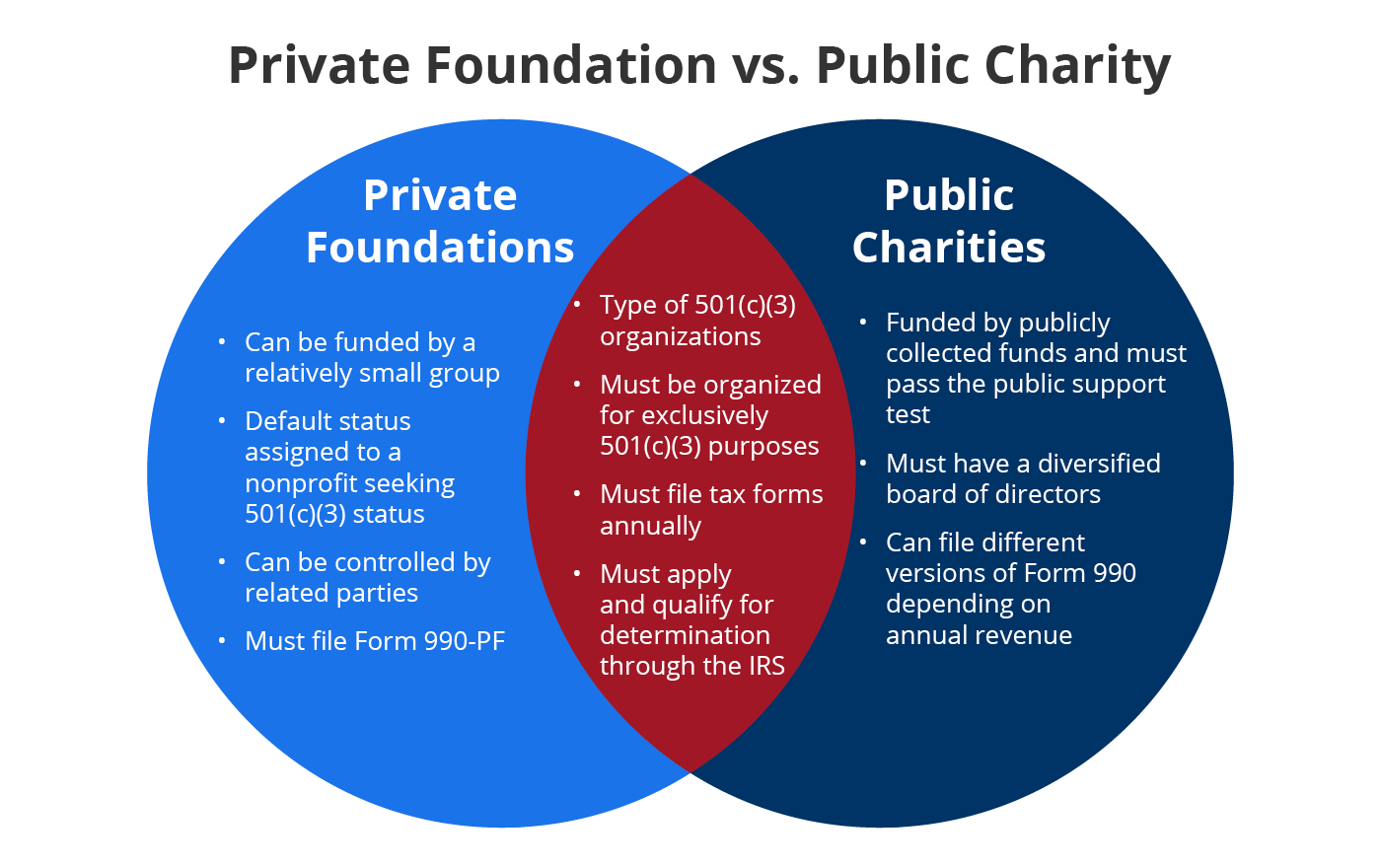

Foundation Group Private Foundation Vs Public Charity Venn Diagram

Foundation Group Private Foundation Vs Public Charity Venn Diagram When starting a 501 (c) (3) organization, there are generally two choices for classifying the organization: private foundation or public charity. public charities represent the largest share (72%) of active, 501 (c) (3) organizations. their purpose is to perform charitable work, while private foundations support the work of public charities. A private foundation is a nonprofit charitable entity that is generally created by a single benefactor, usually an individual or a business, through an endowment of funds. a public charity uses.

501 C 3 Public Charity Vs Private Foundation Differences Lobbying restrictions. may lobby (within 501(c)(3) limits) may earmark grants for lobbying (within 501(c)(3) limits) may make unlimited grants to other public charities that may use for lobbying under rules applicable to private foundations. A private foundation is a 501 (c) (3) nonprofit that generates much of its support from a small number of sources and investment income. according to the irs, they “have as their primary activity the making of grants to other charitable organizations and to individuals, rather than the direct operation of charitable programs.”. Choosing between a public charity and a private foundation for your philanthropic endeavors boils down to your vision for social change and how you’d like to engage with the community. whether you’re drawn to the diverse funding and vibrant community interaction of public charities or you prefer the strategic, long term impact of private. Contributions to public charities and private foundations are both tax deductible. however, public charities have higher tax deductible giving limits and are more likely to allow for a fair market value deduction rather than tax basis. donations to private non operating foundations are generally limited to 30% adjusted gross income (agi.

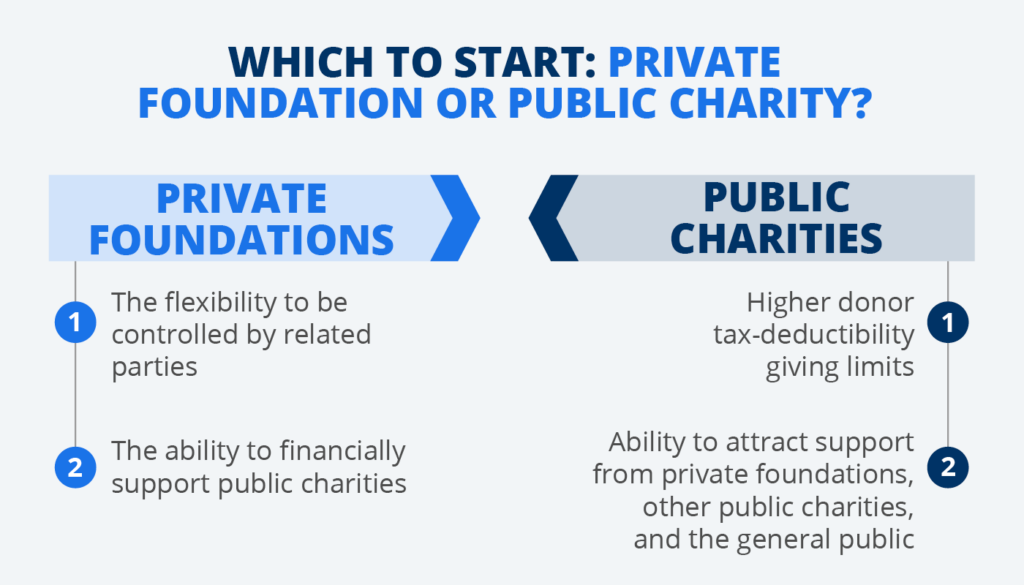

Foundation Group Private Foundation Vs Public Charity Whic Choosing between a public charity and a private foundation for your philanthropic endeavors boils down to your vision for social change and how you’d like to engage with the community. whether you’re drawn to the diverse funding and vibrant community interaction of public charities or you prefer the strategic, long term impact of private. Contributions to public charities and private foundations are both tax deductible. however, public charities have higher tax deductible giving limits and are more likely to allow for a fair market value deduction rather than tax basis. donations to private non operating foundations are generally limited to 30% adjusted gross income (agi. Under the tax law, a section 501 (c) (3) organization is presumed to be a private foundation unless it requests, and qualifies for, a ruling or determination as a public charity. organizations that qualify for public charity status include churches, schools, hospitals, medical research organizations, publicly supported organizations (i.e. January 17, 2020. • business law. private foundations and public charities are both tax exempt charitable organizations allowed by the internal revenue service. both are actually very similar in nature, the only small difference between the two is the manner in which funds are attained by the organization.

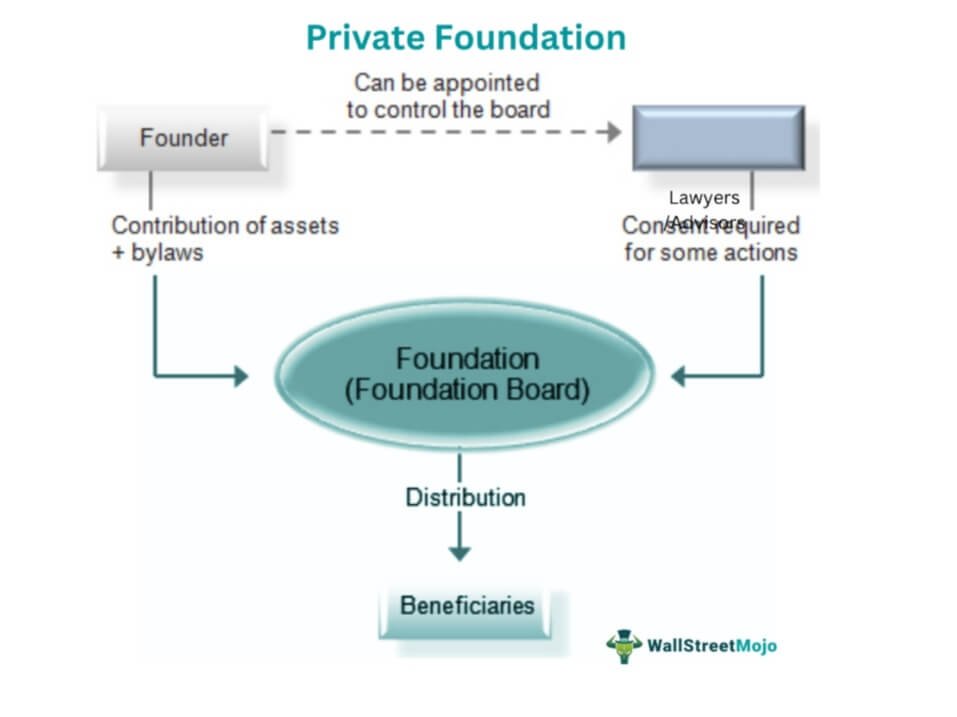

Private Foundation Meaning Types Rules Vs Public Charity Under the tax law, a section 501 (c) (3) organization is presumed to be a private foundation unless it requests, and qualifies for, a ruling or determination as a public charity. organizations that qualify for public charity status include churches, schools, hospitals, medical research organizations, publicly supported organizations (i.e. January 17, 2020. • business law. private foundations and public charities are both tax exempt charitable organizations allowed by the internal revenue service. both are actually very similar in nature, the only small difference between the two is the manner in which funds are attained by the organization.

Comments are closed.