Health Insurance Ppos Hmos Cdhps Explained Learn Price Transparency And Other Tricks

Health Insurance Ppos Hmos Cdhps Explained Learn Priceо Health insurance plan designs are very confusing. this video explains them all:ppo plans learn how family deductibles and in network and out of network be. Providers or doctors either work for the hmo or contract for set rates. networks include providers and facilities that have negotiated lower rates on the services they perform. ppo health plans have access to those negotiated rates. doctors and facilities that participate in an epo are paid per service.

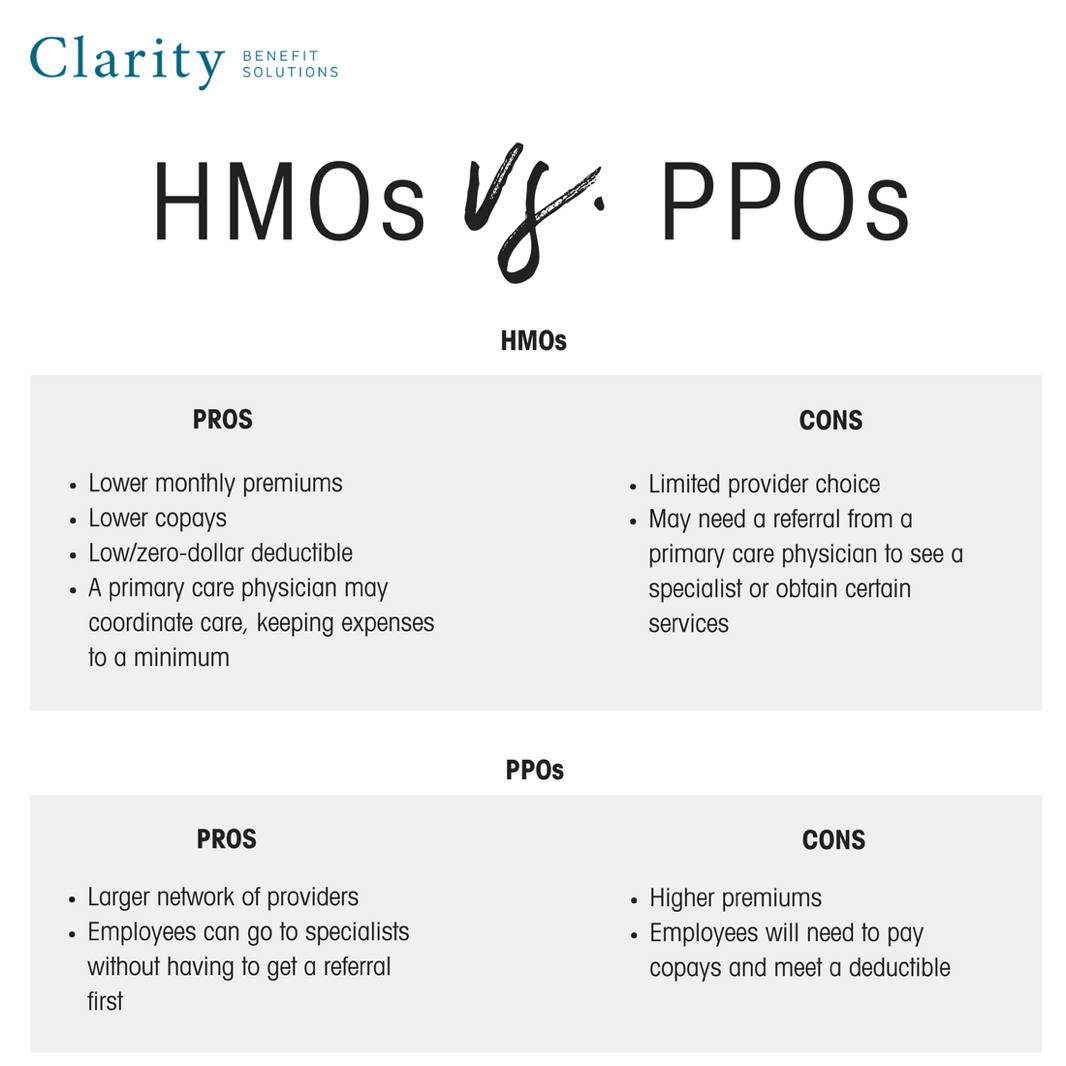

Health Insurance Network Types Ppos Hmos And More Cheaper health insurance rates: hmo plans are usually a lower cost alternative to ppos. the average hmo rate is $427 monthly for an affordable care act (aca) plan for someone who is 30 years old. And the hmo, ppo, epo, or pos designation describes the plan’s approach to managed care. learn more about hsa qualified high deductible health plans (hdhps). louise norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. Hmo: a budget friendly plan. a health maintenance organization (hmo) plan is one of the most affordable types of health insurance. while it may have coinsurance, it generally has lower premiums and deductibles. it also often has fixed copays for doctor visits. it’s a good choice if you’re on a tight budget and don’t have many health issues. Ppos are usually more expensive than an hmo and an hdhp and have greater flexibility. forty six percent of covered employees were enrolled in a ppo in 2021, according to a report by the kaiser family foundation; 16% were in an hmo and 9% were in a pos plan. you usually don’t have to select a primary care provider (pcp) in a ppo plan.

Is Hmo Or Ppo Better Types Of Hmo Vs Ppo Insurance Plans Hmo: a budget friendly plan. a health maintenance organization (hmo) plan is one of the most affordable types of health insurance. while it may have coinsurance, it generally has lower premiums and deductibles. it also often has fixed copays for doctor visits. it’s a good choice if you’re on a tight budget and don’t have many health issues. Ppos are usually more expensive than an hmo and an hdhp and have greater flexibility. forty six percent of covered employees were enrolled in a ppo in 2021, according to a report by the kaiser family foundation; 16% were in an hmo and 9% were in a pos plan. you usually don’t have to select a primary care provider (pcp) in a ppo plan. Exclusive provider organization (epo): a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency). health maintenance organization (hmo): a type of health insurance plan that usually limits coverage to care from doctors who work for or contract with the hmo. For example, the premium price of an hmo with one insurer might not be that much cheaper than ppo health insurance plans with a different company. keep affordable health insurance in mind as we discuss each plan type. cost is represented on the health care exchange by "metal tiers", which range from bronze to platinum. the quality of care.

Comments are closed.