Health Savings Accounts Hsas Explained The Motley Fool

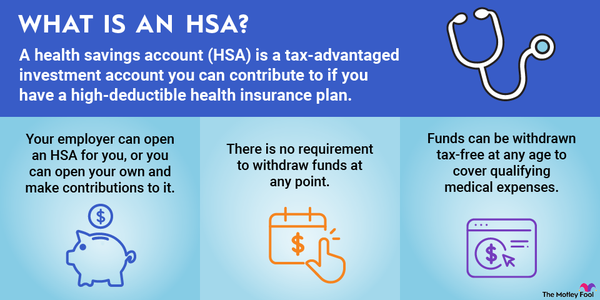

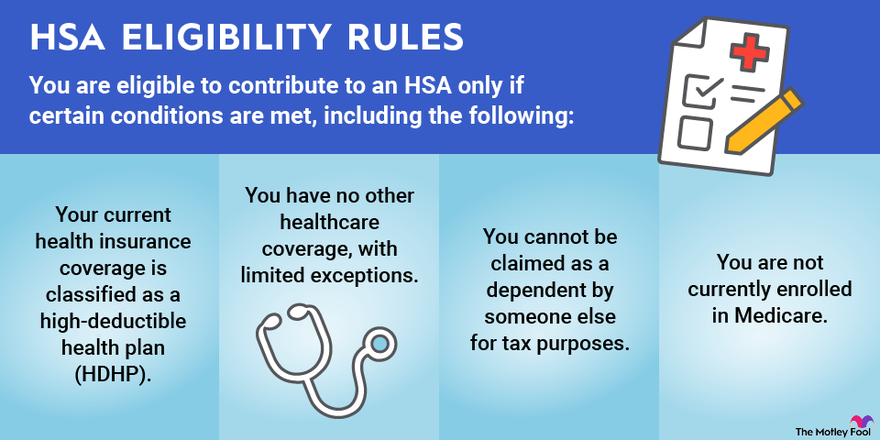

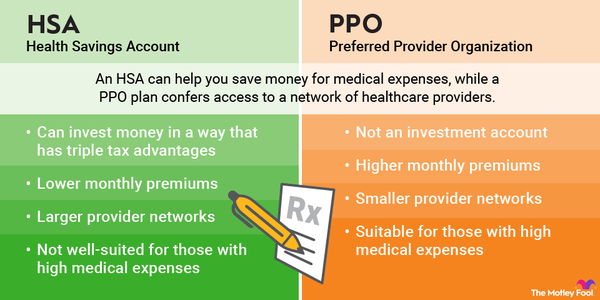

Health Savings Accounts Hsas Explained The Motley Fool A health savings account (hsa) is a tax advantaged account you use to save for medical expenses. you must have a high deductible health plan (hdhp) to fund an hsa. money in an hsa stays with you. Here are the maximum amounts you can contribute to an hsa in 2024: if you have self only coverage, you can contribute up to $4,150 ($3,850 for 2023). if you have family coverage, you can.

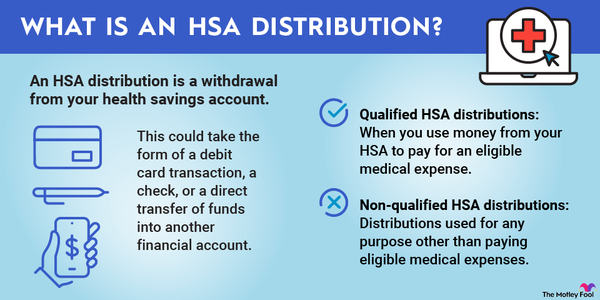

Health Savings Accounts Hsas Explained The Motley Fool A health savings account can be a great vehicle for saving money on health expenses and investing for the future. the motley fool is a financial services company dedicated to making the world. Hsa contributions are deducted from your taxable income, often directly by your employer, which lowers your tax bill. the tax savings equals the amount of your hsa contribution times your marginal. A great example is the health savings account, a powerful tool that offers tax relief when paying for health related expenses while also sporting some retirement savings features. Those with individual health insurance plans with a deductible of $1,600 or more may contribute up to $4,150 to an hsa in 2024. those with family plans with deductibles of $3,200 or more may.

Health Savings Account Rules Hsa Rules In 2023 And 2024 The Motley Foolођ A great example is the health savings account, a powerful tool that offers tax relief when paying for health related expenses while also sporting some retirement savings features. Those with individual health insurance plans with a deductible of $1,600 or more may contribute up to $4,150 to an hsa in 2024. those with family plans with deductibles of $3,200 or more may. How to roll over hsas. the process of rolling over an hsa is simple: step 1: contact your plan administrator to initiate a rollover. you can typically contact your provider online or via phone. The maximum contribution for an hsa in 2024 is $4,150 for an individual (rising to $4,300 for 2025) and $8,300 for a family ($8,550 in 2025). the annual limits on contributions apply to the total.

Health Savings Accounts Hsas Explained The Motley Fool How to roll over hsas. the process of rolling over an hsa is simple: step 1: contact your plan administrator to initiate a rollover. you can typically contact your provider online or via phone. The maximum contribution for an hsa in 2024 is $4,150 for an individual (rising to $4,300 for 2025) and $8,300 for a family ($8,550 in 2025). the annual limits on contributions apply to the total.

Health Savings Accounts Hsas Explained The Motley Fool

Comments are closed.