Fintech Business Models Explained

A Complete Guide To Fintech Business Models Fintech business models – a complete guide. you may not realize it, but the financial industry is currently undergoing one of its biggest shifts in recent memory. just a little over a decade ago, over 50 percent of our purchases were still conducted using cash. today, that number is below 20 percent. this is, in large part, driven by the. How fintech makes money—9 leading fintech business models please note that there are hundreds of ways that fintech companies make money. this article aims to explain the most popular methods, but there are always going to be lesser known—or even brand new and undiscovered—ways that fintech companies are able to generate revenue.

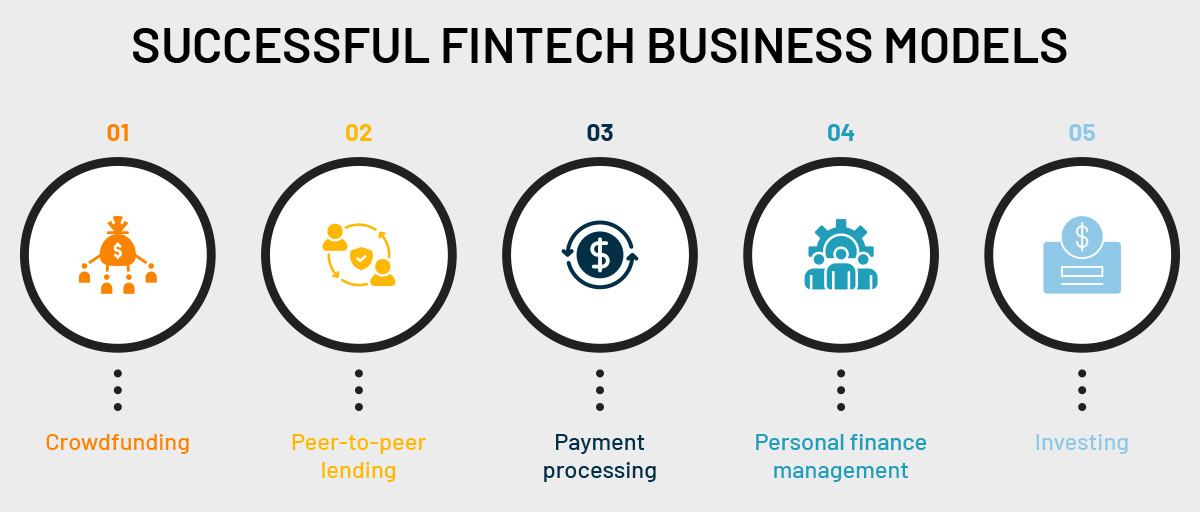

Fintech Business Models Explained Youtube The landscape of financial technology, or fintech, is characterized by its dynamism, innovation, and transformative potential. central to the success of any fintech venture is a robust business model that not only addresses existing market needs but also anticipates future trends and disruptions. in this section, we’ll delve deeper into the. The following list of typical fintech business models includes: peer to peer (p2p) lending: platforms that bypass conventional financial institutions and put borrowers and lenders in direct contact. p2p lending systems help connect borrowers and lenders, frequently providing better rates and faster loan processing. Model 2: small ticket loans. this fintech business model is catching up fast. it contains benefits, like helping borrowers build a credit history, a quick online process, and improved management of loans. for most fintech companies, adopting this model means targeting first time borrowers. Sumit khanna, coo of neev credit sheds light on the fintech business models. get a complete understanding of the origin, growth, different models, and future.

A Complete Guide To Fintech Business Models Model 2: small ticket loans. this fintech business model is catching up fast. it contains benefits, like helping borrowers build a credit history, a quick online process, and improved management of loans. for most fintech companies, adopting this model means targeting first time borrowers. Sumit khanna, coo of neev credit sheds light on the fintech business models. get a complete understanding of the origin, growth, different models, and future. These are the top fintech business models that will help cater to the effective monetization for the fintech offerings. 1. incessant fee oriented financial services. fintech based enterprises are creating a revolution in the industry by offering currency exchange, asset management, and recurring payments. Understanding fintech business models. fintech, a sector with about 26,000 active startups innovating financial technology solutions, is gradually getting competitive as more fintech startups emerge. the financial expectations of the sector’s service users are also expanding; thus, newbies need to adopt an innovative business model to thrive.

Part 2 Fintech Business Models Explained Youtube These are the top fintech business models that will help cater to the effective monetization for the fintech offerings. 1. incessant fee oriented financial services. fintech based enterprises are creating a revolution in the industry by offering currency exchange, asset management, and recurring payments. Understanding fintech business models. fintech, a sector with about 26,000 active startups innovating financial technology solutions, is gradually getting competitive as more fintech startups emerge. the financial expectations of the sector’s service users are also expanding; thus, newbies need to adopt an innovative business model to thrive.

Comments are closed.