How Startup Funding Works

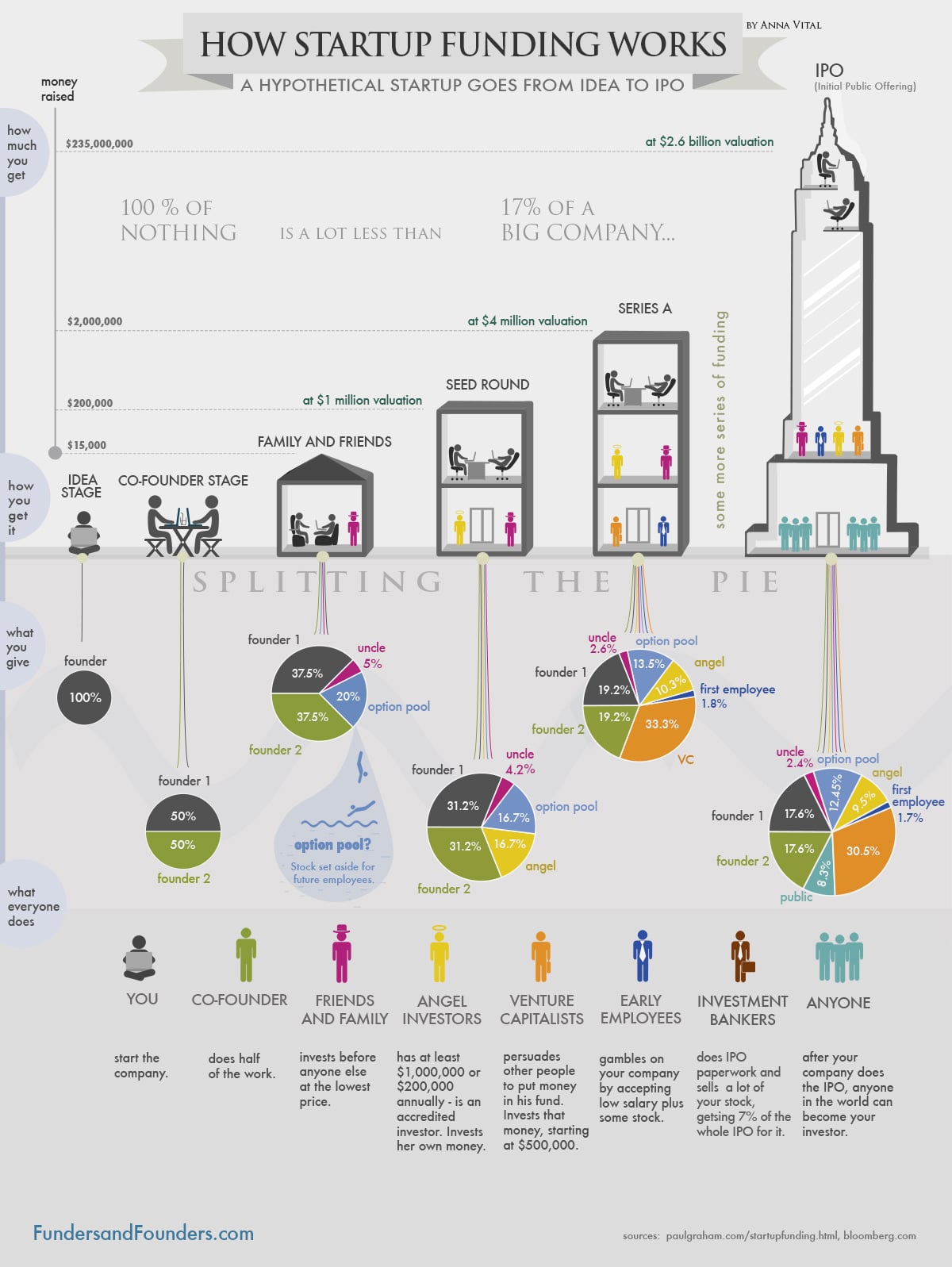

Startup Funding How It Works The Journey From Idea To Ipo Chart Startup funding is the money a business uses to start or support a new business. there are many different types of funding. startups use these funds to cover marketing, growth, and operating expenses to launch the business. the number and types of funding options can be overwhelming for a new startup. understanding the types of startup funding. 5. friends and family. if more traditional lenders aren't an option, family loans may help fund your startup. while these loans may come with little or no interest obligations, they can be costly.

How Startup Funding Works Infographic Behance But if you’re self funding and you’re concerned you’ll run out of funds, consider freelancing on the side so you can continue to earn an income. 2. friends and family. a great piece of startup advice is to start with your inner circle and branch out when it comes to selling your business. A series b round is usually between $7 million and $10 million. companies can expect a valuation between $30 million and $60 million. series b funding usually comes from venture capital firms, often the same investors who led the previous round. because each round comes with a new valuation for the startup, previous investors often choose to. Fundraising doesn’t happen overnight. it can take three to six months of regular pitching and conversations with investors before you get any money. to avoid falling behind or missing opportunities to get in front of customers, you may want to start looking for funding before you need it. you need more support. Step 2: write a business plan for your startup. your startup’s business plan is essentially the roadmap to the first three to five years of your startup’s life. not only does creating one help you strategize and manage your company, it is essential to securing funding.

How Startup Funding Works A Hypothetical Startup Will Get Aboutвђ By Fundraising doesn’t happen overnight. it can take three to six months of regular pitching and conversations with investors before you get any money. to avoid falling behind or missing opportunities to get in front of customers, you may want to start looking for funding before you need it. you need more support. Step 2: write a business plan for your startup. your startup’s business plan is essentially the roadmap to the first three to five years of your startup’s life. not only does creating one help you strategize and manage your company, it is essential to securing funding. Pre seed funding. pre seed funding is the earliest startup funding stage, so early that many people don’t include it in the cycle of equity funding. at this stage, founders are working with a very small team (or even by themselves) and are developing a prototype or proof of concept. the money to fund a pre seed stage typically comes from the. The four main stages of venture capital funding are pre seed, seed, series a, and series b rounds. each stage offers a different form of investment to help businesses grow and reach their goals. ultimately, it is essential for startups to understand these rounds in order to secure the right funding for their venture.

How To Finance A Startup 10 1 Ways To Find Funding B Plannow Pre seed funding. pre seed funding is the earliest startup funding stage, so early that many people don’t include it in the cycle of equity funding. at this stage, founders are working with a very small team (or even by themselves) and are developing a prototype or proof of concept. the money to fund a pre seed stage typically comes from the. The four main stages of venture capital funding are pre seed, seed, series a, and series b rounds. each stage offers a different form of investment to help businesses grow and reach their goals. ultimately, it is essential for startups to understand these rounds in order to secure the right funding for their venture.

7 Ways To Raise Funds For Your Startup Or Business Idea

Comments are closed.