How A Credit Card Balance Transfer Works

How Does A Credit Card Balance Transfer Process Work Say you have a $3,000 balance with a 30% interest rate, which translates into $900 a year in interest. transferring the balance to a card with a 27% apr and a 3% transfer fee means paying $810 in. Most issuers charge a balance transfer fee of around 1% to 5% of the amount you transferred. the fee is usually added to your balance. so if the fee is 3% and you transferred $2,000, you’ll be charged $60, bringing your total to $2,060. sometimes, an issuer will waive the fee or offer a lower fee as part of a promotion.

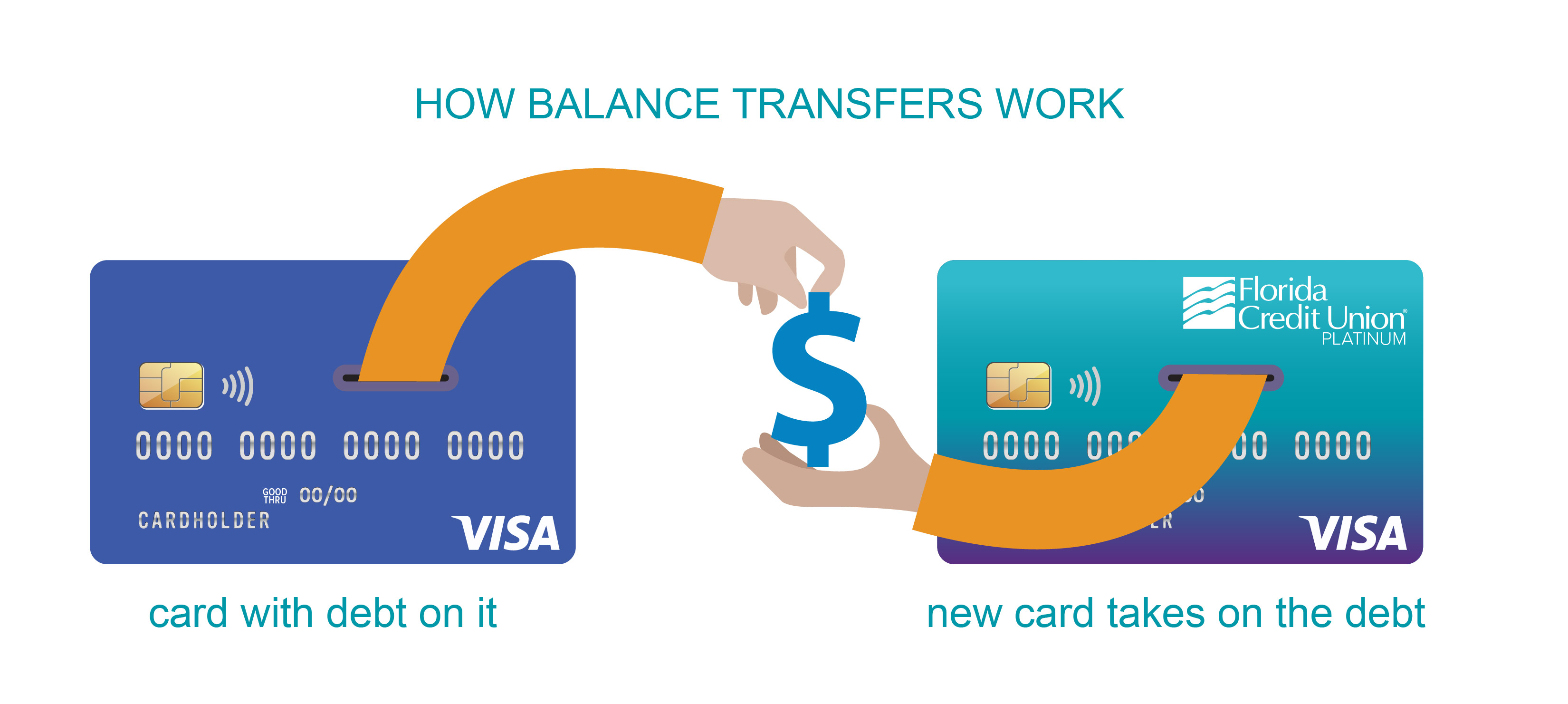

How A Credit Card Balance Transfer Works 5. apply for the new card. the process of applying for a balance transfer credit card is the same as applying for any other credit card. you’ll have to supply some basic information about. A balance transfer lets you transfer debt from one credit card — or even a qualifying loan — to another credit card. the debt still needs to be paid off, but depending on the balance transfer card you choose, you can get a lower interest rate. or some cards offer a 0% apr introductory period where no interest accrues. A balance transfer can save you money by moving your debt from a high interest credit card to one with a lower apr. learn how they work, and find a card that fits your needs. many, or all, of the. 5. apply for the new card. the process of applying for a balance transfer credit card is the same as applying for any other credit card. you’ll have to supply some basic information about.

Balance Transfer Credit Card Services Florida Credit Union A balance transfer can save you money by moving your debt from a high interest credit card to one with a lower apr. learn how they work, and find a card that fits your needs. many, or all, of the. 5. apply for the new card. the process of applying for a balance transfer credit card is the same as applying for any other credit card. you’ll have to supply some basic information about. A balance transfer moves a balance from one account to another account or card, ideally to take advantage of a lower or 0% introductory apr, and provides more time to pay down debt. after an intro. 1. request a balance transfer. typically, the first step of doing a balance transfer is getting in touch with the issuer of the card to which you're moving debt and providing some information.

Comments are closed.