Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical Updated september 11, 2023.the majority of people who have health care insurance obtain it through their employers during open enrollment, though only a small minority understands the complexities of insurance well enough to feel like they made an empowered choice. this handy guide will help you understand the key differences between ppo and hmo plans and how to make the right choice for you. Key takeaways: hmos and ppos have different rules about covering healthcare services delivered by out of network providers. hmos limit your choice of providers but often have a lower deductible and premiums. ppos offer you more flexibility than hmos in choosing doctors and hospitals. lpettet istock via getty images.

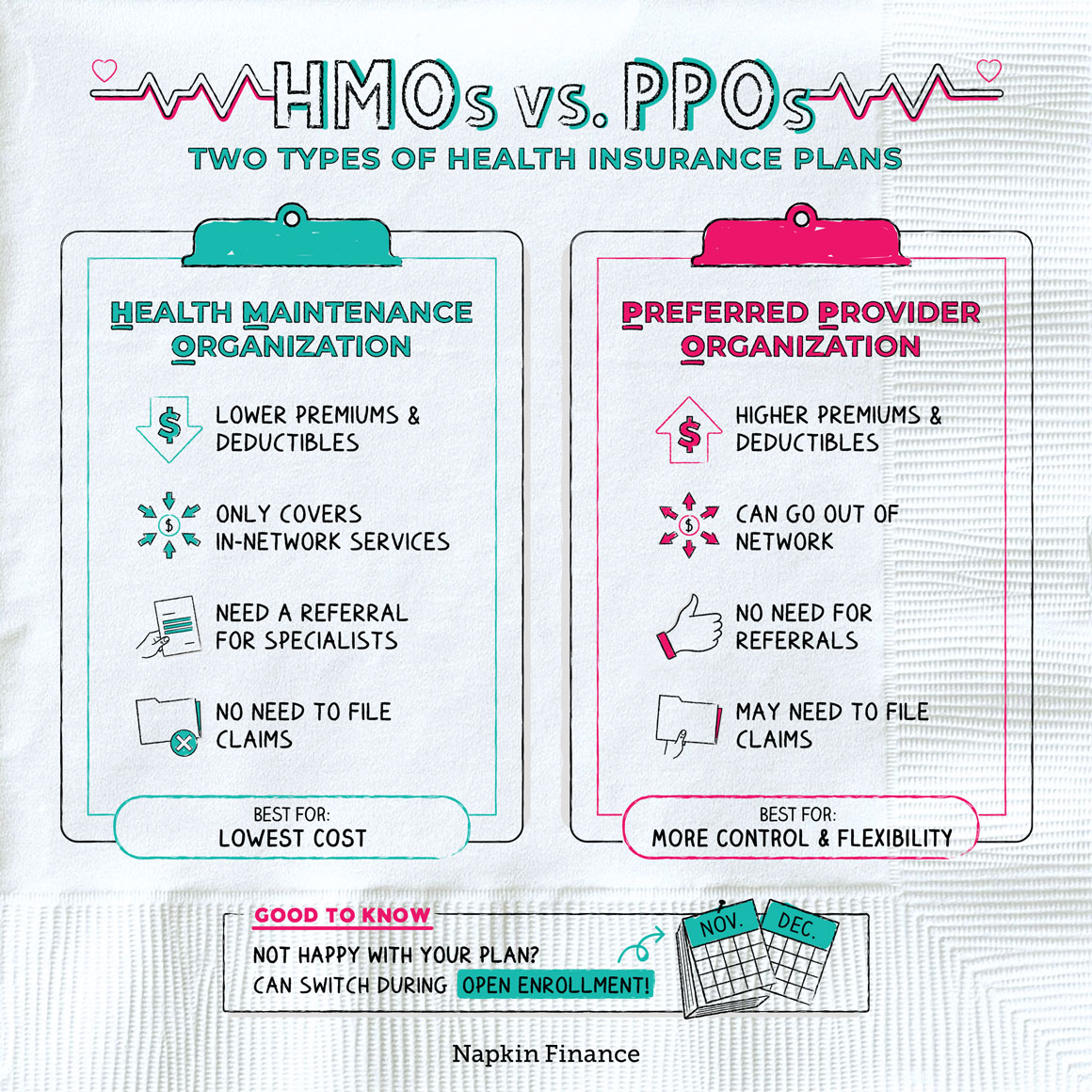

Hmo Vs Ppo Health Insurance Plans вђ Napkin Finance Cheaper health insurance rates: hmo plans are usually a lower cost alternative to ppos. the average hmo rate is $427 monthly for an affordable care act (aca) plan for someone who is 30 years old. Before deciding on hmo vs. ppo health insurance, look at the network of providers around you. “if you have many physicians in your hmo network near you, that may also be a good reason to go for an hmo,” said plummer. “on the other hand, if there are not many in network providers near you, you may prefer to opt for a ppo instead.”. Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. Hmos are more budget friendly than ppos. hmos usually have lower monthly premiums. both may require you to meet a deductible before services are covered, but it’s less common with an hmo. with a.

Comments are closed.