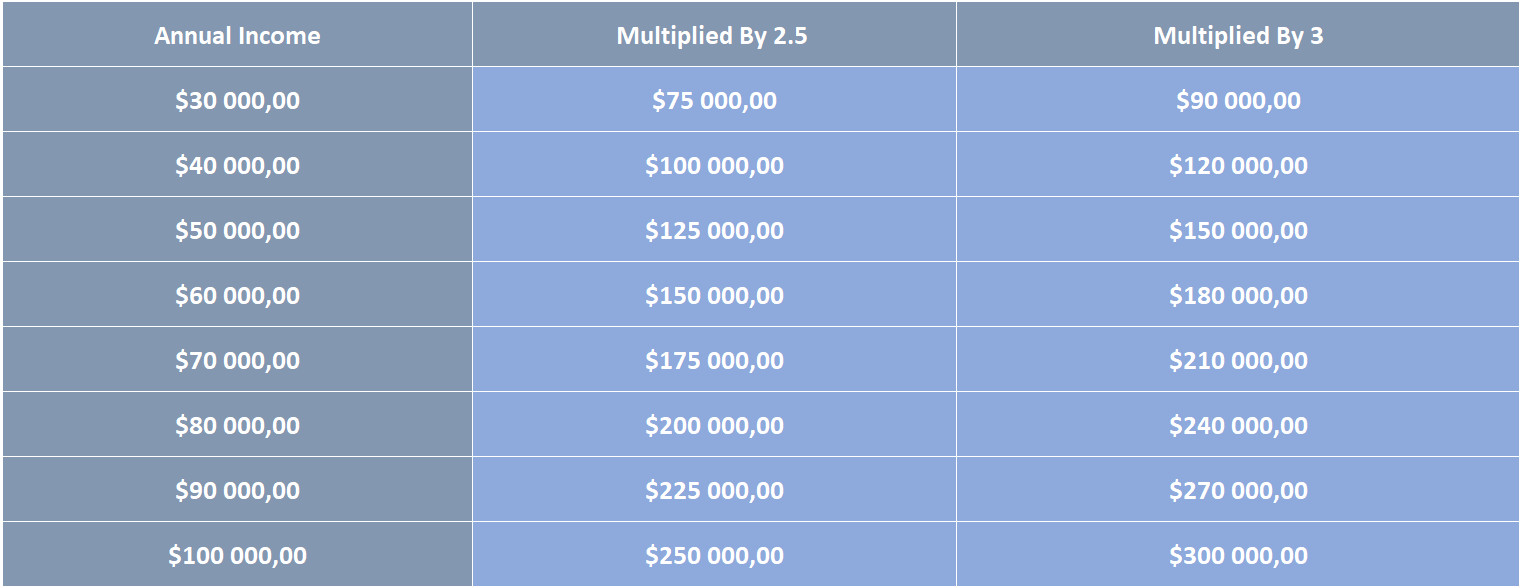

How Much House Can I Afford Base On My Income

How Much House Can I Afford Base On My Income The amount of money you spend upfront to purchase a home. most home loans require a down payment of at least 3%. a 20% down payment is ideal to lower your monthly payment, avoid private mortgage insurance and increase your affordability. for a $250,000 home, a down payment of 3% is $7,500 and a down payment of 20% is $50,000. The 28 36 rule is a commonly accepted guideline used in the u.s. and canada to determine each household's risk for conventional loans. it states that a household should spend no more than 28% of its gross monthly income on the front end debt and no more than 36% of its gross monthly income on the back end debt.

How Much House Can I Afford Quick Guide To Home Affordability How to figure out your dti. add up your total monthly debt and divide it by your gross monthly income, which is how much you brought home before taxes and deductions. here’s an example: now. To calculate "how much house can i afford," one rule of thumb is the 28 36 rule, which states that you shouldn't spend more than 28% of your gross monthly income on home related costs and 36% on. To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and select a loan term. lendingtree’s calculator defaults to a 30 year fixed rate mortgage, but there’s a 15 year fixed rate term option if you want to save on interest charges and can afford a. Combined with their debt payments, that adds up to $1,200 – or around 34% of their income. house #2 is a 2,100 square foot home in san jose, california. built in 1941, it sits on a 10,000 square foot lot, and has three bedrooms and two bathrooms. it’s listed for $820,000, but could probably be bought for $815,000.

What House Price Can I Afford Based On Salary At Charline May Blog To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and select a loan term. lendingtree’s calculator defaults to a 30 year fixed rate mortgage, but there’s a 15 year fixed rate term option if you want to save on interest charges and can afford a. Combined with their debt payments, that adds up to $1,200 – or around 34% of their income. house #2 is a 2,100 square foot home in san jose, california. built in 1941, it sits on a 10,000 square foot lot, and has three bedrooms and two bathrooms. it’s listed for $820,000, but could probably be bought for $815,000. Mortgage affordability calculator. get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. find out how much you can afford with our mortgage affordability calculator. see estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your. Front end dti: this only includes your housing payment. lenders usually don’t want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance.

How Much House Can I Afford Quick Guide To Home Affordability Paul Mortgage affordability calculator. get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. find out how much you can afford with our mortgage affordability calculator. see estimated annual property taxes, homeowners insurance, and mortgage insurance premiums along with your. Front end dti: this only includes your housing payment. lenders usually don’t want you to spend more than 31% to 36% of your monthly income on principal, interest, property taxes and insurance.

Comments are closed.