Flood Insurance Explained

What Is Flood Insurance Flood Insurance Explained Youtube Flood insurance is a type of property insurance that covers a dwelling for losses sustained by water damage, specifically due to flooding. floods may be caused by heavy or prolonged rain, melting. You’ll need a separate flood insurance policy. a commercial flood insurance policy from the nfip offers: building property, up to $500,000. personal property, up to $500,000. the building.

Flood Insurance Explained Youtube And yet, flood insurance is still a relatively new concept in the great white north. (ibc), which represents canada’s private home insurers, explained. Flood insurance. flood insurance is the specific insurance coverage issued against property loss from flooding. to determine risk factors for specific properties, insurers will often refer to topographical maps that denote lowlands, floodplains and other areas that are susceptible to flooding. [1]. Flood insurance covers two main things: your stuff and your place. by stuff we mean your personal property – we’re talking all your clothes, electronics, curtains, carpets, and other valuables up to $100,000. by place, we mean things like flooring, carpets, built in appliances, walls, ceilings, and more. think of it this way: if you were to. Flood insurance coverage — explained. flood insurance reimburses you for damage to your home and belongings due to a flood. homeowners insurance typically doesn't cover flooding, so you’ll need a separate flood insurance policy if your home is in a flood prone area. your mortgage lender may even require this coverage if your home is in a.

Flood Insurance Explained Youtube Flood insurance covers two main things: your stuff and your place. by stuff we mean your personal property – we’re talking all your clothes, electronics, curtains, carpets, and other valuables up to $100,000. by place, we mean things like flooring, carpets, built in appliances, walls, ceilings, and more. think of it this way: if you were to. Flood insurance coverage — explained. flood insurance reimburses you for damage to your home and belongings due to a flood. homeowners insurance typically doesn't cover flooding, so you’ll need a separate flood insurance policy if your home is in a flood prone area. your mortgage lender may even require this coverage if your home is in a. With this understanding, congress stepped in with the national flood insurance act (1968) to provide homeowners with an affordable flood insurance option. the policies they offered and rates were generic across the board—up to $250,000 in coverage for damages to the structure of a home and up to $100,000 in coverage for damages to contents. Compare private flood insurance & nfip rates. the average annual cost of nfip flood insurance is $888 per year, while private flood insurance costs around $1,074 per year, according to our 2023 analysis of flood insurance pricing data from fema and the national association of insurance commissioners.

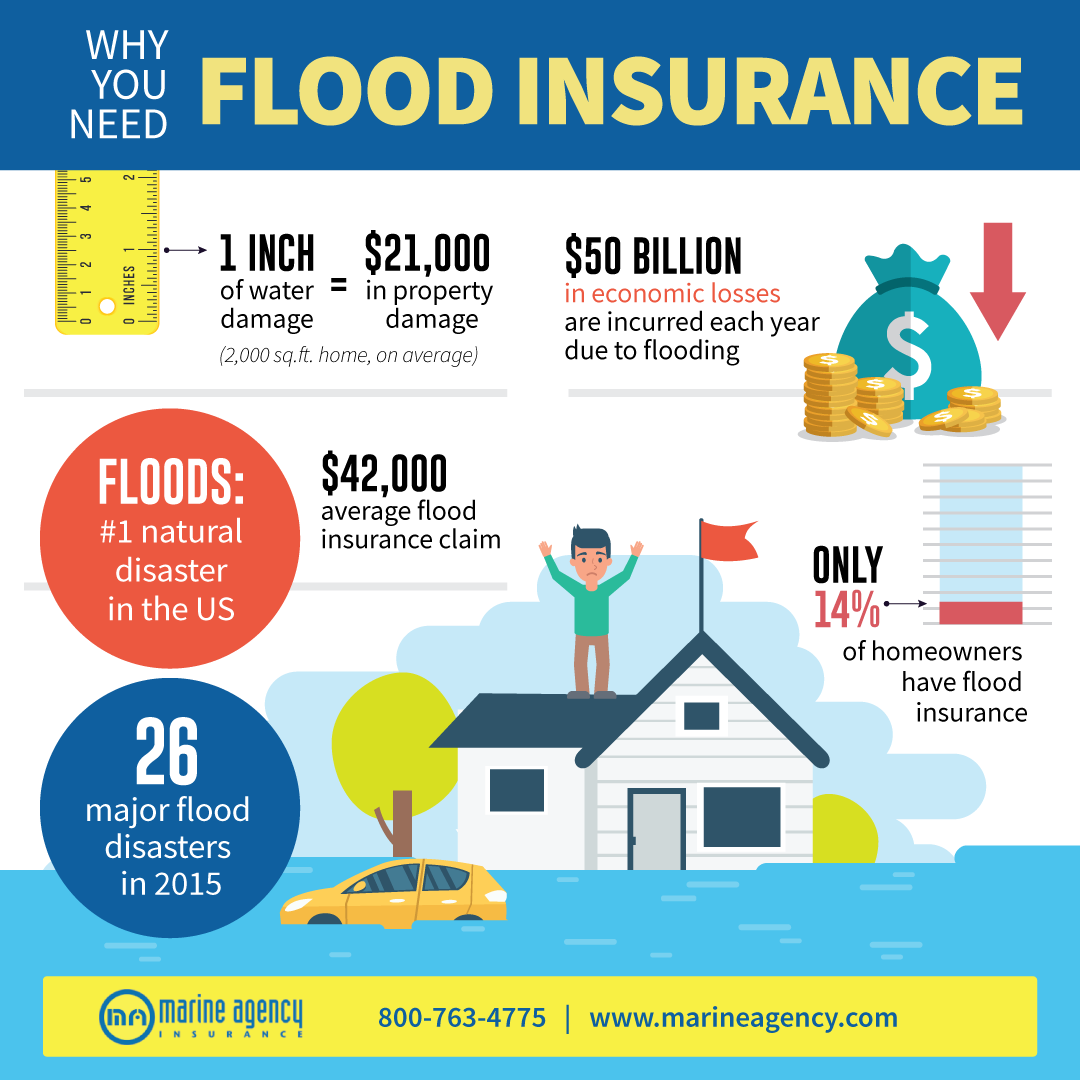

Why You Need Flood Insurance Infographic Marine Agency With this understanding, congress stepped in with the national flood insurance act (1968) to provide homeowners with an affordable flood insurance option. the policies they offered and rates were generic across the board—up to $250,000 in coverage for damages to the structure of a home and up to $100,000 in coverage for damages to contents. Compare private flood insurance & nfip rates. the average annual cost of nfip flood insurance is $888 per year, while private flood insurance costs around $1,074 per year, according to our 2023 analysis of flood insurance pricing data from fema and the national association of insurance commissioners.

Comments are closed.