Flexible Spending Accounts Serra Benefits Group

Benefits Of A Flexible Spending Account Health Life Insurance Georgia 3059 tri park drive, grand blanc, mi 48439; pete@serrabenefitsgroup ; call us: (810) 584 7458. Serra benefits group, inc. we are committed to meeting and exceeding our client’s needs through quality products, services, and support. over the years we have grown to expertly handle the benefits for dozens of automobile dealerships, physician groups, and a cross section of diverse companies, each with specific needs to which we cater to.

Flexible Spending Accounts Serra Benefits Group A flexible spending account, or fsa, is a tax advantaged account offered by your employer that allows you to pay for medical expenses or dependent care. depending on the extent of your health care. Here are the ones that have the biggest impact on your finances. #1. tax free healthcare expenses. the biggest benefit to flexible spending accounts is the ability to pay for healthcare expenses tax free. this is because when you open an fsa account, the money is taken from your paycheck first, before taxes. A flexible spending account (fsa) is an account that allows you to save pre tax dollars and use them toward your medical and dependent care expenses. many employers offer fsas as a benefit. you. Flexible spending accounts (fsas, also known as flexible spending arrangements) help offset the high price of healthcare by allowing you to pay for some medical expenses with pretax dollars. that.

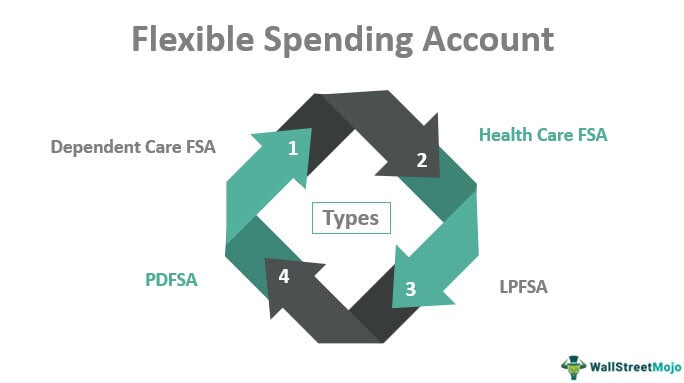

Flexible Spending Account Definition Types Benefits A flexible spending account (fsa) is an account that allows you to save pre tax dollars and use them toward your medical and dependent care expenses. many employers offer fsas as a benefit. you. Flexible spending accounts (fsas, also known as flexible spending arrangements) help offset the high price of healthcare by allowing you to pay for some medical expenses with pretax dollars. that. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year). the fsa maximum contribution is the maximum amount of employee salary reductions per fsa. as with other tax advantaged accounts, the maximum contribution is annually indexed to inflation. A flexible spending account (fsa) is a type of savings account, usually for healthcare expenses, that sets aside pretax funds for later use.

Comments are closed.