Fixed Cost And Variable Cost Examples For Manufacturing At Judy Smith Blog

Fixed Cost And Variable Cost Examples For Manufacturing At Judy Smith Blog Fixed costs vs variable costs vs semi variable costs. taken together, fixed and variable costs are the total cost of keeping your business running and making sales. fixed costs stay the same no matter how many sales you make, while your total variable cost increases with sales volume. fixed and variable costs also have a friend in common: semi. Examples of fixed cost. we have learned what fixed cost is and how it is a vital part of your business. we have also learned how you can calculate the fixed cost incurred to mention in your books. to understand it a little better here are a few examples of fixed cost. the most common examples of fixed cost include: 1. labour.

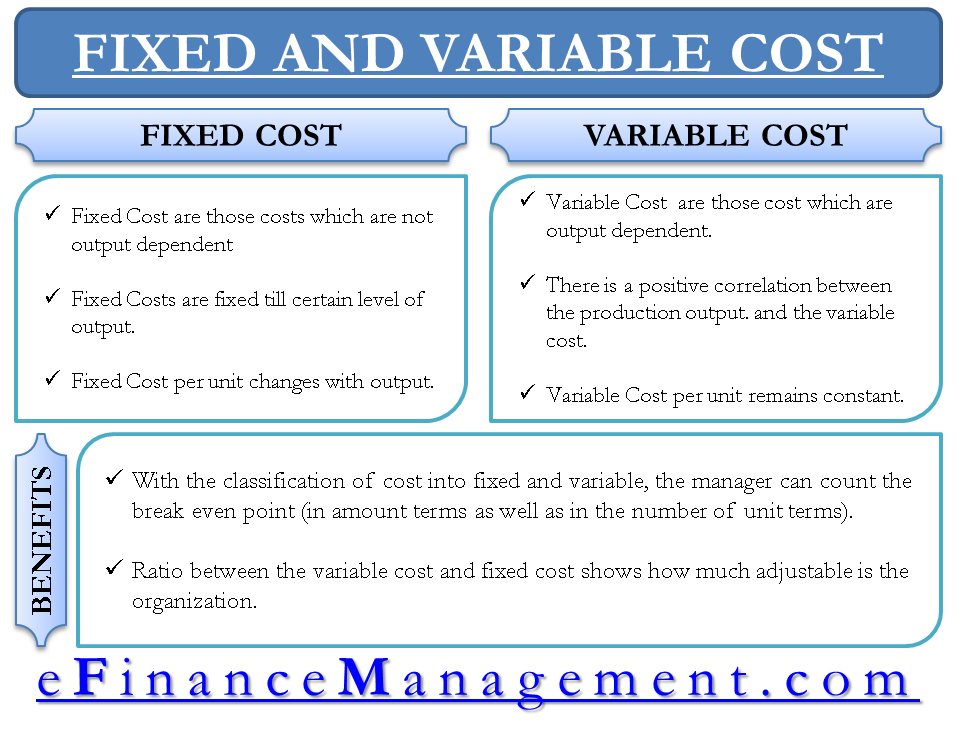

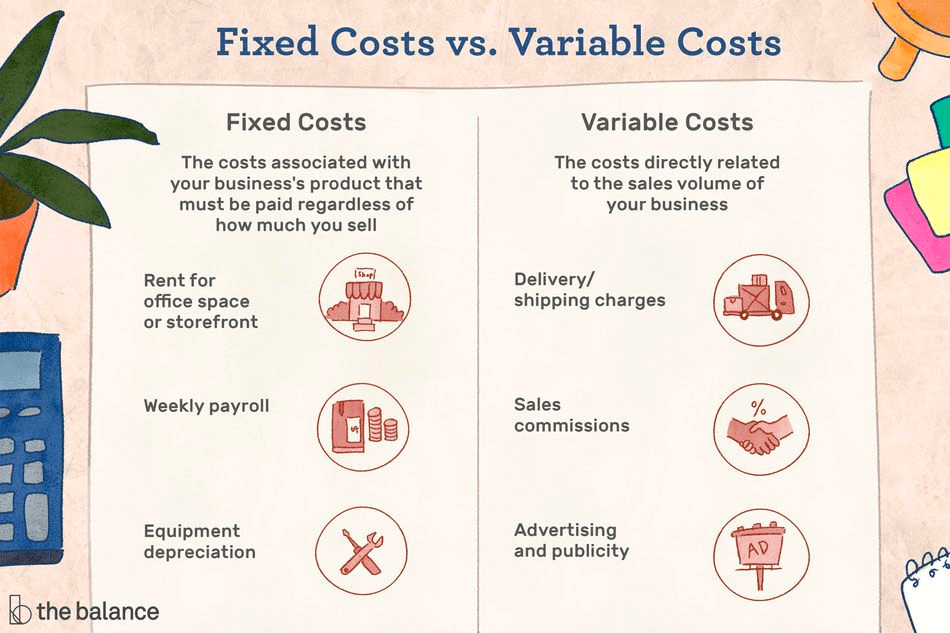

Fixed Cost And Variable Cost Examples For Manufacturing At Judy Smith Blog The first example is about how fixed and variable costs work. the second is on semi variable cost functioning. 1. examples of fixed and variable costs. in the above chart, the total cost incurred by company a is shown as seen. the fixed costs, such as rent and interest, continue to remain constant irrespective of the volume of production. Since the equipment in a restaurant undergoes high wear and tear, depreciation is another factor to account for. examples of fixed costs for the restaurant industry include rent, loan payments, insurance premiums, salaries, license fees, and mortgages. variable costs for restaurants include utilities, raw materials and beverages, and marketing. Understanding cost behavior is essential to effective decision making, as it helps businesses anticipate how costs will affect profitability. the two main types of costs a business has to deal with are fixed costs and variable costs. fixed costs are expenses that remain unchanged regardless of production levels. examples include rent, salaries. Fixed costs: easier to predict and budget for, as they do not change over time. variable costs: less predictable, as they vary with business activity. impact on profit margins: fixed costs: spread out over the number of units produced, meaning higher production reduces the fixed cost per unit. variable costs: directly affect the cost per unit.

Fixed Cost And Variable Cost Examples For Manufacturing At Judy Smith Blog Understanding cost behavior is essential to effective decision making, as it helps businesses anticipate how costs will affect profitability. the two main types of costs a business has to deal with are fixed costs and variable costs. fixed costs are expenses that remain unchanged regardless of production levels. examples include rent, salaries. Fixed costs: easier to predict and budget for, as they do not change over time. variable costs: less predictable, as they vary with business activity. impact on profit margins: fixed costs: spread out over the number of units produced, meaning higher production reduces the fixed cost per unit. variable costs: directly affect the cost per unit. Exercises and examples for fixed costs. let’s look at some specific exercises and examples for analysing fixed costs: example 1 – budgeting. a manufacturer of treadmills produces at a variable cost per unit of $500 with fixed costs of $10,000 per quarter. in q1 they produced 50 treadmills, and in q2 they produced 65. Manufacturing businesses use variable costs more frequently, since materials cost is directly tied to current manufacturing levels. there are advantages and disadvantages to both categories, with.

Fixed Cost And Variable Cost Examples For Manufacturing At Judy Smith Blog Exercises and examples for fixed costs. let’s look at some specific exercises and examples for analysing fixed costs: example 1 – budgeting. a manufacturer of treadmills produces at a variable cost per unit of $500 with fixed costs of $10,000 per quarter. in q1 they produced 50 treadmills, and in q2 they produced 65. Manufacturing businesses use variable costs more frequently, since materials cost is directly tied to current manufacturing levels. there are advantages and disadvantages to both categories, with.

Differences Between Fixed Cost And Variable Cost

Comments are closed.