Frm Three Approaches To Value At Risk Var

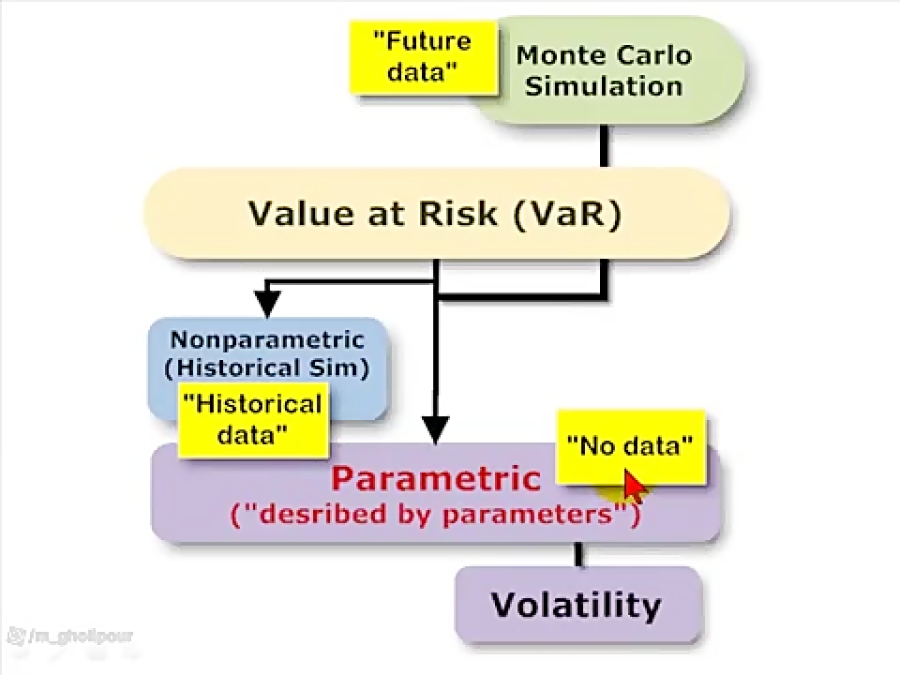

Frm Three Approaches To Value At Risk Var Youtube This is a brief introduction to the three basic approaches to value at risk (var): historical simulation, monte carlo simulation, parametric var (e.g., delta. The three approaches are 1. parametric; aka, analytical; 2. historical simulation; and 3. monte carlo simulation (mcs). the parametric approach assumes a cle.

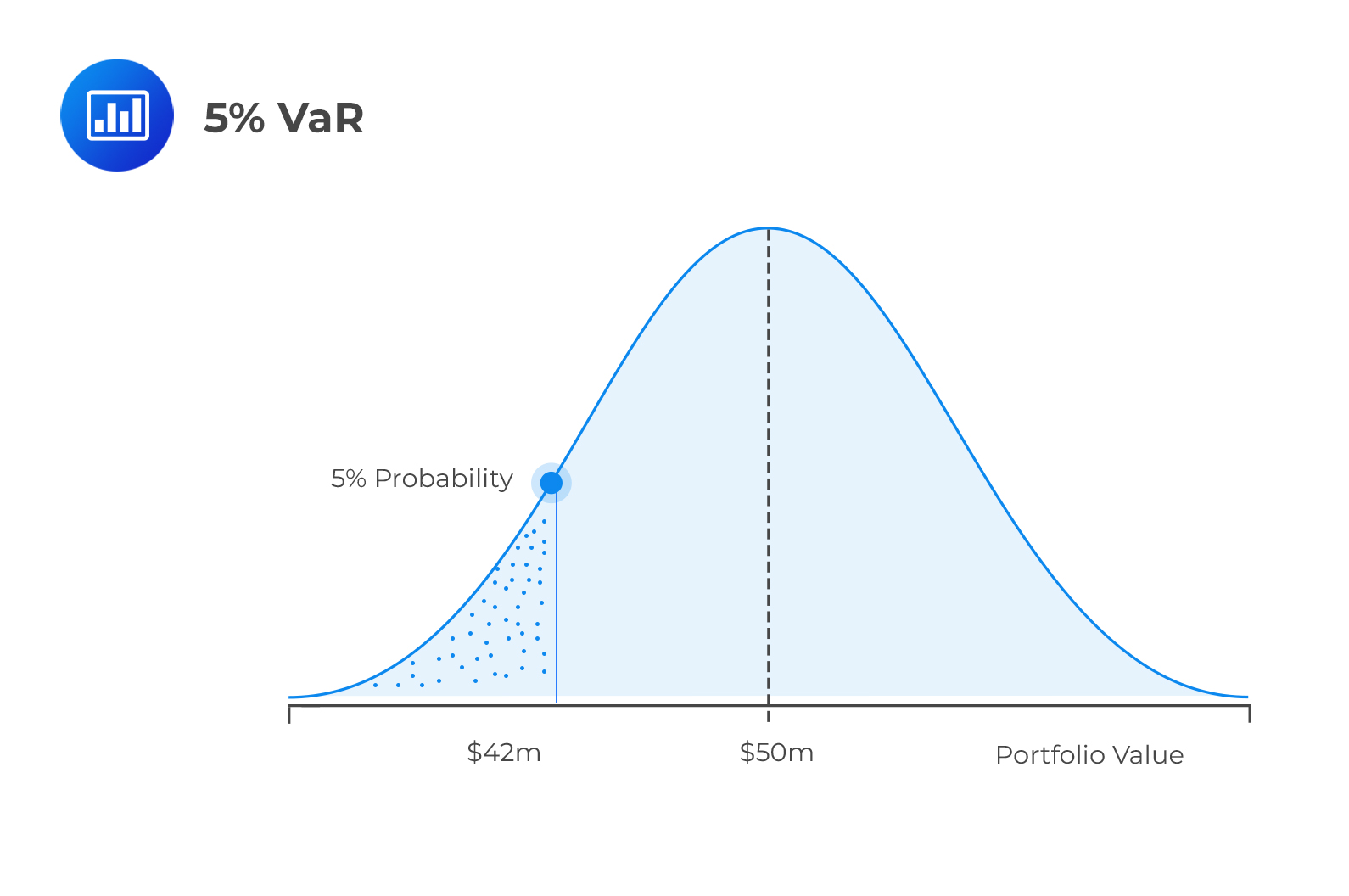

Frm Three Approaches To Value At Risk Var Specifically, at the end of the 12 week horizon, the position’s expected future value is $100 * (1 9%*12 52) = $102.077 due to its expected gain (aka, drift) of 9.0% per annum. the relative var is $15.803 because that is the worst expected loss relative to the expected future value of $102.077. Value at risk. value at risk = vm (vi v (i 1)) m = the number of days from which historical data is taken. vi = the number of variables on the day i. in calculating each daily return, we. In its most general form, the value at risk measures the potential loss in value of. risky asset or portfolio over a defined period for a given confidence interval. thus, if the var on an asset is $ 100 million at a one week, 95% confidence level, there is a only. 5% chance that the value of the asset will drop more than $ 100 million over any. A risk manager wishes to calculate the var for a nikkei futures contract using the historical simulation approach. the current price of the contract is 955, and the multiplier is 250. for the last 300 days, the following return data has been recorded:.

Value At Risk Var Cfa Frm And Actuarial Exams Study Notes In its most general form, the value at risk measures the potential loss in value of. risky asset or portfolio over a defined period for a given confidence interval. thus, if the var on an asset is $ 100 million at a one week, 95% confidence level, there is a only. 5% chance that the value of the asset will drop more than $ 100 million over any. A risk manager wishes to calculate the var for a nikkei futures contract using the historical simulation approach. the current price of the contract is 955, and the multiplier is 250. for the last 300 days, the following return data has been recorded:. Var (x%) = the x% probability value at risk. zx% = the critical z value based on the normal distribution and the selected x% probability. σ = the standard deviation of daily returns on a percentage basis. var conversions # risk managers may be interested in measuring risk over longer time periods, such as a month, quarter, or year. Var. value at risk is a statistical metric to compute a portfolio's risk. it displays the highest possible loss and a given confidence level. it considers the market price and the volatility in a given time frame. investors, analysts, and regulators widely use var to measure the risks in their portfolios.

Comments are closed.