Foundation Vs Public Charity Chart A Visual Reference Of Charts

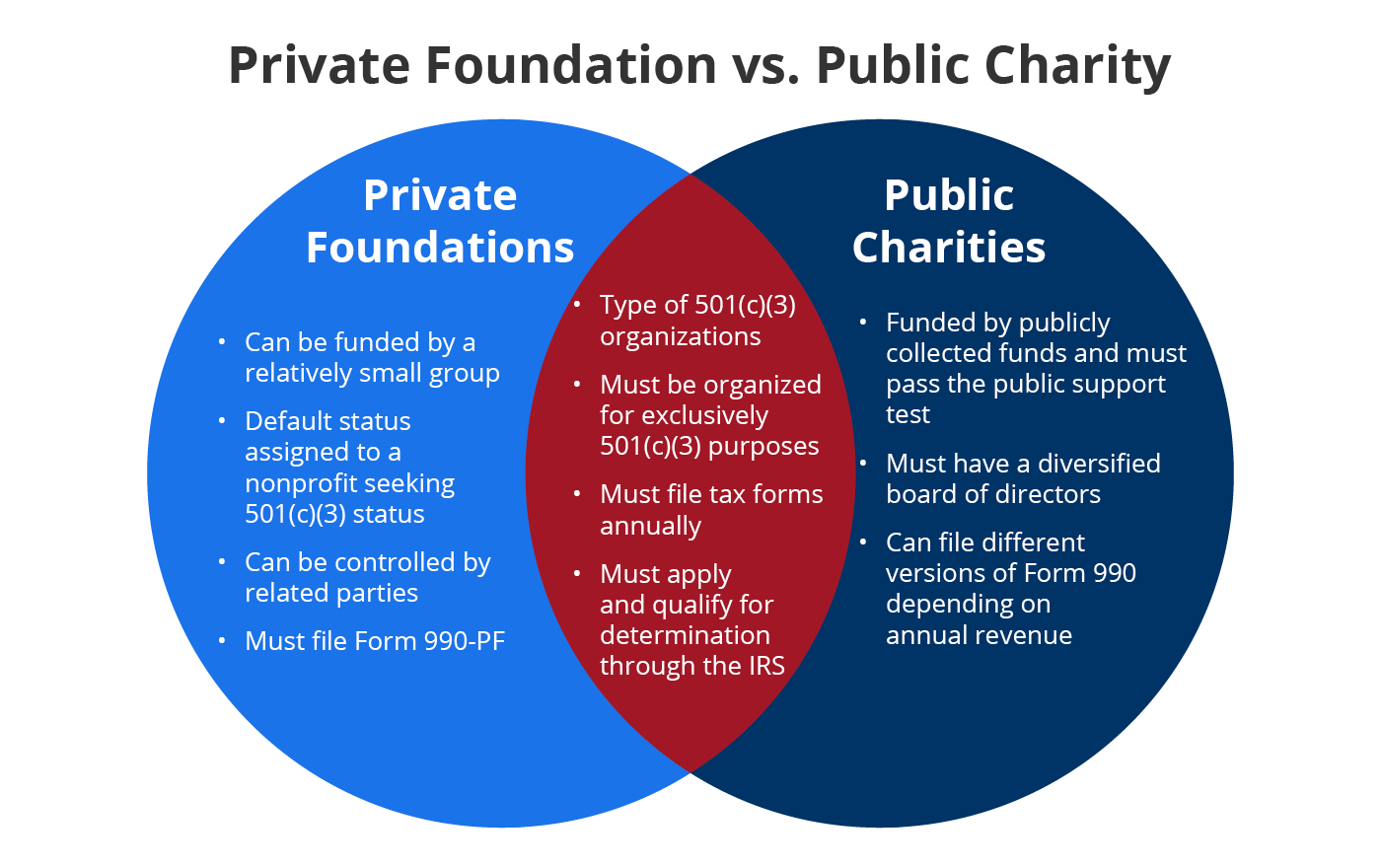

Foundation Vs Public Charity Chart A Visual Reference Of Charts When starting a 501 (c) (3) organization, there are generally two choices for classifying the organization: private foundation or public charity. public charities represent the largest share (72%) of active, 501 (c) (3) organizations. their purpose is to perform charitable work, while private foundations support the work of public charities. A private foundation is a nonprofit charitable entity that is generally created by a single benefactor, usually an individual or a business, through an endowment of funds. a public charity uses.

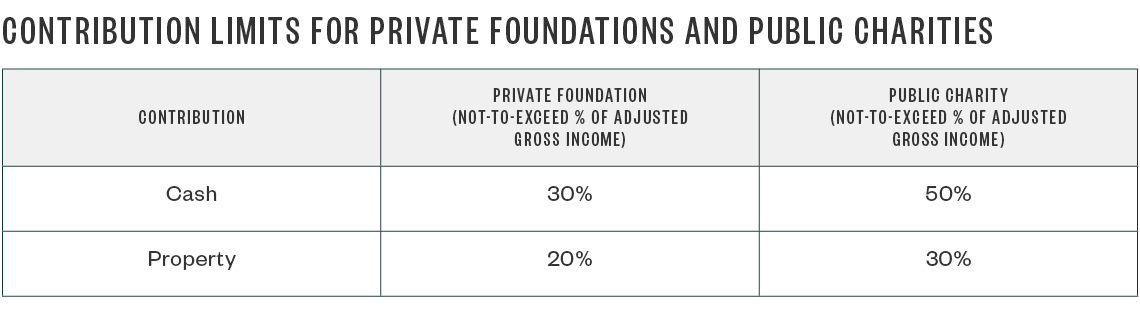

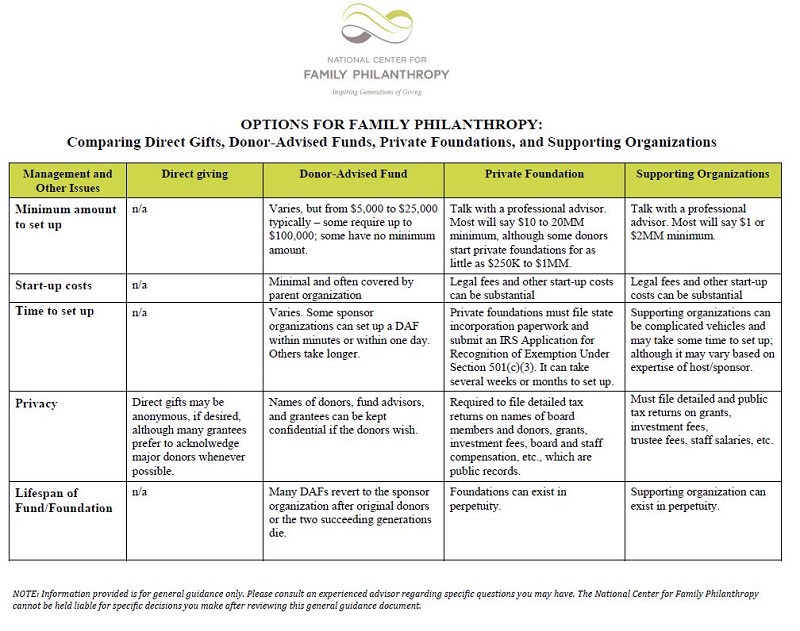

Foundation Vs Public Charity Chart A Visual Reference Of Charts A private foundation is a 501 (c) (3) nonprofit that generates much of its support from a small number of sources and investment income. according to the irs, they “have as their primary activity the making of grants to other charitable organizations and to individuals, rather than the direct operation of charitable programs.”. Every section 501 (c) (3) organization is classified as either a private foundation or a public charity. private foundations and public charities are distinguished primarily by the level of public involvement in their activities. public charities generally receive a greater portion of their financial support from the general public or. Foundation vs public charity chart: a visual reference of charts. foundation vs public charity chart is a topic that can benefit from charts. charts are visual aids that help you display and understand data, patterns, or trends. they can be used for various purposes, such as education, business, science, and art. Contributions to public charities and private foundations are both tax deductible. however, public charities have higher tax deductible giving limits and are more likely to allow for a fair market value deduction rather than tax basis. donations to private non operating foundations are generally limited to 30% adjusted gross income (agi.

Foundation Vs Public Charity Chart A Visual Reference Of Charts Foundation vs public charity chart: a visual reference of charts. foundation vs public charity chart is a topic that can benefit from charts. charts are visual aids that help you display and understand data, patterns, or trends. they can be used for various purposes, such as education, business, science, and art. Contributions to public charities and private foundations are both tax deductible. however, public charities have higher tax deductible giving limits and are more likely to allow for a fair market value deduction rather than tax basis. donations to private non operating foundations are generally limited to 30% adjusted gross income (agi. First off, the applicant for 501 (c) (3) status must affirmatively prove to the irs in its application why it should be considered a public charity. otherwise, you will be considered a private foundation by default. there are a number of different tests that can be used to prove an organization qualifies for public charity status, and the. Life cycle of a public charity private foundation. organizations that meet the requirements of internal revenue code section 501 (c) (3) are exempt from federal income tax as charitable organizations. in addition, contributions made to charitable organizations by individuals and corporations are deductible under code section 170. every exempt.

Foundation Vs Public Charity Chart A Visual Reference Of Charts First off, the applicant for 501 (c) (3) status must affirmatively prove to the irs in its application why it should be considered a public charity. otherwise, you will be considered a private foundation by default. there are a number of different tests that can be used to prove an organization qualifies for public charity status, and the. Life cycle of a public charity private foundation. organizations that meet the requirements of internal revenue code section 501 (c) (3) are exempt from federal income tax as charitable organizations. in addition, contributions made to charitable organizations by individuals and corporations are deductible under code section 170. every exempt.

Foundation Group Private Foundation Vs Public Charity Venn Diagram

Comments are closed.