How Credit Scores Are Calculated And How To Interpret Them

How Credit Scores Are Calculated And How To Interpret Them Score ranges: for the vantagescore and the base fico ® score, the range is 300 to 850. however, fico's bankcard and auto scoring models use a range of 250 to 900. weighting factors: when calculating your credit score, vantagescore and fico generally look at the same information. however, they weigh certain factors differently. If you have $1,000 in balances and $5,000 in available credit, then your credit utilization is 20%. a low credit utilization is better for your credit score. there's no specific amount separating.

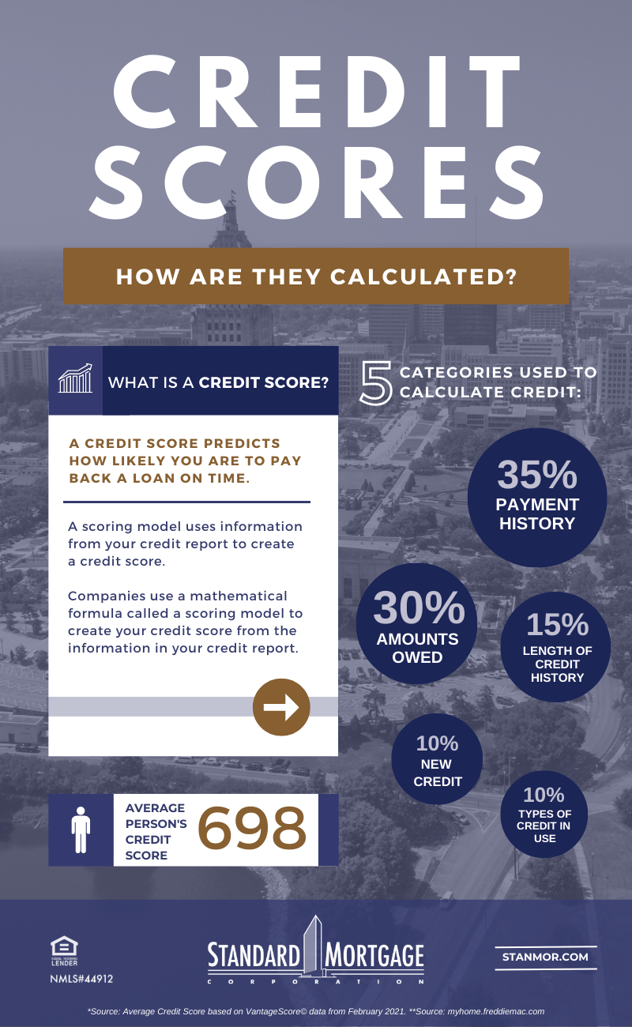

How Credit Scores Are Calculated And How To Interpret Them Fico scores are calculated using many different pieces of credit data in your credit report. this data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). your fico scores consider both positive and negative information in your credit report. Fico scores range from 300 to 850, with 850 considered a perfect score. the higher your score, the better your odds of being approved for loans and lines of credit at the most favorable interest. There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of. Nerdy takeaways. your fico score is a number, typically in the 300 to 850 range, used by lenders to determine your ability to pay back borrowed debt. fico has five credit score ranges. the company.

Credit Scores How Are They Calculated Infographic There are four main ways to get your credit score: check your credit or loan statements. talk to a credit or housing counselor. find a credit score service. buy your score from one of the three major credit reporting agencies: equifax, experian, or transunion. learn more from the consumer financial protection bureau (cfpb) about each method of. Nerdy takeaways. your fico score is a number, typically in the 300 to 850 range, used by lenders to determine your ability to pay back borrowed debt. fico has five credit score ranges. the company. The credit scoring algorithms look at the actual age of your credit accounts in terms of the average age of your credit accounts, the age of your oldest account, and the age of your newest account. Industry specific fico scores range from 250 to 900, but fico based scores and vantagescore versions 3.0 and 4.0 each range from 300 to 850. a credit score of 700 or higher is generally considered.

Comments are closed.