Hdhp Vs Ppo Which Is Better The Motley Fool

Hdhp Vs Ppo Which Is Better The Motley Fool If you don't go to the doctor at all, the hdhp is the clear winner. you'd save about $2,500 in premiums compared to going with the ppo plan. but if you had a $5,000 medical bill, you'd fare better. The bottom line. a ppo is a type of health insurance plan, while an hsa is an account you use to save and invest money for healthcare. an hsa can be a smart way to save for health related costs.

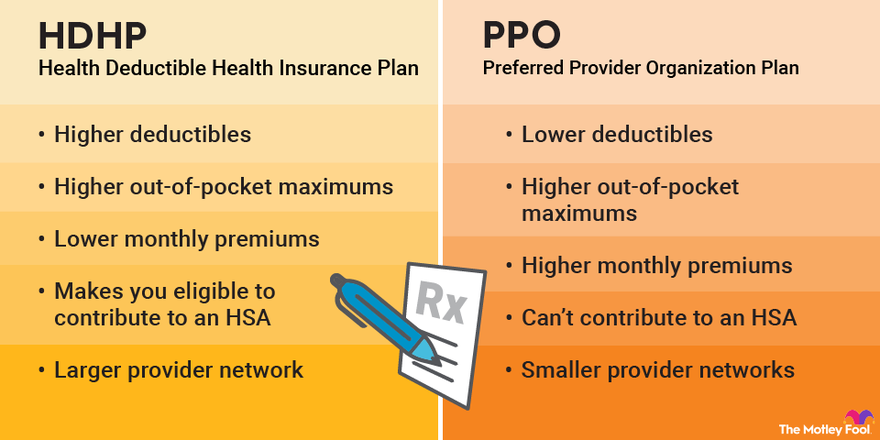

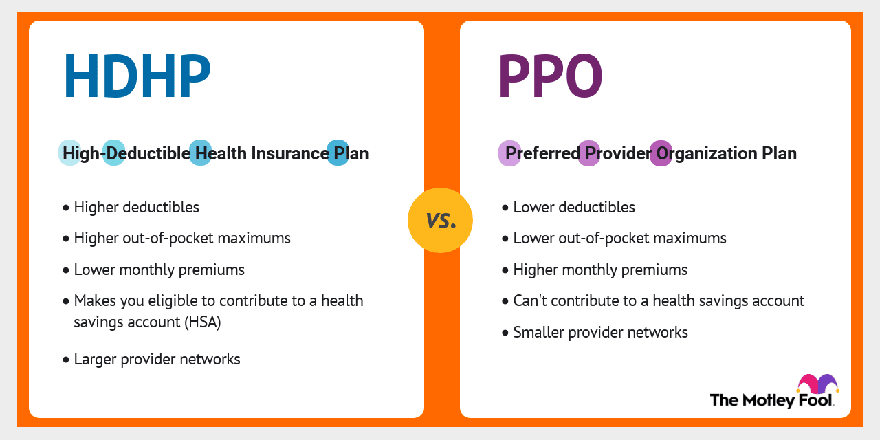

Hdhp Vs Ppo Which Is Better The Motley Fool A health savings account (hsa) is a tax advantaged account you use to save for medical expenses. you must have a high deductible health plan (hdhp) to fund an hsa. money in an hsa stays with you. High deductible health plans (hdhps) were created to help consumers lower their monthly premiums. the downside of hdhps is that individuals are responsible for more healthcare costs before their insurance coverage kicks in. in contrast, ppo plans have a wider network of providers and more affordable cost sharing but higher monthly premiums. Ppo pros and cons. first, the upside: lower deductible: we all want to save money where we can. and having a lower deductible means a ppo kicks in with help on medical expenses sooner, rather than later. lower out of pocket maximum: the ppo typically has a lower maximum out of pocket cost than an hdhp. On the flip side, a traditional ppo plan typically has a lower deductible and lower out of pocket maximum than an hdhp. for example, let’s say you receive a medical bill for $5,000. under an hdhp, your deductible might be $3,000. that means you’ll be required to cover $3,000 of the bill before your insurance provider covers the rest.

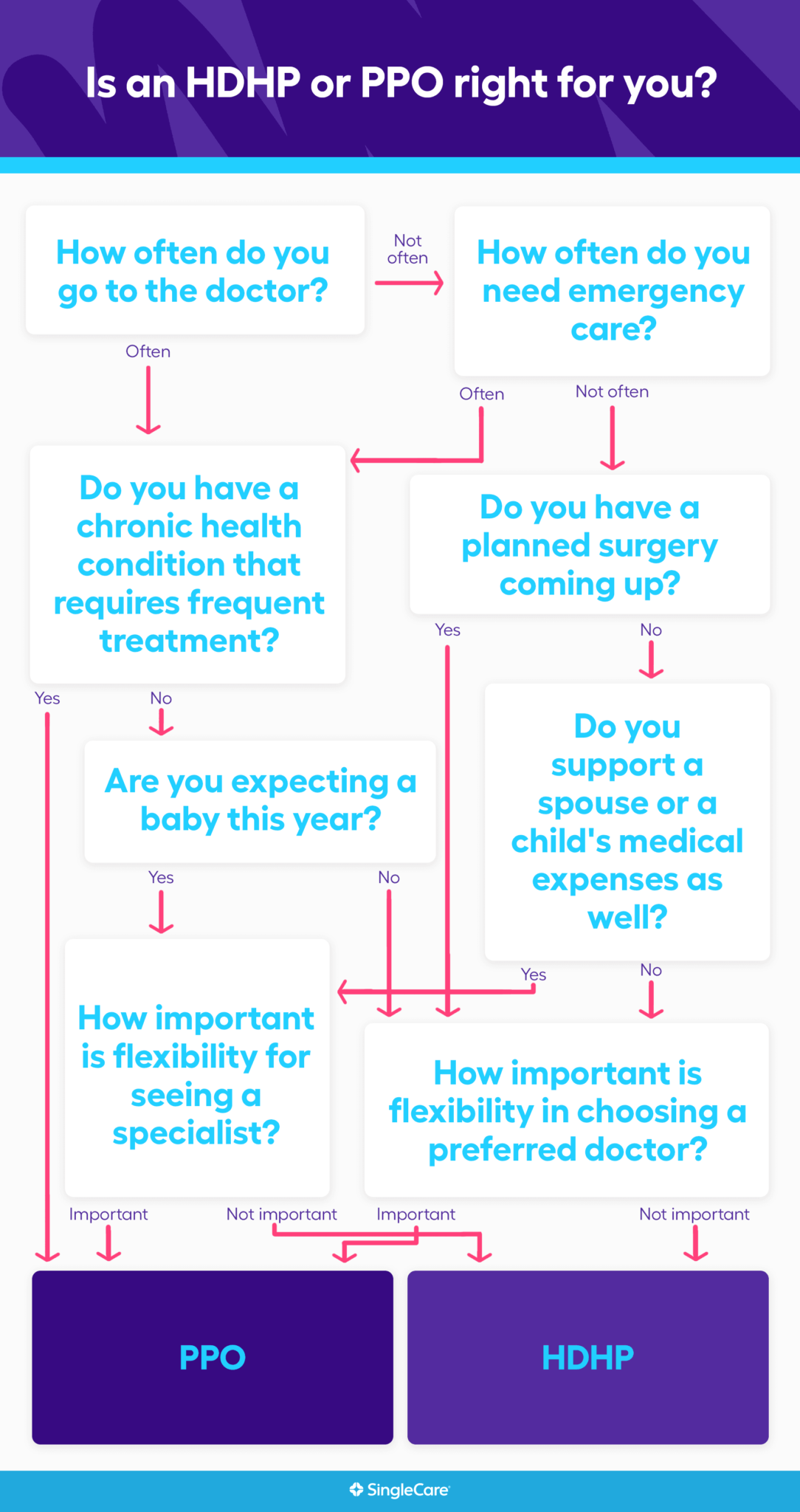

Hdhp Vs Ppo Which Is Better Singlecare Ppo pros and cons. first, the upside: lower deductible: we all want to save money where we can. and having a lower deductible means a ppo kicks in with help on medical expenses sooner, rather than later. lower out of pocket maximum: the ppo typically has a lower maximum out of pocket cost than an hdhp. On the flip side, a traditional ppo plan typically has a lower deductible and lower out of pocket maximum than an hdhp. for example, let’s say you receive a medical bill for $5,000. under an hdhp, your deductible might be $3,000. that means you’ll be required to cover $3,000 of the bill before your insurance provider covers the rest. An hdhp is a category of non traditional health plan that features lower monthly premiums. because these plans have a higher deductible, that means you'll pay more in out of pocket costs before the health insurance company begins sharing the cost (also called "coinsurance"). you can combine an hdhp with a health savings account (hsa). Let's say you’re deciding between the following hdhp and ppo plans: an hdhp with an annual premium of $4,800 ($400 per month) and $5,500 deductible. a ppo with an annual premium of $7,200 ($600 per month) and a $1,200 deductible. now, consider the scenarios outlined in the chart below.

Ppo Vs Hdhp Comparison Youtube An hdhp is a category of non traditional health plan that features lower monthly premiums. because these plans have a higher deductible, that means you'll pay more in out of pocket costs before the health insurance company begins sharing the cost (also called "coinsurance"). you can combine an hdhp with a health savings account (hsa). Let's say you’re deciding between the following hdhp and ppo plans: an hdhp with an annual premium of $4,800 ($400 per month) and $5,500 deductible. a ppo with an annual premium of $7,200 ($600 per month) and a $1,200 deductible. now, consider the scenarios outlined in the chart below.

Comments are closed.