How To Adjust A Wage Report In Myui Employer Department Of Labor

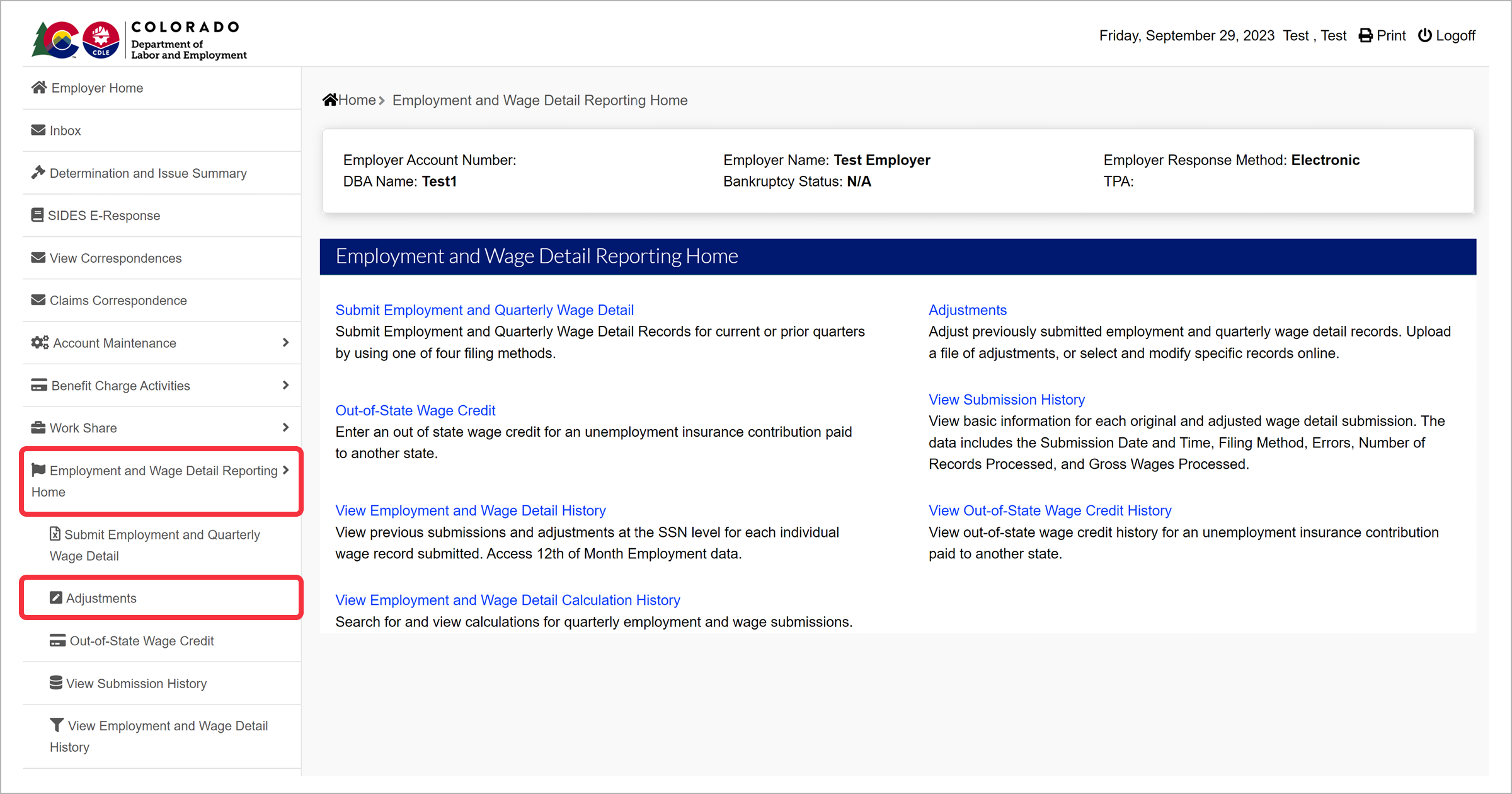

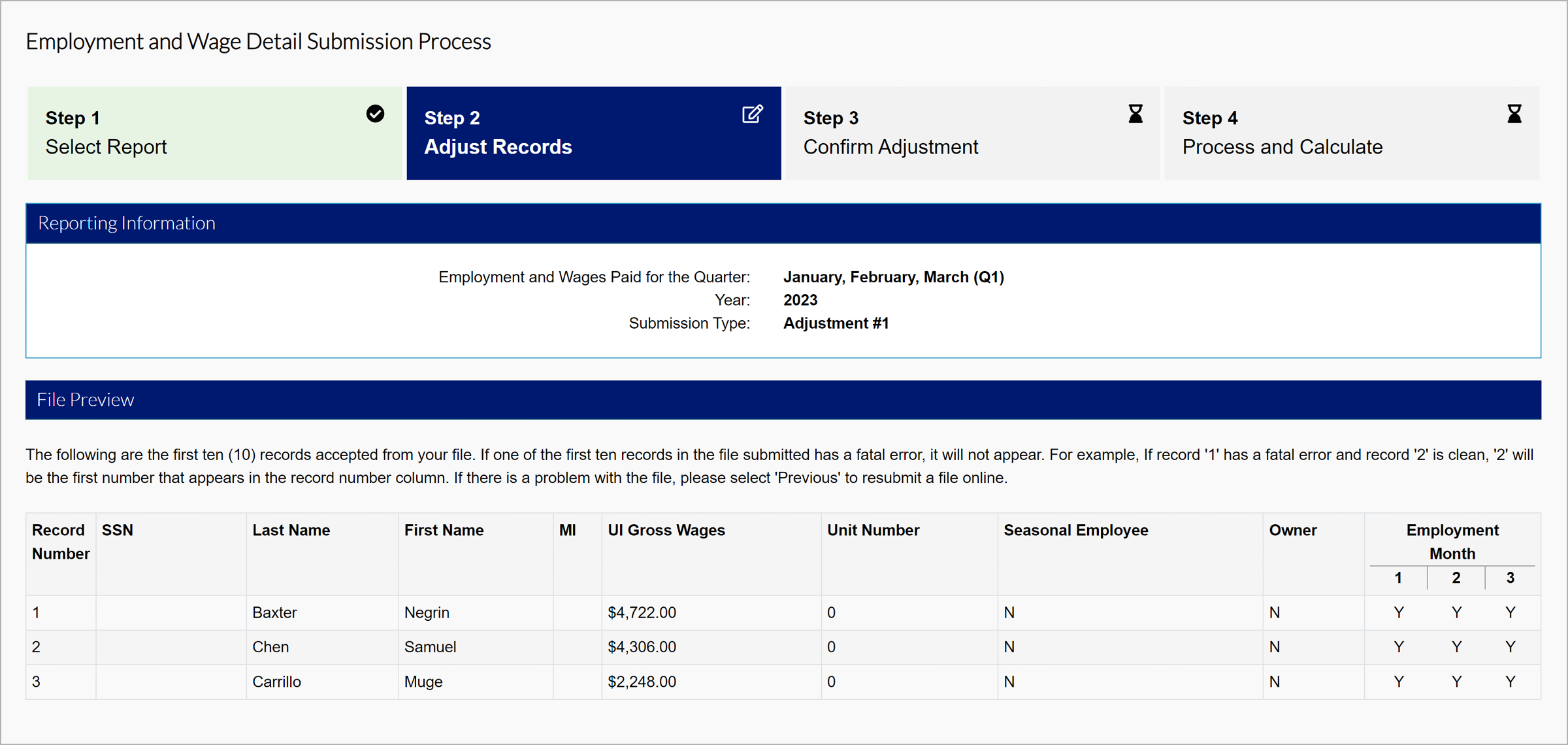

How To Adjust A Wage Report In Myui Employer Department Of Labor You can report your wages in myui employer . wage reports are required to be filed electronically — you will need to sign up for a myui employer account and file online. if you have been filing wage reports by paper and would like to continue doing so, you will need to apply for a non electronic communication waiver. contact ui employer. Click the “employment and wage detail reporting home” tab in the left hand navigation menu. click the “adjustments” subtab. step 2. select the report to adjust. select the year and quarter of the report you would like to adjust. click “search”.

How To Adjust A Wage Report In Myui Employer Department Of Labor Wage reports automatically trigger updates to qualification information on the employer account (if applicable). myui employer users can: submit delimited, icesa, esw2, xml, and zero (delimited) wage file formats. copy and submit wage detail information from the previous quarter. adjust submitted wage reports electronically. The taxable wages can be different for a number of reasons: wrong taxable wage base used by employer, ssn keyed wrong, other state wages not being reported, or wrong rate used by employer. sign into your myiowaui account and review your wage detail. if you want to make changes, fill out the employer’s wage adjustment report 68 0061. Department of labor and employment myui employer is a secure system giving employers online access to their unemployment account information 24 hours a day, 7 days a week. have the convenience of accessing forms, data, reports, information, and anything else you need to do online. Many employers in colorado are required to pay employees a minimum wage. if an employee is covered by federal and colorado state minimum wage laws, then the employer must pay the higher minimum wage. federal minimum wage is currently $7.25 per hour, which is lower than the colorado state minimum wage of $10.20.

Comments are closed.