For Employers Open Enrollment For Your Health Savings Account Hsa

.png)

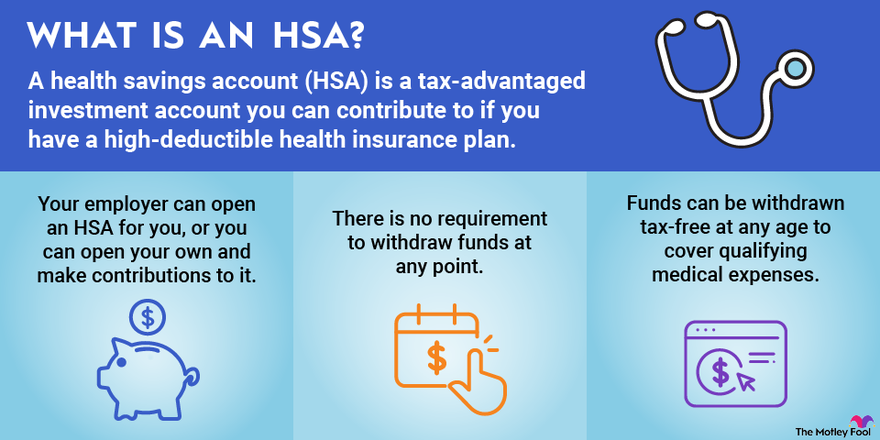

Open Enrollment 2024 Health Savings Accounts Hsas Christensen Gr Everything you need to kick off open enrollment and to empower your employees to make the right decisions about their hsa benefits. find tools and resources like quick start guides, educational flyers, email templates and more to help you navigate open enrollment with ease. (select resources also available in spanish.). A health savings account, or hsa, is a unique, tax advantaged account that your employees can use to pay for current or future healthcare expenses. when you offer an hsa, you’re really offering tax savings, investment opportunities, and a retirement savings option. hsa accountholders can use their funds now on qualified healthcare expenses or.

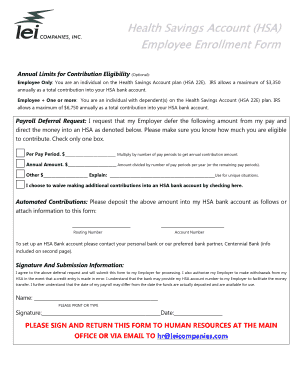

Health Savings Account Hsa Employee Enrollment Form Fill And Sig Access videos, communications and other tools to easily educate your employees and manage your hsa program. get answers to common hsa, fsa and hra questions employers ask. find tools to help you successfully navigate open enrollment, from educating employees about how to make the right decisions to increasing their overall engagement. Hsa vs. 401 (k) both accounts let you make pre tax contributions and grow tax free earnings. but only an hsa lets you take tax free distributions for qualified medical expenses. after age 65 you can use your health savings account for any expense, you’ll simply pay ordinary income taxes—just like a 401 (k). Start with a health savings account or hsa. from the moment you decide to open your account— to maximizing your health care dollars, your hsa journey will take you through five stages. (graphic of 5 stages include: decide, open, use, manage, optimize) (stage 1 decide) before you decide to open an hsa, find out if you’re eligible. For 2023, the hsa contribution limit is $3,850 if you are enrolled in an hsa eligible plan for yourself only. if you have family coverage, the limit is $7,750. there's also a $1,000 catch up.

For Employers Open Enrollment For Your Health Savings Account Hsa Start with a health savings account or hsa. from the moment you decide to open your account— to maximizing your health care dollars, your hsa journey will take you through five stages. (graphic of 5 stages include: decide, open, use, manage, optimize) (stage 1 decide) before you decide to open an hsa, find out if you’re eligible. For 2023, the hsa contribution limit is $3,850 if you are enrolled in an hsa eligible plan for yourself only. if you have family coverage, the limit is $7,750. there's also a $1,000 catch up. Select “don’t allow” to block this tracking. one way to manage your health care expenses is by enrolling in a high deductible health plan (hdhp) in combination with opening a health savings account (hsa). learn how to set up hsa after enrolling in health savings account eligible hdhp. open health savings account through bank, insurance. Please complete the form below to refer one of your clients to healthequity. please complete the form below to refer one of your clients, request a bid or rfp response, or request more information about becoming a healthequity registered broker. for immediate assistance, please call 866.855.8908. phone assistance is available m f 8am 5pm mst.

Health Savings Accounts Hsas Explained The Motley Fool Select “don’t allow” to block this tracking. one way to manage your health care expenses is by enrolling in a high deductible health plan (hdhp) in combination with opening a health savings account (hsa). learn how to set up hsa after enrolling in health savings account eligible hdhp. open health savings account through bank, insurance. Please complete the form below to refer one of your clients to healthequity. please complete the form below to refer one of your clients, request a bid or rfp response, or request more information about becoming a healthequity registered broker. for immediate assistance, please call 866.855.8908. phone assistance is available m f 8am 5pm mst.

Health Savings Account Hsa Workest

Comments are closed.