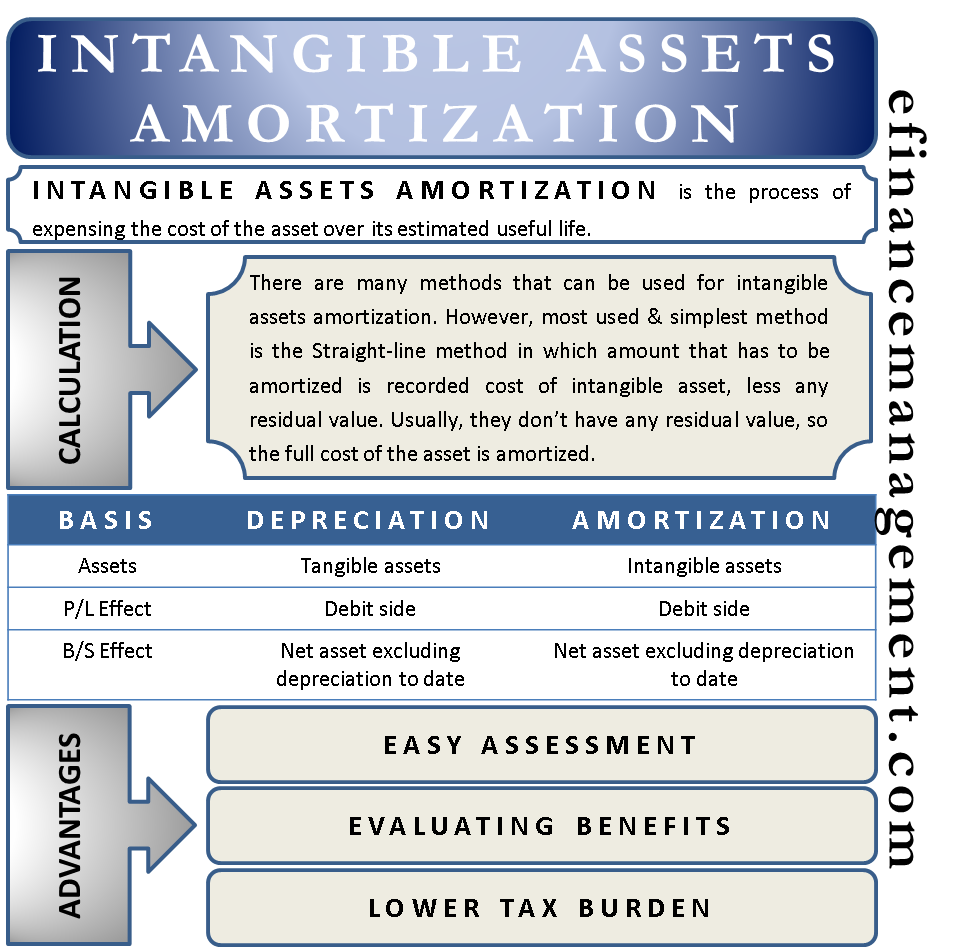

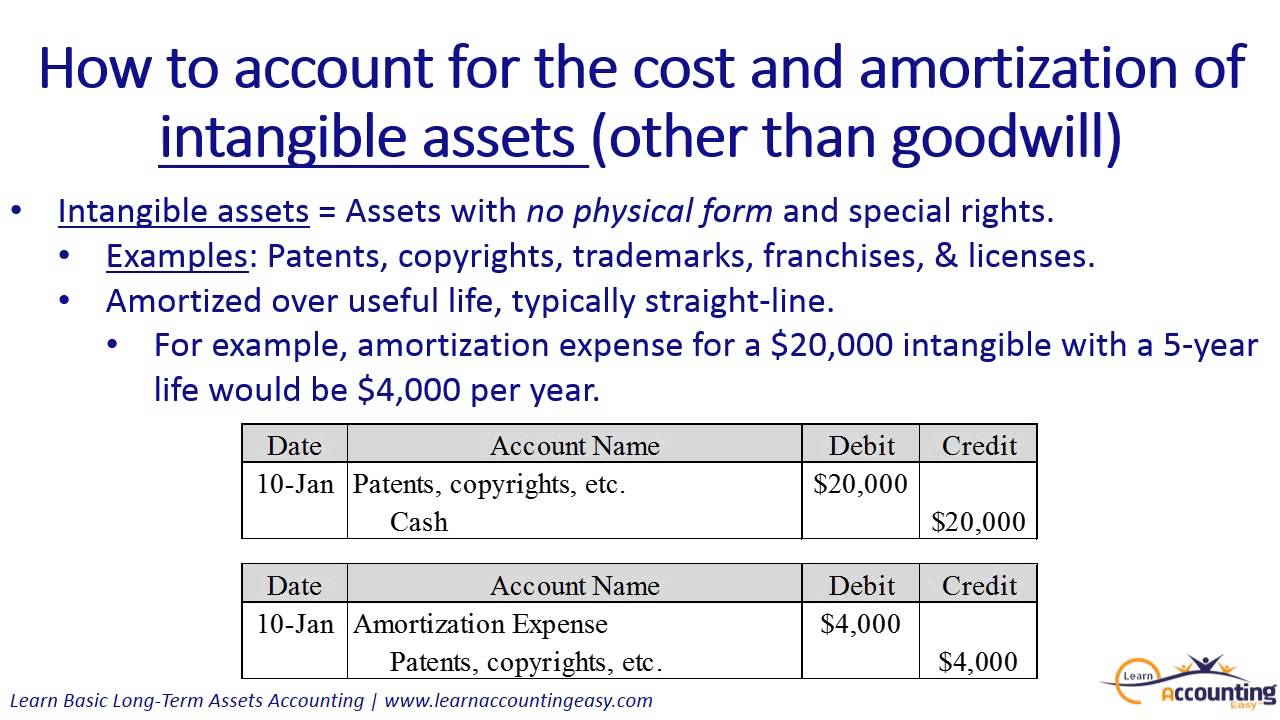

How To Account For Intangible Assets Including Amortization 3 Of 5 Additionally, the accumulated amortization is recorded on the balance sheet as a contra asset account, reducing the net book value of the intangible asset over time. impact on financial statements the amortization of intangible assets significantly influences a company’s financial statements, affecting both the balance sheet and the income. Amortization of intangibles, also simply known as amortization, is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or accounting purposes. Intangible assets refer to assets of a company that are not physical in nature. they include trademarks, customer lists, goodwill, etc. intangible assets are classified into two different categories: definite life and indefinite life. definite life intangible assets are typically subject to amortization, whereas indefinite life intangible. The company should subtract the residual value from the recorded cost, and then divide that difference by the useful life of the asset. each year, that value will be netted from the recorded cost.

How To Amortize Intangible Assets Youtube Intangible assets refer to assets of a company that are not physical in nature. they include trademarks, customer lists, goodwill, etc. intangible assets are classified into two different categories: definite life and indefinite life. definite life intangible assets are typically subject to amortization, whereas indefinite life intangible. The company should subtract the residual value from the recorded cost, and then divide that difference by the useful life of the asset. each year, that value will be netted from the recorded cost. However, intangible assets are usually not considered to have any residual value, so the full amount of the asset is typically amortized. if there is any pattern of economic benefits to be gained from the intangible asset, then adopt an amortization method that approximates that pattern. if not, the customary approach is to amortize it using. Both amortization of intangible assets and depreciation are non cash expenses but differ in their application to the type of asset involved. depreciation writes off the value of fixed (tangible) assets over time, such as property, plant, and equipment , whereas amortization writes off intangible assets, such as patents, licenses, goodwill , etc.

How To Amortize Intangible Assets Accounting Education However, intangible assets are usually not considered to have any residual value, so the full amount of the asset is typically amortized. if there is any pattern of economic benefits to be gained from the intangible asset, then adopt an amortization method that approximates that pattern. if not, the customary approach is to amortize it using. Both amortization of intangible assets and depreciation are non cash expenses but differ in their application to the type of asset involved. depreciation writes off the value of fixed (tangible) assets over time, such as property, plant, and equipment , whereas amortization writes off intangible assets, such as patents, licenses, goodwill , etc.

Comments are closed.