Heloc Draw Period Vs Repayment Period

How To Repay A Heloc Draw Vs Repayment Period Explained Youtube Learn what a heloc draw period is, how long it lasts, and what payments are due during and after it. find out how to avoid debt reloading and prepare for the repayment period. Unlike a credit card, however, a heloc includes two main phases: the draw period and the repayment period. combined, these two periods can last up to 30 years. the heloc draw period is the first.

Heloc Draw Period Vs Repayment Period Aesthetic Drawing A: the repayment period takes place once the draw period ends, which is typically 10 years after you start using the heloc. you’ll no longer be able to borrow from your credit line, and you’ll start paying back the amount that you borrowed on top of the interest payments that were already taking place during the draw period on the amount. A heloc’s draw period refers to the period of time during which a borrower can withdrawal funds from the line of credit. draw periods vary in length depending on each one’s terms, but typically range between 5 and 15 years. ten years is the most common draw period length. during the draw period, you’ll be able to take out any amount of. Instead, you start the draw phase: a period of time during which you can borrow money from your line of credit whenever you like. your lender will set the length of time for your heloc draw period. A home equity line of credit (heloc) is a revolving line of credit that uses your home as collateral. helocs have a fixed draw period during which you can access the funds in your line of credit. once the heloc’s repayment period begins, you’ll need to repay both principal and interest.

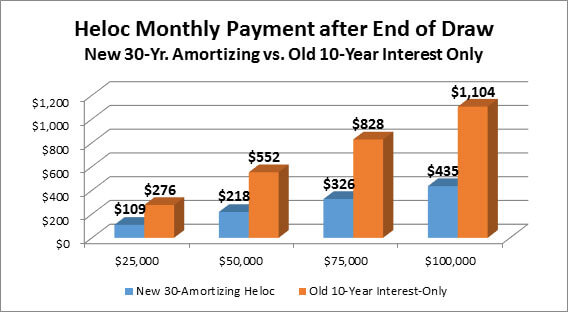

юааhelocюаб Doтащs And Donтащts A Step By Step Guide To Home Equity Lines Of Instead, you start the draw phase: a period of time during which you can borrow money from your line of credit whenever you like. your lender will set the length of time for your heloc draw period. A home equity line of credit (heloc) is a revolving line of credit that uses your home as collateral. helocs have a fixed draw period during which you can access the funds in your line of credit. once the heloc’s repayment period begins, you’ll need to repay both principal and interest. 1. make the minimum payments. it’s ok to make the minimum payments during the draw period as long as you’re keeping tabs on when the draw period ends and what your payments might look like once it does. it’s not uncommon for monthly payments to more than double once the repayment period hits. 2. Helocs have draw periods the period of time when you can use your line of credit that range from five to 20 years, with 10 years being the typical draw period. this makes a heloc an.

Heloc Draw Period Vs Repayment Period 1. make the minimum payments. it’s ok to make the minimum payments during the draw period as long as you’re keeping tabs on when the draw period ends and what your payments might look like once it does. it’s not uncommon for monthly payments to more than double once the repayment period hits. 2. Helocs have draw periods the period of time when you can use your line of credit that range from five to 20 years, with 10 years being the typical draw period. this makes a heloc an.

Comments are closed.