How Should A Company Offer Financing Options

Should Your Company Offer Revenue Based Financing Options Forwardai Klarna is one of the largest financing companies on the market, with over 20 million us users and more than 250,000 retail partners. it offers customers flexible financing options, including four interest free payments, pay in 30 days, and 6–36 month payment plans (0%–24.99% apr). In house customer financing. in house customer financing is when a business offers financing directly to its customers. while you can save on potential fees that third party financing providers may charge, businesses should expect more work alongside greater risk — if you don’t have the proper infrastructure verifying that customers are creditworthy, you risk drowning in outstanding payments.

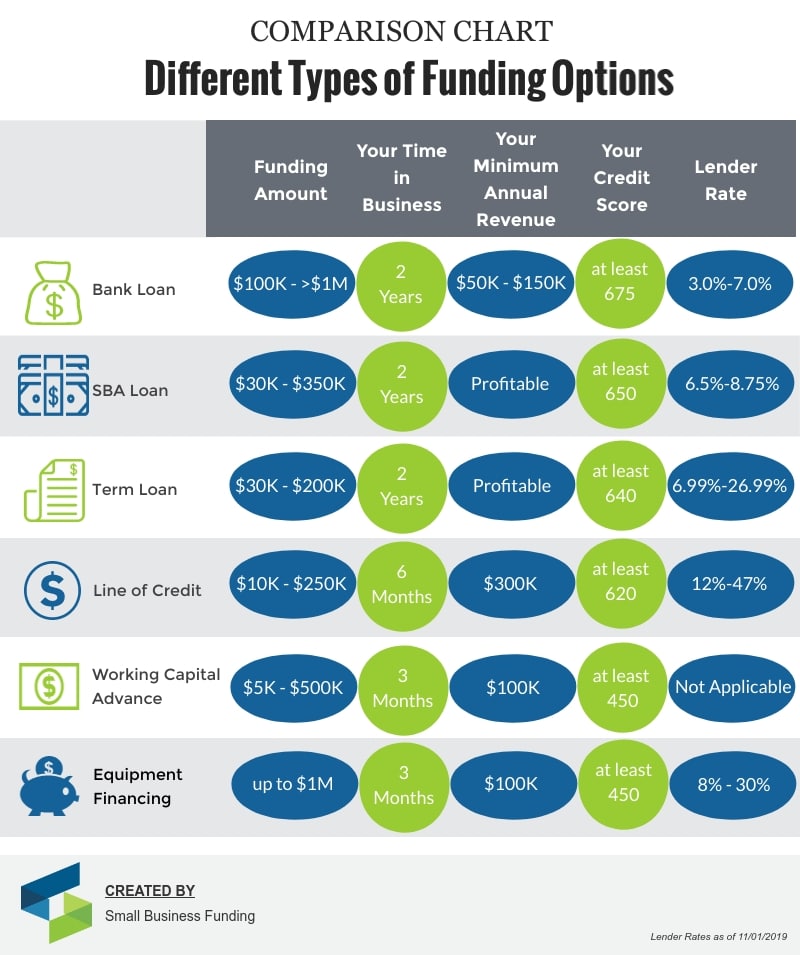

How To Get A Business Loan In 7 Easy Steps Small Business Funding Step 1: tell your customers you offer financing. this information can be included in quotes and estimates, or directly on your website. but if a client expresses concerns with the cost of the project or their budget, it doesn’t hurt to bring it up to them personally, either. 3. choose provider (s) select financing partners that align with your business needs, tech stack, and customer demographics. 4. integrate into checkout. follow provider guides to integrate their financing products into your online or in store checkout flow. 5. train staff. Snap finance can help you help more customers. as a retailer, it’s important to understand your customers’ needs and financial situations. providing lease to own financing can help more customers get what they need while boosting your business. snap finance partners with merchants to offer lease to own financing to help your customers. How to offer financing to your customers. there are two main ways to offer consumer funding. the first method is providing in house customer financing, where the merchant becomes a lender. the second method is to use third party customer financing and partner with a point of sale (pos) financing company.

Comments are closed.