Fintech Course 2 2 Fintech Business Model And Disruption You

Fintech Course 2 2 Fintech Business Model And Disrupti In this lecture, you will be introduced to main trends and key features of fintech services, defined as frictionless, personalized, accessible and inclusive . The fintech online short course from harvard’s office of the vice provost for advances in learning (vpal), in association with harvardx, provides an up to date look into the maturing fintech industry. you’ll explore how organizations have filled gaps left by existing financial institutions to successfully meet customers’ shifting needs.

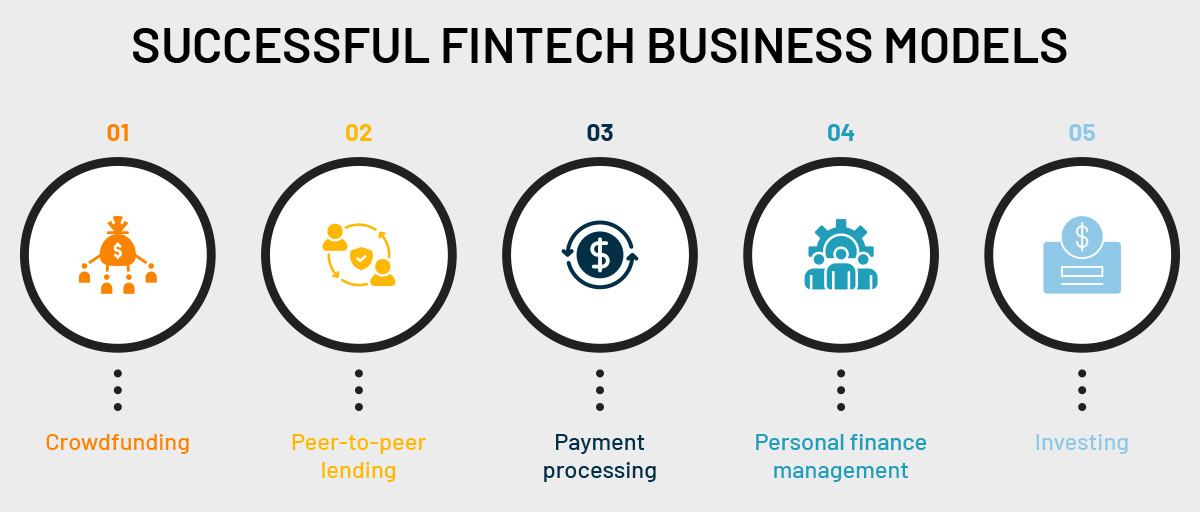

A Complete Guide To Fintech Business Models This course about financial technology, or fintech, is for students wishing to explore the ways in which new technologies are disrupting the financial services industry—driving material change in business models, products, applications and customer user interface. amongst the significant technological trends affecting financial services into the 2020’s, the class will explore ai, deep. This business model allows fintech companies to provide a wide range of payment methods, encompassing credit and debit cards as well as digital wallets, all through a single integration. In summary, here are 10 of our most popular fintech courses. fintech: foundations & applications of financial technology: university of pennsylvania. fintech: foundations, payments, and regulations: university of pennsylvania. fintech: finance industry transformation and regulation: the hong kong university of science and technology. The technology enabling and supporting fintech is important to understand, and this module provides a brief introduction to each of the areas of technology that enable fintech business changes, including identity and privacy technologies, blockchain and encryption, big data analytics, ai and automation, and consumer tech innovations.

A Complete Guide To Fintech Business Models In summary, here are 10 of our most popular fintech courses. fintech: foundations & applications of financial technology: university of pennsylvania. fintech: foundations, payments, and regulations: university of pennsylvania. fintech: finance industry transformation and regulation: the hong kong university of science and technology. The technology enabling and supporting fintech is important to understand, and this module provides a brief introduction to each of the areas of technology that enable fintech business changes, including identity and privacy technologies, blockchain and encryption, big data analytics, ai and automation, and consumer tech innovations. Enter mit’s fintech certificate course: future commerce this 12 week online class is designed for those who want to experience, engage with, and embrace the disruption fintech is bringing to the global economy. the course will focus on business strategy for fintech innovation, from the perspective of entrepreneurs and corporate innovators. Why take a fintech certificate program? 81% of banking ceos are concerned about the speed of technological change, more than any other industry sector. 1. by 2020 there will be 20 times more usable data than today. 2. assets under management in the robo advisors segment amounts to $980,541m in 2019. assets under management are expected to show.

Part 2 Fintech Business Models Explained Youtube Enter mit’s fintech certificate course: future commerce this 12 week online class is designed for those who want to experience, engage with, and embrace the disruption fintech is bringing to the global economy. the course will focus on business strategy for fintech innovation, from the perspective of entrepreneurs and corporate innovators. Why take a fintech certificate program? 81% of banking ceos are concerned about the speed of technological change, more than any other industry sector. 1. by 2020 there will be 20 times more usable data than today. 2. assets under management in the robo advisors segment amounts to $980,541m in 2019. assets under management are expected to show.

A Complete Guide To Fintech Payments Business Model Vrogue Co

Comments are closed.