Future Value Of Compound Interest Math Compound Interest Showme

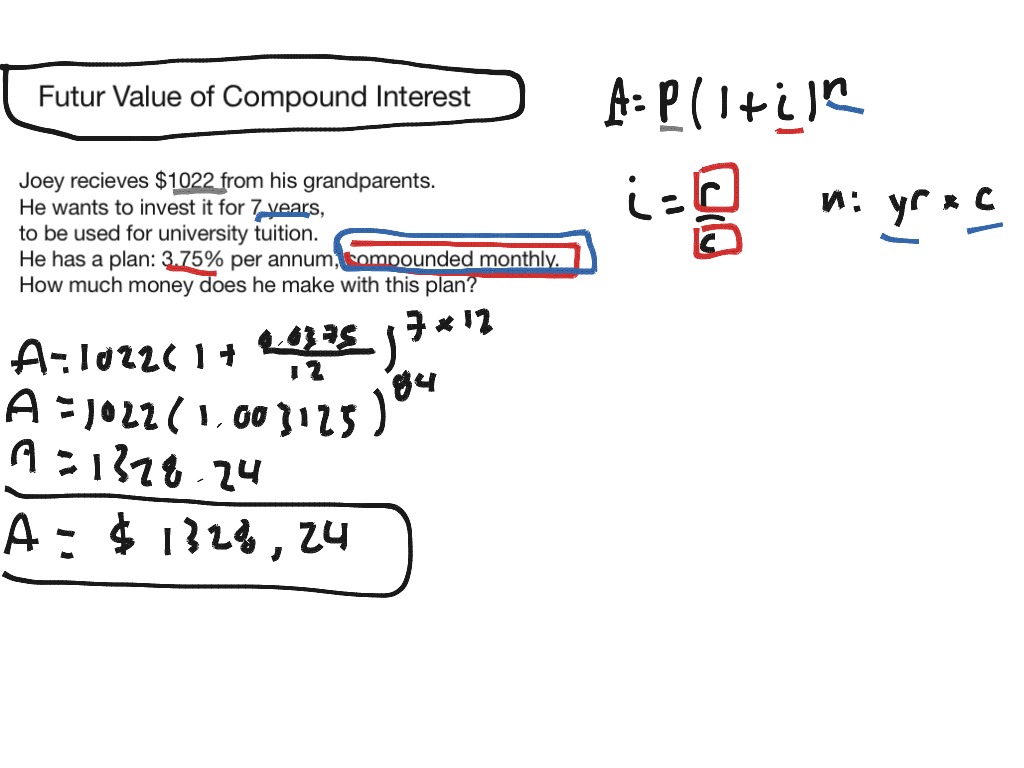

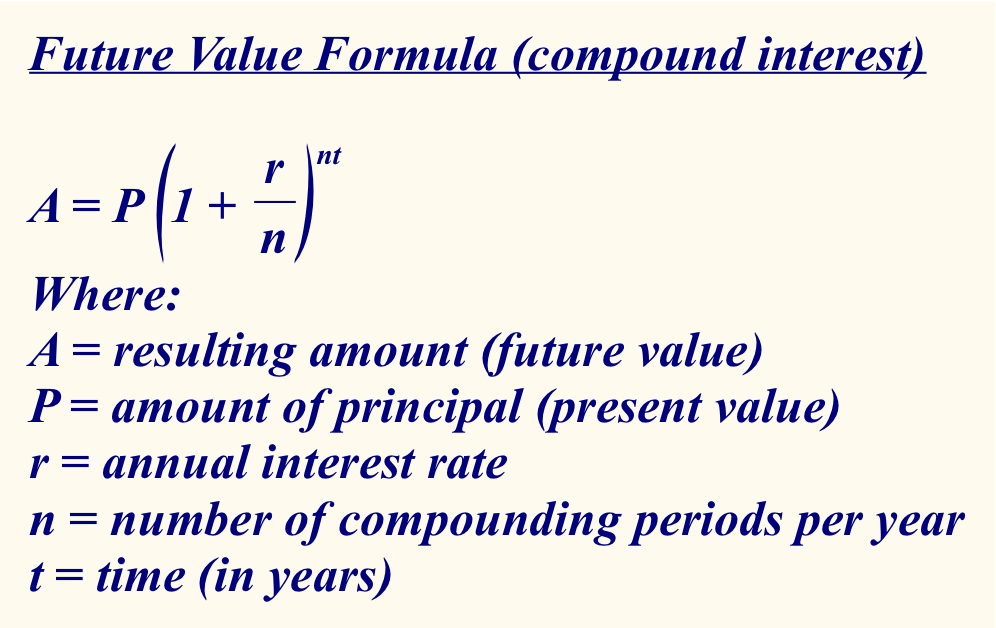

Future Value Of Compound Interest Math Compound Interest Showme The basic formula for compound interest is: fv = pv (1 r) n. finds the future value, where: fv = future value, pv = present value, r = interest rate (as a decimal value), and; n = number of periods; and by rearranging that formula (see compound interest formula derivation) we can find any value when we know the other three:. Solution: to find: fututre value for an investment after 10 years. the present value (investment), pv = $1000. the rate of interest, r = 5% =5 100 = 0.05. the time in years, t = 10. since the amount is compounded daily, n = 365. using the future value formula of compound interest: fv = pv (1 r n) n t.

The Mind Blowing Math Of Money The Solver Blog Rimwe Educational To calculate compound interest is necessary to use the compound interest formula, which will show the fv future value of investment (or future balance): fv = p × (1 (r m)) (m × t) this formula takes into consideration the initial balance p , the annual interest rate r , the compounding frequency m , and the number of years t . The four formulas. so, the basic formula for compound interest is: fv = pv (1 r) n. fv = future value, pv = present value, r = interest rate (as a decimal value), and. n = number of periods. with that we can work out the future value fv when we know the present value pv, the interest rate r and number of periods n. Compound interest calculator. select want to calculate either present value, interest rate, number of periods or future value from the other three. learn more at compound interest. The compound interest formula is given below: compound interest = amount – principal where the amount is given by: a = p(1 r n) {nt} p = principal r = annual nominal interest rate as a decimal n = number of compounding periods t = time (in years) for example, if mohan deposits rs. 4000 into an account paying 6% annual interest compounded.

Comments are closed.