Form Mo Pts Property Tax Credit Chart 2011 Printable Pdf Download

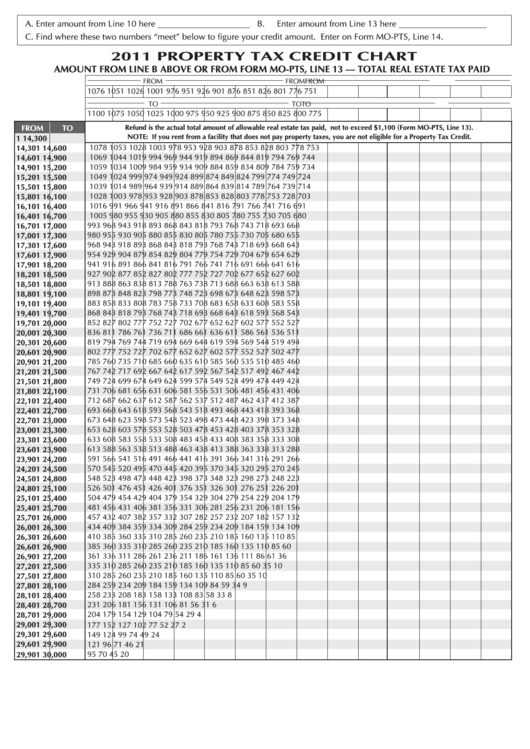

Form Mo Pts Property Tax Credit Chart 2011 Printable Pdf Download Mo pts page 1. this form must be attached to form mo 1040. *22323010001* 22323010001. department use only (mm dd yy) social security number. spouse’s social security number. date of birth (mm dd yyyy) spouse’s date of birth (mm dd yyyy) select only one qualification. copies of letters, forms, etc., must be included with claim. The missouri property tax credit claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year. the credit is for a maximum of $750 for renters and $1,100 for owners who owned and occupied their home. the actual credit is based on the amount of real.

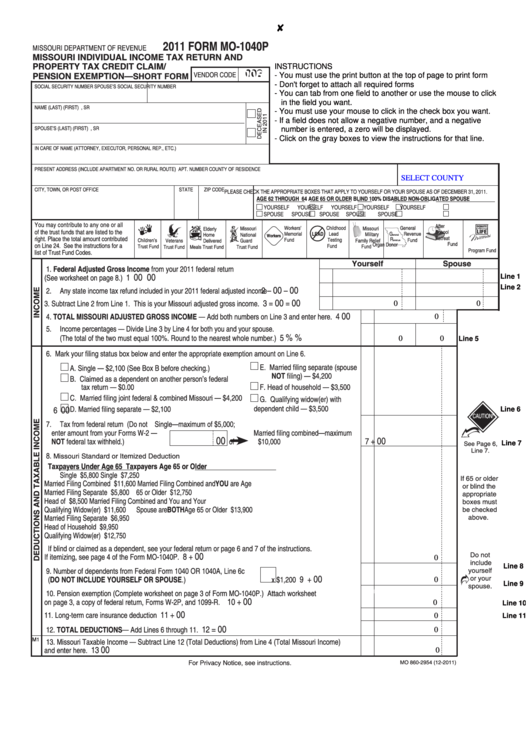

Form Mo 1040p Individual Income Tax Return And Property Tax Creditо Download a blank fillable form mo pts property tax credit 2011 in pdf format just by clicking the "download pdf" button. open the file in any pdf viewing software. adobe reader or any alternative for windows or macos are required to access and complete fillable content. Refund is the actual total amount of allowable real estate tax paid, not to exceed $1,100 or rent credit equivalent not to exceed $750 (form mo ptc, line 11). note: if you rent from a facility that does not pay property taxes, you are not eligible for a property tax credit. is $525, then the tax credit would be $16. A. if you rented or did not own and occupy your home for the entire year, line 8 cannot exceed $27,500. if the total is greater than $27,500, stop ‐ no credit is allowed. do not file this claim. if you owned and occupied your home for the entire year, line 8 cannot exceed $30,000. Reset form print form department use only (mm dd yy) form mo pts 2023 property tax credit schedule this form must be attached to form mo 1040. social security number date of birth (mm dd yyyy) first name m.i. spouse’s social security number last name spouse’s date of birth (mm dd yyyy) spouse’s first name m.i.

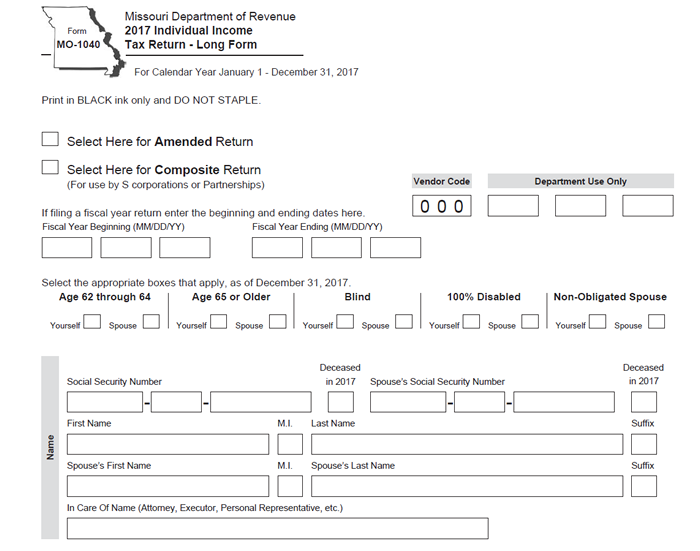

New Forms A. if you rented or did not own and occupy your home for the entire year, line 8 cannot exceed $27,500. if the total is greater than $27,500, stop ‐ no credit is allowed. do not file this claim. if you owned and occupied your home for the entire year, line 8 cannot exceed $30,000. Reset form print form department use only (mm dd yy) form mo pts 2023 property tax credit schedule this form must be attached to form mo 1040. social security number date of birth (mm dd yyyy) first name m.i. spouse’s social security number last name spouse’s date of birth (mm dd yyyy) spouse’s first name m.i. Download fillable form mo pts in pdf the latest version applicable for 2024. fill out the property tax credit schedule missouri online and print it out for free. form mo pts is often used in missouri department of revenue, missouri legal forms, legal and united states legal forms. Enter on form mo ptc, line 12. 2023 property tax credit chart amount from line b above or from form mo ptc, line 11 total property tax paid from 1076 1051 1026 1001 from 976 951 to 1100 1075 1050 1025 1000 975 926 901 from 876 851 826 to 950 801 776 751 800 775 to 925 900 875 850 825 refund is the actual total amount of allowable real estate.

Comments are closed.