How Credit Score Is Calculated

Tips For Managing Your Credit Score Awardwallet Blog The main factors involved in calculating a credit score are: your payment history. your used credit vs. your available credit. the length of your credit history. public records. number of inquiries into your credit file. if you look at your credit scores based on data from both national credit reporting agencies – equifax and transunion. Your credit score. your credit score is a three digit number that comes from the information in your credit report. it shows how well you manage credit and how risky it would be for a lender to lend you money. your credit score is calculated using a formula based on your credit report. note that you:.

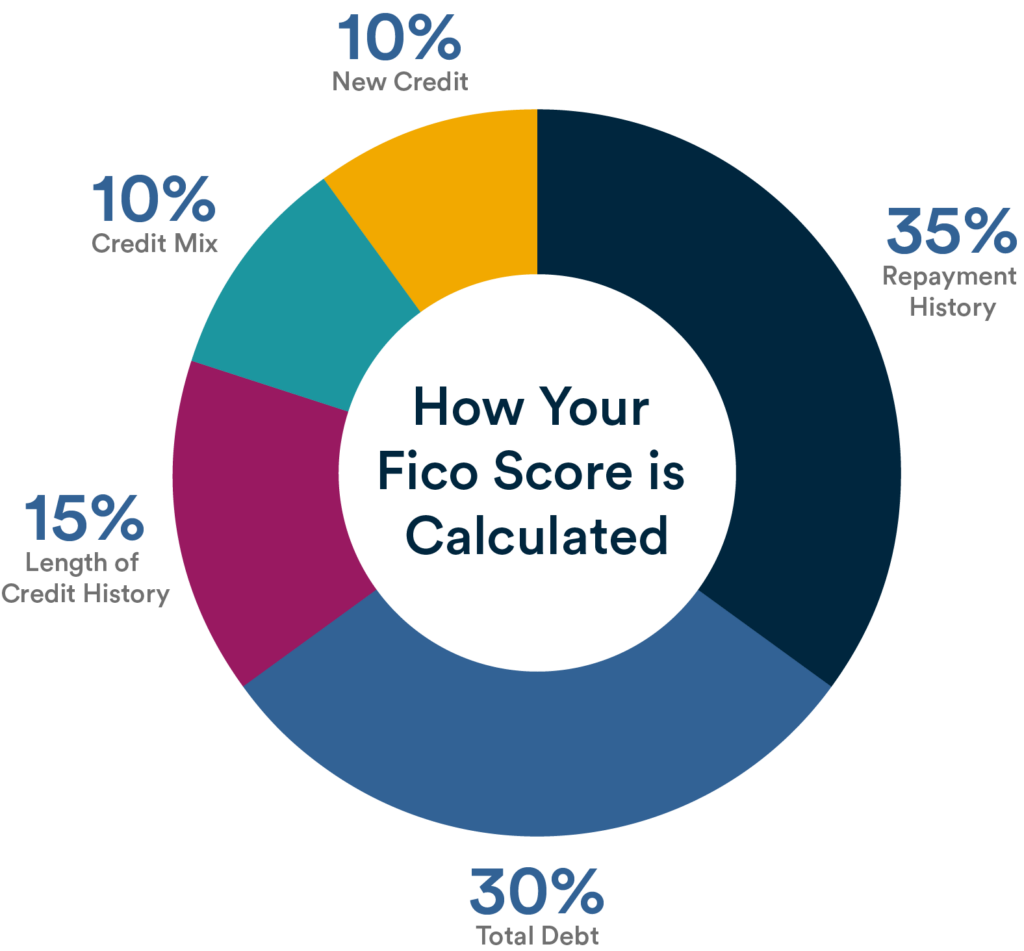

What Makes Up Your Credit Score And Why Is It Important Learn the five factors that fico uses to calculate your credit score, such as payment history, amount owed, and credit mix. find out what information is not included in your credit score and how often it is updated. Learn about the factors that affect your credit score, such as payment history, credit utilization, credit history and types of accounts. find out how different credit scoring models and credit bureaus may vary your credit score. Learn how credit scores are calculated based on payment history, accounts owed, length of credit history, credit mix and new credit. find out the ranges and factors of fico and vantagescore models and how to improve your score. A credit score is a number on a scale of 300 to 900. it tells potential lenders how well you manage debt and credit; money that doesn’t belong to you. you should aim for a credit score of at least 660 to come across well when applying for loans. the higher the score, the better you are at repaying your debts.

How Is Your Credit Score Calculated вђ Your Mortgage Banker Learn how credit scores are calculated based on payment history, accounts owed, length of credit history, credit mix and new credit. find out the ranges and factors of fico and vantagescore models and how to improve your score. A credit score is a number on a scale of 300 to 900. it tells potential lenders how well you manage debt and credit; money that doesn’t belong to you. you should aim for a credit score of at least 660 to come across well when applying for loans. the higher the score, the better you are at repaying your debts. Learn what credit scores are, how they're calculated and why they matter for your financial well being. compare fico and vantagescore models, factors that affect your score and tips to improve it. Learn the factors and weights that affect your credit score, such as payment history, credit utilization, and length of credit history. find out how to improve your credit score and what doesn't matter for your score.

Your Fico Credit Score вђ What Is It And Why Is It Important Laurel Road Learn what credit scores are, how they're calculated and why they matter for your financial well being. compare fico and vantagescore models, factors that affect your score and tips to improve it. Learn the factors and weights that affect your credit score, such as payment history, credit utilization, and length of credit history. find out how to improve your credit score and what doesn't matter for your score.

Comments are closed.