Frm Value At Risk Var Of Linear Derivatives Youtube

Frm Value At Risk Var Of Linear Derivatives Youtube When calculating the var of a linear derivative one of the easiest way is to simply multiply the sensitivity (delta) of the derivative relating to the underl. For frm (part i & part ii) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the frm syllabus, click on the.

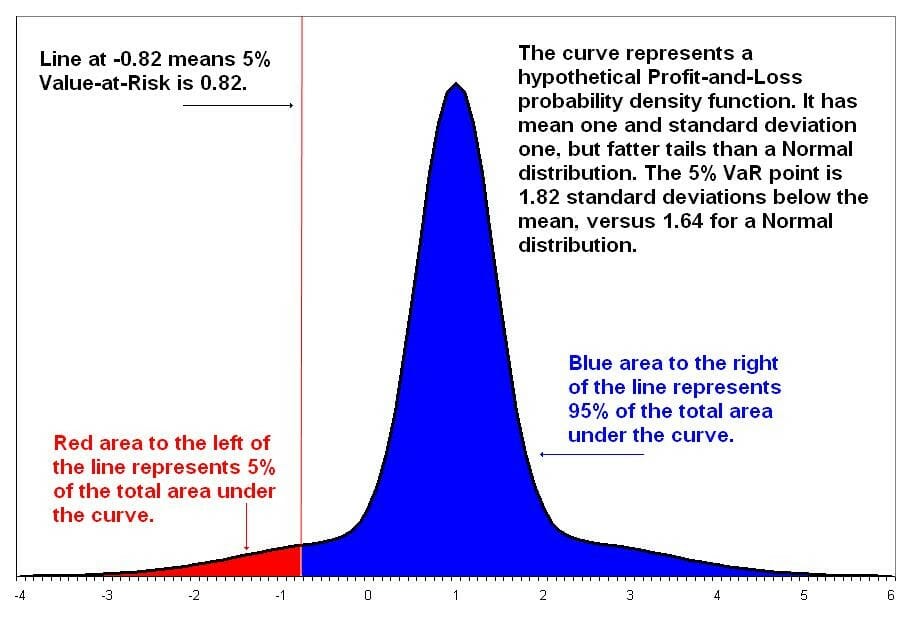

Value At Risk Learn About Assessing And Calculating Var [here is my xls trtl.bz 2rlvj7h] the taylor series lets us approximate a smooth function with a polynomial. here we apply it to both an option positi. As with any linear relationship, the biggest change in the value of the portfolio will accompany the biggest change in the risk factor. the var at a given level of significance, z, can be written as: var = |Δ0| x (zσs0) the delta normal method for estimating var requires the assumption of a normal distribution. In general terms, the var of a linear derivative can be expressed as: varlinear derivative = Δ×varunderlying factor var linear derivative = Δ × var underlying factor. where Δ Δ represents the sensitivity of the derivative’s price to the price of the underlying asset. it is usually expressed as a percentage. In the you tube video, delta normal value at risk the var of a long call option for single risk factor of underlying stock price change has been calculated assuming delta to be constant. that means gamma has been assumed to be zero. does this method have any practical use as in real life gamma of an option is never zero and delta is never constant?.

Calculating And Applying Var Frm Part 1 2023 вђ Book 4 вђ Valuation And In general terms, the var of a linear derivative can be expressed as: varlinear derivative = Δ×varunderlying factor var linear derivative = Δ × var underlying factor. where Δ Δ represents the sensitivity of the derivative’s price to the price of the underlying asset. it is usually expressed as a percentage. In the you tube video, delta normal value at risk the var of a long call option for single risk factor of underlying stock price change has been calculated assuming delta to be constant. that means gamma has been assumed to be zero. does this method have any practical use as in real life gamma of an option is never zero and delta is never constant?. A linear derivative is one whose value is directly related to the market price of the underlying variable. o if the underlying makes a move, the value of the derivative moves with a nearly identical margin. o examples include futures and forwards contracts. a non linear derivative is one whose value payoff changes with time and space. Value at risk, linear and non linear concept: these on line quiz questions are not specifically linked to aims, but are instead based on recent sample questions. the difficulty level is a notch, or two notches, easier than bionicturtle 's typical aim by aim question such that the intended difficulty level is nearer to an actual.

Comments are closed.