Fraud Detection Using Ai In Banking Youverify

Fraud Detection Using Ai In Banking Youverify In summary, leveraging ai for fraud detection in the banking industry brings about immense benefits that collectively strengthen fraud prevention efforts, minimize financial losses, and enhance overall security within the banking sector. join 100 leading companies that use youverify’s ai powered solution for real time fraud detection. Trained ai systems can help execute this important part of fraud prevention, especially in e commerce and online banking transactions. fraudsters often use fake or stolen addresses to carry out fraudulent activities, like making purchases with illegally obtained credit cards or applying for loans under fake identities.

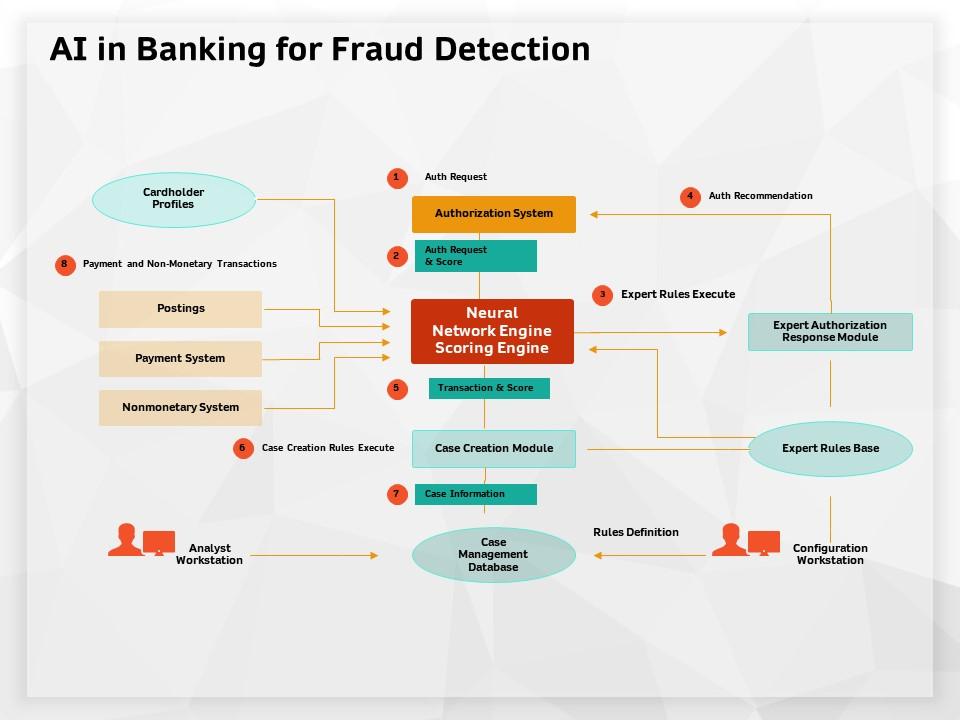

Intelligent Fraud Detection In The Banking Sector Wittypen Samples Banks implement fraud prevention through encryption, two factor authentication, ai driven anomaly detection, and real time monitoring. they also conduct regular security audits, educate employees and customers on safe practices, and collaborate with industry partners to share intelligence on emerging threats. 4. 7. looking out for red flags. consumers or individuals can benefit from being alert and looking out for red flags that can indicate online fraud detection; common red flags to look out for include avoiding unusually low prices, unsolicited promotion spams, phishing, and divulging personal information without tact. 8. The integration of generative ai in fraud detection represents more than just a technological advancement; it signifies a fundamental shift in the approach to banking security. Now, the conversation is shifting to fraud detection using ai in banking — it’s a beacon of innovation and potential solution in the ongoing war against deceit and deception. the association of certified fraud examiners found that fraud costs organizations an estimated 5% of their annual revenue, amounting to billions annually.

Comments are closed.