First Dollar Coverage Exemption For Hsa Plans Set To Expire

First Dollar Coverage Exemption For Hsa Plans Set To Expire The 2023 caa generally extends this exception for another two years. summarize the creation of this hdhp hsa telehealth exception in response to the pandemic, as well as its first extension. specifically, 2023 caa’s extension applies to plan years beginning after december 31, 2022 and before january 1, 2025. for calendar year plans, this. Telehealth and other remote care services. public law 117 328, december 29, 2022, amended section 223 to provide that an hdhp may have a $0 deductible for telehealth and other remote care services for plan years beginning before 2022; months beginning after march 2022 and before 2023; and plan years beginning after 2022 and before 2025. also, an “eligible individual” remains eligible to.

Do Hsa Funds Expire First dollar coverage exemption for hsa plans set to expire. the cares act created a temporary safe harbor that allows (but did not require) a hdhp health plan with a health savings account (hsa) to cover telehealth and remote care services prior to the member reaching their plan’s deductible. the cares act provision extended the safe harbor. High deductible health plans: first dollar coverage of telehealth is back. december 30, 2022 by kristine m. bingman. the consolidated appropriations act, 2023 (caa 2023) holds some welcome news for employers that offer a high deductible health plan (hdhp) option paired with a health savings account (hsa). the consolidated appropriations act. January 11, 2023. a two year extension of covid 19 telehealth relief for health savings account (hsa) qualifying high deductible health plans (hdhps) became law on dec. 29, 2022, as part of a government spending package, the 2023 consolidated appropriations act (pub. l. no. 117 328, see section 4151). the legislation extends through plan years. The caa 2023 extends for a second time the hsa relief permitting high deductible health plans (“hdhps”) to provide first dollar telehealth and other remote care services for plan years beginning after december 31, 2022 and before january 1, 2025 (i.e., the 2023 and 2024 plan years for employers with a calendar plan year).

Irs Announces Updated Hsa Limits For 2023 First Dollar Hot Sex Picture January 11, 2023. a two year extension of covid 19 telehealth relief for health savings account (hsa) qualifying high deductible health plans (hdhps) became law on dec. 29, 2022, as part of a government spending package, the 2023 consolidated appropriations act (pub. l. no. 117 328, see section 4151). the legislation extends through plan years. The caa 2023 extends for a second time the hsa relief permitting high deductible health plans (“hdhps”) to provide first dollar telehealth and other remote care services for plan years beginning after december 31, 2022 and before january 1, 2025 (i.e., the 2023 and 2024 plan years for employers with a calendar plan year). The proposed legislation would extend flexibilities put into place by the cares act, allowing fqhcs and rhcs to serve as distant sites (the location of the practitioner) for an additional 151 days after the expiration of the phe. 6. extension of first dollar coverage for telehealth under hdhp hsa plans. temporary relief for telehealth and high. Unfortunately, the revived relief is not retroactive to jan. 1, 2022, so employers and lawmakers will continue to urge the irs not to enforce the pre cares act restrictive hdhp hsa rule that technically makes an individual with predeductible telehealth coverage ineligible for hsa contributions during the first quarter of 2022 as congress considers a retroactive renewal and extension.

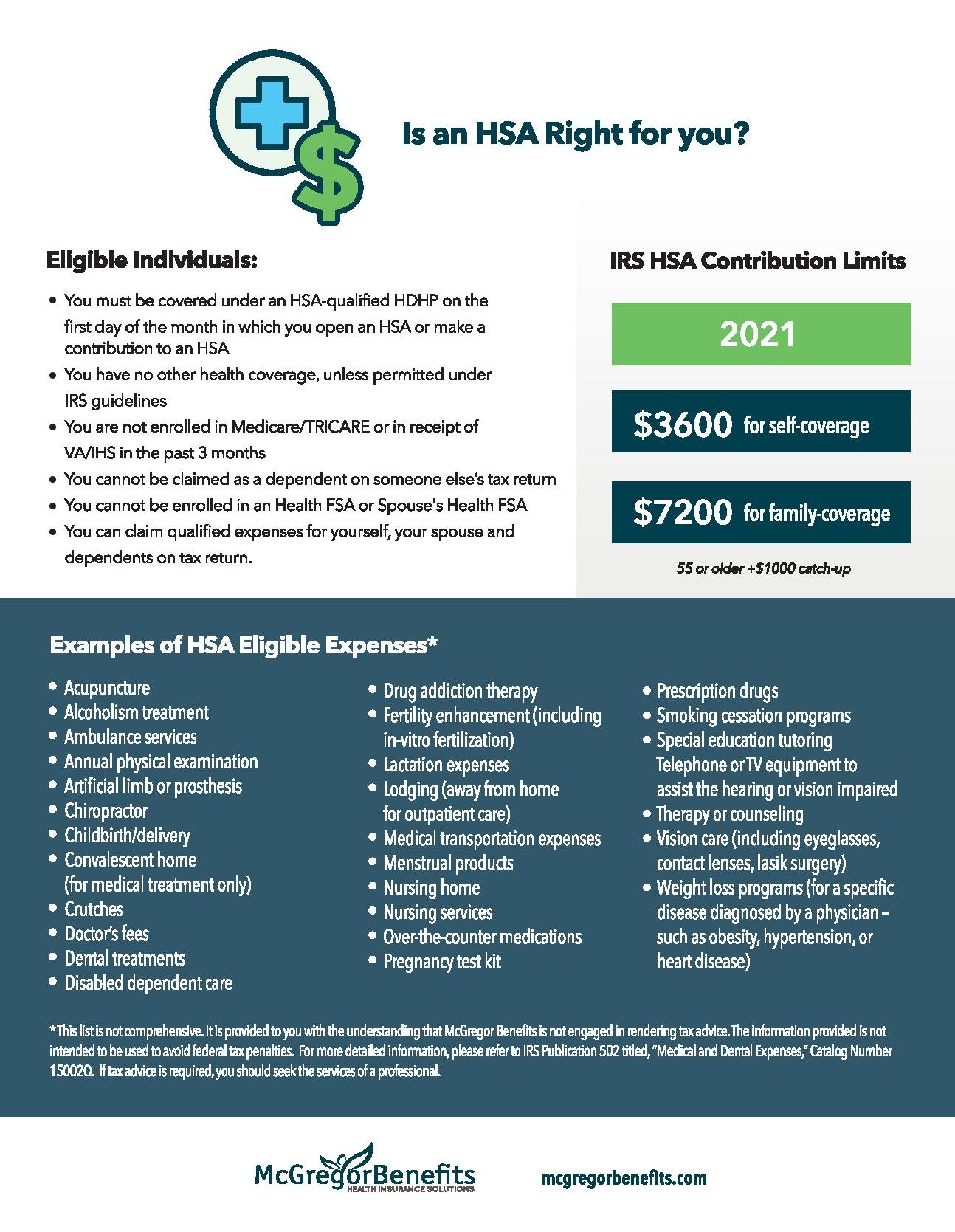

Individual Hsa Plans Washington State Mcgregor Benefits Hsa Broker The proposed legislation would extend flexibilities put into place by the cares act, allowing fqhcs and rhcs to serve as distant sites (the location of the practitioner) for an additional 151 days after the expiration of the phe. 6. extension of first dollar coverage for telehealth under hdhp hsa plans. temporary relief for telehealth and high. Unfortunately, the revived relief is not retroactive to jan. 1, 2022, so employers and lawmakers will continue to urge the irs not to enforce the pre cares act restrictive hdhp hsa rule that technically makes an individual with predeductible telehealth coverage ineligible for hsa contributions during the first quarter of 2022 as congress considers a retroactive renewal and extension.

Comments are closed.