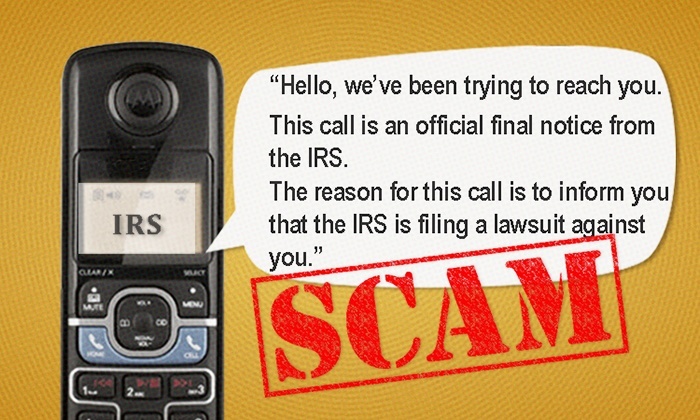

How Irs Tax Collection Phone Call Scam Works 5 Steps To Identify

How Irs Tax Collection Phone Call Scam Works 5 Steps To Identify Linksif you owe taxes, make payments to the u.s. treasury or review irs.gov payments for irs online options.report impersonation scams to the tre. Tax scam warning signs. scammers mislead you about tax refunds, credits and payments. they pressure you for money, personal, financial or employee information. irs impersonators try to look like us. watch out for: a big payday if it sounds too good to be true, it probably is. bad tax advice on social media could urge you to falsify tax forms.

Avoid Being A Tax Scam Victim Taxpayers can also call 800 366 4484 to report impersonation scams. report phone scams to the federal trade commission using the ftc complaint assistant. add "irs telephone scam" in the notes. report an unsolicited email claiming to be from the irs or an irs related system like the electronic federal tax payment system to the irs at phishing. 1. the tax debt has been removed from the irs’s active inventory due to a lack of resources or an inability to find the taxpayer; 2. more than one third of the applicable limitation period has. Report the caller id and callback number to the irs by sending it to [email protected]. the subject line should include "irs phone scam." report the call to the federal trade commission. if a taxpayer wants to verify what taxes they owe the irs, they should: view tax account information online at irs.gov. review their payment options. 9. ghost tax preparer scams. anyone you pay to prepare your tax return must have a valid preparer tax identification number and must sign your tax return. reluctance to sign your return is a red.

5 Easy Ways To Spot A Scam Irs Call Blog Taxbandits Report the caller id and callback number to the irs by sending it to [email protected]. the subject line should include "irs phone scam." report the call to the federal trade commission. if a taxpayer wants to verify what taxes they owe the irs, they should: view tax account information online at irs.gov. review their payment options. 9. ghost tax preparer scams. anyone you pay to prepare your tax return must have a valid preparer tax identification number and must sign your tax return. reluctance to sign your return is a red. Report the incident to the following: treasury inspector general for tax administration: do it online or via phone at 800 366 4484. the federal trade commission: use the “ ftc complaint assistant ” on ftc.gov. make sure to include “irs telephone scam” in the notes. the irs at [email protected]. it is always wise to select a qualified and. The irs publishes an annual list of what it calls the “dirty dozen”—some of the most common tax scams currently circulating. in 2021, new scams emerged to take advantage of coronavirus tax.

Irs Phone Scams Youtube Report the incident to the following: treasury inspector general for tax administration: do it online or via phone at 800 366 4484. the federal trade commission: use the “ ftc complaint assistant ” on ftc.gov. make sure to include “irs telephone scam” in the notes. the irs at [email protected]. it is always wise to select a qualified and. The irs publishes an annual list of what it calls the “dirty dozen”—some of the most common tax scams currently circulating. in 2021, new scams emerged to take advantage of coronavirus tax.

Comments are closed.